The future of money: three ways to go cashless

Summary

TLDRThe script discusses the global shift towards a cashless society, highlighting the US's reliance on credit card networks like Visa and MasterCard, driven by high merchant fees and consumer rewards. It contrasts this with India's Unified Payment Interface (UPI), a government-backed system promoting interoperability among banks and fintech wallets, facilitating digital payments even for those without credit history. Lastly, it examines China's closed fintech app model dominated by Alipay and WeChat Pay, which leverages QR codes for easy digital transactions, and the government's concerns over their financial dominance.

Takeaways

- 🌐 The global trend towards a cashless society is accelerating, with digital payments becoming more prevalent.

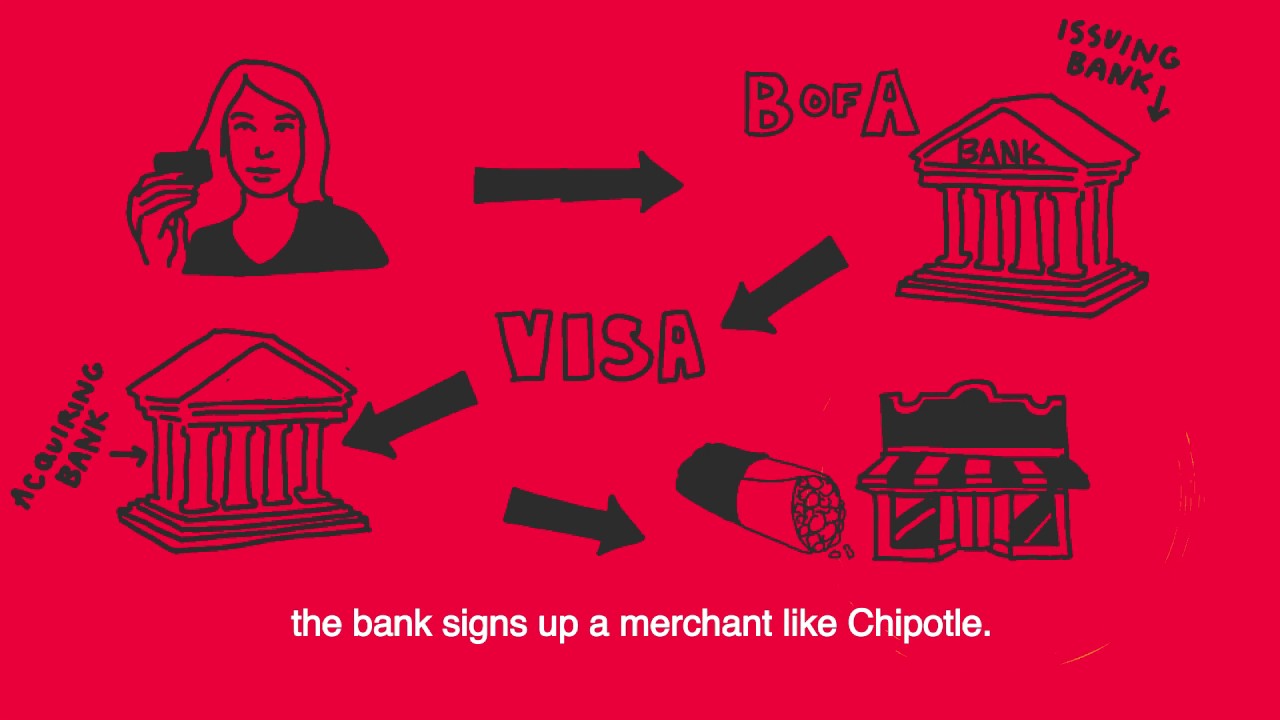

- 💳 In the US, card networks like Visa and MasterCard dominate due to high merchant fees and consumer rewards programs.

- 🏪 Merchants are compelled to accept these cards due to their ubiquity, despite the fees, because consumers prefer them for the rewards and protections they offer.

- 🇮🇳 India has adopted a unique model with the Unified Payments Interface (UPI), a non-profit system that facilitates direct bank-to-bank transactions through mobile apps.

- 📲 UPI's interoperability allows various banks and fintech wallets to communicate, enabling digital payments even for those without credit histories.

- 📈 The shift to digital payments in India has spurred significant growth in loan provision, as transaction data enhances creditworthiness.

- 🔗 The account aggregator system in India allows individuals to control their financial data, facilitating access to a range of financial services.

- 🇨🇳 China's digital payment landscape is dominated by Alipay and WeChat Pay, which control about 90% of the market through closed networks.

- 👥 The QR code system in China revolutionized payments by allowing cheap and easy digital transactions, even in emerging markets.

- 🏦 The success of Alipay and WeChat Pay has led to the expansion into lending and other financial services, becoming a significant part of China's economy.

- ⚠️ The dominance of a few payment providers in China raised concerns for the government, influencing the design of more decentralized systems like UPI in India.

Q & A

What is the trend towards a cashless society accelerating due to?

-The trend towards a cashless society is accelerating due to the increased use of digital payments, especially during the COVID-19 pandemic when people had to shop from home.

How has the pandemic influenced the shift towards digital payments in the US?

-During the pandemic, the shift towards digital payments in the US has been influenced by people shopping more from home, leading to an increased use of cards and digital transactions.

What is the underlying model that makes Visa and MasterCard's network so entrenched and resilient?

-Visa and MasterCard's network is resilient due to their model where they charge enormous fees to merchants, which are then used to pay consumers with rewards and provide consumer protection.

Why do merchants feel compelled to accept cards from Visa and MasterCard?

-Merchants feel compelled to accept cards from Visa and MasterCard because these cards are ubiquitous, and consumers love to use them, making it almost mandatory for businesses to accept them.

What is the Unified Payment Interface (UPI) and how does it differ from Western models?

-Unified Payment Interface (UPI) is a digital payment system in India that allows interoperability between various banks and fintech wallets. It differs from Western models as it does not require a credit card network and enables direct payments between bank accounts facilitated by a fintech app.

How has UPI impacted the financial system in India?

-UPI has impacted the financial system in India by enabling digital payments for those who previously relied on cash, unlocking a range of other financial services, and allowing people to own and export their transaction data to improve creditworthiness and access to loans and insurance.

What is the account aggregator system in India and how does it work?

-The account aggregator system in India allows users to export their transaction data from one financial service provider and import it into another, enabling them to own their data and access financial services from various providers.

How do Alipay and WeChat Pay differ from traditional bank card systems and UPI?

-Alipay and WeChat Pay differ from traditional bank card systems and UPI by operating as closed networks where payments typically occur within the same app's user base. They also leverage QR codes for easy and low-cost transactions, which has contributed to their widespread adoption.

Why did the Chinese government view the dominance of Alipay and WeChat Pay with concern?

-The Chinese government viewed the dominance of Alipay and WeChat Pay with concern because these platforms controlled a significant portion of the financial system, which could pose risks to financial stability and regulatory oversight.

What was one of the motivations behind the design of UPI in India?

-One of the motivations behind the design of UPI in India was to avoid creating a single dominant player in the financial system that could control a large part of the market, as seen with Alipay and WeChat Pay in China.

How has the shift towards digital payments influenced the lending sector in China?

-The shift towards digital payments has significantly influenced the lending sector in China, with platforms like Alipay's affiliate, Ant Financial, originating a substantial portion of short-term consumer credit before being regulated by the government.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Visa & Mastercard Continue To Dominate | Joseph Carlson Ep. 343

A Brief History of Credit Cards (or What Happens When You Swipe)

💳 Cartões Bradesco com Anuidade Grátis? Veja Como Conseguir Mastercard Black e Visa Infinite!

How UPI's Bold Business STRATEGY will KILL VISA and MASTERCARD? : UPI CREDIT LINKING EXPLAINED

Is American Express Stock a Buy Now!? | American Express (AXP) Stock Analysis! |

CREDIT CARD FOR BEGINNERS | CREDIT CARD 101 PHILIPPINES | What you need to know

5.0 / 5 (0 votes)