The Future of Payments

Summary

TLDRThe video script discusses the shifting dynamics in the payments space, highlighting how companies like Visa and Mastercard are facing competition from newer, more flexible digital payment solutions. It explores the role of tech giants like Apple, Amazon, and Facebook, which are innovating in peer-to-peer payments and wallets, bypassing traditional payment methods. The conversation touches on the evolution of payment systems, with Apple Pay and digital credit cards leading the way. Barriers to change, such as points, perks, and dispute resolution, are discussed, with an eye on the future of credit and payment systems, including buy-now-pay-later and crypto alternatives.

Takeaways

- 😀 The rise of peer-to-peer payment systems like Apple Pay, Facebook Pay, and Amazon Pay is challenging traditional credit card networks like Visa and Mastercard.

- 😀 Visa and Mastercard’s initial challenge was convincing both consumers and businesses to adopt their payment methods. This struggle eventually led to nearly full adoption over 60 years.

- 😀 The iPad and other tablets democratized payment acceptance by allowing businesses to accept payments without the need for expensive credit card terminals, opening the door to more competition.

- 😀 The shift from traditional credit card terminals to software-driven payment systems has leveled the playing field, with the internet now acting as the primary infrastructure for payments.

- 😀 The trust that consumers and businesses have in brands like Apple, Amazon, and Google is increasingly competing with the established trust in Visa and Mastercard.

- 😀 Companies like Apple are positioning themselves to eventually transition to Apple-to-Apple payments, leveraging their existing products like Apple Pay and Apple Wallet for future payment innovations.

- 😀 Apple’s credit card, which is tied to the Apple ecosystem, allows for peer-to-peer payments with low transaction fees, signaling a step towards more comprehensive payment solutions.

- 😀 Younger consumers are moving away from traditional credit cards, opting for Buy Now, Pay Later (BNPL) services, which allow for more manageable payments without accruing high interest rates.

- 😀 Two major barriers that still protect Visa and Mastercard’s dominance are the loyalty programs (points and perks) they offer to consumers and the robust dispute resolution systems they provide.

- 😀 Without effective chargeback systems, cryptocurrencies and new payment models will struggle to replace Visa and Mastercard, as these chargebacks play a significant role in protecting consumers and businesses from fraud.

- 😀 Despite growing competition from digital payment solutions, Visa and Mastercard are likely to retain a strong market position for the next 5-10 years due to the existing barriers and customer loyalty programs.

Q & A

What challenges did Visa and Mastercard face when they started in the 1950s?

-Visa and Mastercard had to convince two main parties: consumers to trust a system where they could buy now and pay later, and businesses to accept credit cards despite having to wait a few days for payment and paying high transaction fees.

How did Visa and Mastercard overcome initial skepticism about credit card adoption?

-Visa and Mastercard's pitch was that consumers would spend more when using credit cards, which proved to be true, leading to near-full adoption over 60 years.

What technological shift in 2010 changed the payment industry?

-The release of the iPad and similar tablets democratized payment acceptance by enabling software-based systems to process payments without needing traditional credit card terminals.

How has the internet influenced the payment ecosystem?

-The internet enabled anyone to create software that could run on existing networks, breaking down the exclusivity of the Visa and Mastercard ecosystem and allowing new players to enter the payment space.

What companies are seen as potential competitors to Visa and Mastercard in the payment space?

-Companies like Apple, Amazon, Facebook, Samsung, and Google are emerging as strong competitors due to their trust among consumers and businesses and their existing digital infrastructures.

How are companies like Facebook approaching payment systems?

-Facebook is launching features like Facebook Shops and aiming to offer lower processing fees for businesses, providing an alternative to traditional payment methods like Visa and Mastercard.

What is Apple's long-term strategy with Apple Pay and Apple Wallet?

-Apple's long-term strategy is to transition from just using Apple Pay as a digital wallet to offering full Apple-to-Apple payments, integrating both credit cards and peer-to-peer money transfers.

What steps has Apple taken to facilitate peer-to-peer payments?

-Apple introduced the ability to transfer money between Apple Credit Card holders with a 1% transaction fee, positioning themselves to compete with peer-to-peer payment services like Cash App and Venmo.

How has the younger generation's approach to credit changed, and how does this affect payment systems?

-The younger generation, particularly those under 30, is moving away from traditional credit cards and opting for buy-now-pay-later services to avoid high interest rates. This shift is accelerating the use of alternative payment systems.

What are the barriers that will protect Visa and Mastercard in the coming years?

-Visa and Mastercard are protected by loyalty programs, points, and perks that attract consumers, as well as their dispute management networks, which are key in protecting consumers and businesses from fraud and chargebacks.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

Menjelaskan dengan Mudah Kenapa QRIS dan GPN Dikomplain Amerika

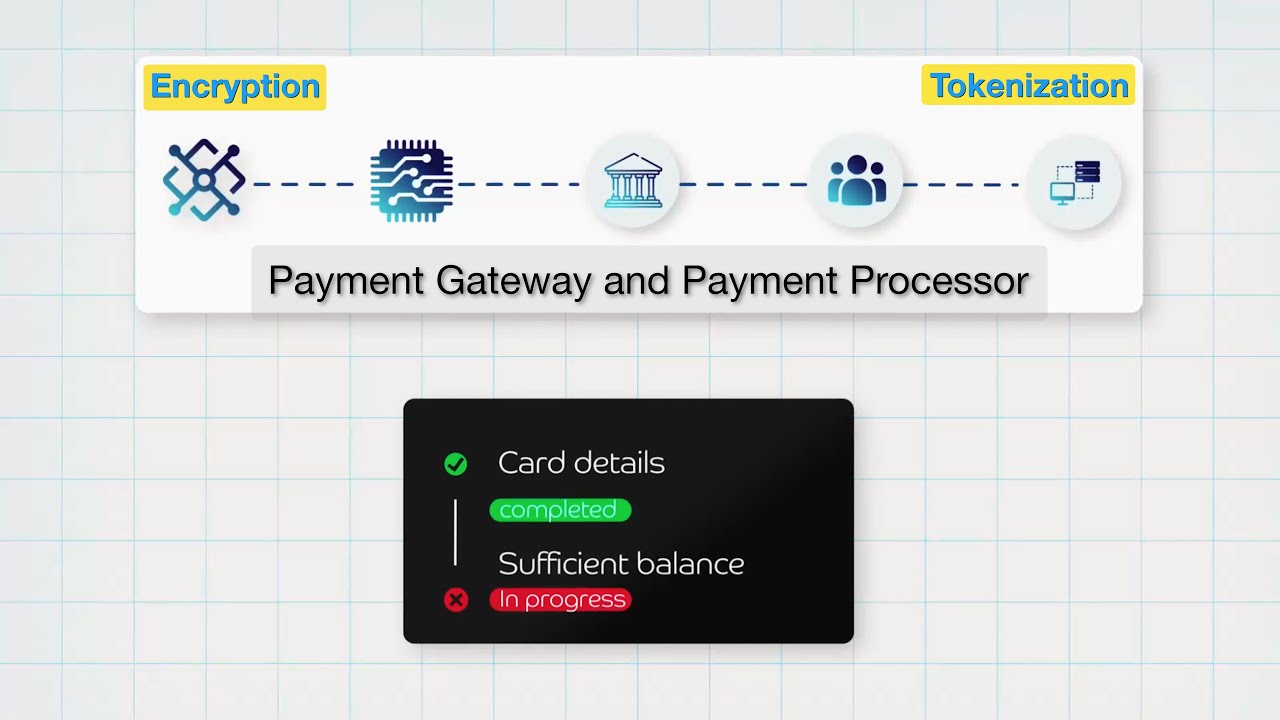

Payment Gateway, Payment Processor and Payment Security Explained

The future of money: three ways to go cashless

How UPI's Bold Business STRATEGY will KILL VISA and MASTERCARD? : UPI CREDIT LINKING EXPLAINED

AS Soroti Penggunaan QRIS & GPN, Tuding Penghambat Perdagangan Bebas? - [Newsline]

Don't Touch Our QRIS | Pangeran Siahaan

5.0 / 5 (0 votes)