11 ACC 4 JOUR N PAY &EXP

Summary

TLDRIn this accounting lecture, the focus is on journal entries, specifically how to record transactions related to company expenses and borrowing. The lecturer explains how to record salary payments made in cash, with salary expenses being debited and cash credited. The lecture also covers borrowing from a bank, where cash is debited and notes payable is credited. Examples of journal entries are provided for both scenarios, emphasizing the importance of understanding debits, credits, and proper transaction declarations. Students are encouraged to practice with various exercises to strengthen their understanding.

Takeaways

- 😀 Paying salaries requires a journal entry that debits salary expenses and credits cash.

- 😀 Journal entries for salary payments are recorded as 'salary expenses' (debit) and 'cash' (credit).

- 😀 When expenses are paid in cash, the 'cash' account decreases, which is recorded as a credit.

- 😀 Salary expenses are recorded as debits because they represent an increase in the company's expenses.

- 😀 Understanding journal entries involves knowing when to debit and credit different accounts (assets, liabilities, expenses).

- 😀 Borrowing money is recorded as a debit to cash and a credit to notes payable, reflecting the increase in assets and liabilities.

- 😀 The term 'notes payable' refers to money borrowed with a formal agreement to repay later, increasing liabilities.

- 😀 A journal entry for borrowing money includes a debit to cash (asset increase) and a credit to notes payable (liability increase).

- 😀 For every journal entry, a declaration or description should clarify the purpose of the transaction (e.g., 'payment of salaries').

- 😀 When assets increase (such as cash from a loan), they are debited, while liabilities increase (such as notes payable), and they are credited.

- 😀 Practice exercises involve changing the amounts in examples while keeping the journal entry format the same, reinforcing understanding of the process.

Q & A

What is the main focus of the lecture?

-The main focus of the lecture is on journal entries related to company payments, particularly the payment of employee salaries and the borrowing of money from a bank. The lecture explains how these transactions are recorded in accounting journals.

How is the payment of employee salaries recorded in the journal entries?

-When a company pays employee salaries, the transaction is recorded by debiting the salaries expense account and crediting the cash account. For example, if the company pays $300 in salaries, the journal entry will be: Debit Salaries Expense (300) and Credit Cash (300).

Why is cash credited when paying salaries?

-Cash is credited because it is an asset, and when an asset decreases (such as paying cash), it is recorded as a credit. This reflects the reduction in the company's cash balance after the salary payment.

What is the purpose of writing the declaration in a journal entry?

-The declaration explains the purpose or reason for the transaction, helping to clarify the context of the journal entry. It ensures that anyone reviewing the entry understands why the transaction was recorded.

What happens when a company borrows money from a bank?

-When a company borrows money, it increases its cash balance, which is recorded as a debit to the cash account. At the same time, a liability is created in the form of a notes payable account, which is credited. For example, if the company borrows $9,000, the journal entry will be: Debit Cash (9000) and Credit Notes Payable (9000).

How is notes payable treated in journal entries?

-Notes payable is a liability account. When a company borrows money, it increases its liability, which is recorded as a credit. The company is obligated to repay this amount in the future, hence it is classified as a liability.

What is the significance of the terms 'debit' and 'credit' in accounting journal entries?

-'Debit' and 'credit' are the fundamental terms in accounting used to record changes in accounts. Debits increase expenses and assets, while credits decrease assets and increase liabilities. In the case of paying salaries, expenses are debited, and cash is credited. In the case of borrowing, cash is debited, and notes payable is credited.

How does the instructor recommend handling journal entries for students?

-The instructor recommends students practice journal entries manually to better understand the structure of accounting transactions. By doing this, students can see firsthand how debits and credits impact different accounts and gain a clearer understanding of the process.

What is the reasoning behind placing the cash entry on the credit side when salaries are paid?

-Cash is placed on the credit side because it is an asset that decreases when the company pays salaries. In accounting, a decrease in assets is recorded as a credit, reflecting the reduction in cash.

What is the key takeaway from the final exercise given to the students?

-The final exercise is designed to help students practice recording transactions involving cash and liabilities. The key takeaway is to understand how to apply the concepts of debit and credit in real-world scenarios, including changes to both cash and liabilities, such as borrowing money or paying salaries.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

[MEET 8-2] AKUNTANSI SEKTOR PUBLIK - TRANSAKSI BELANJA & BEBAN PPKD

Cara Membuat Jurnal Umum Perusahaan Jasa untuk Pemula

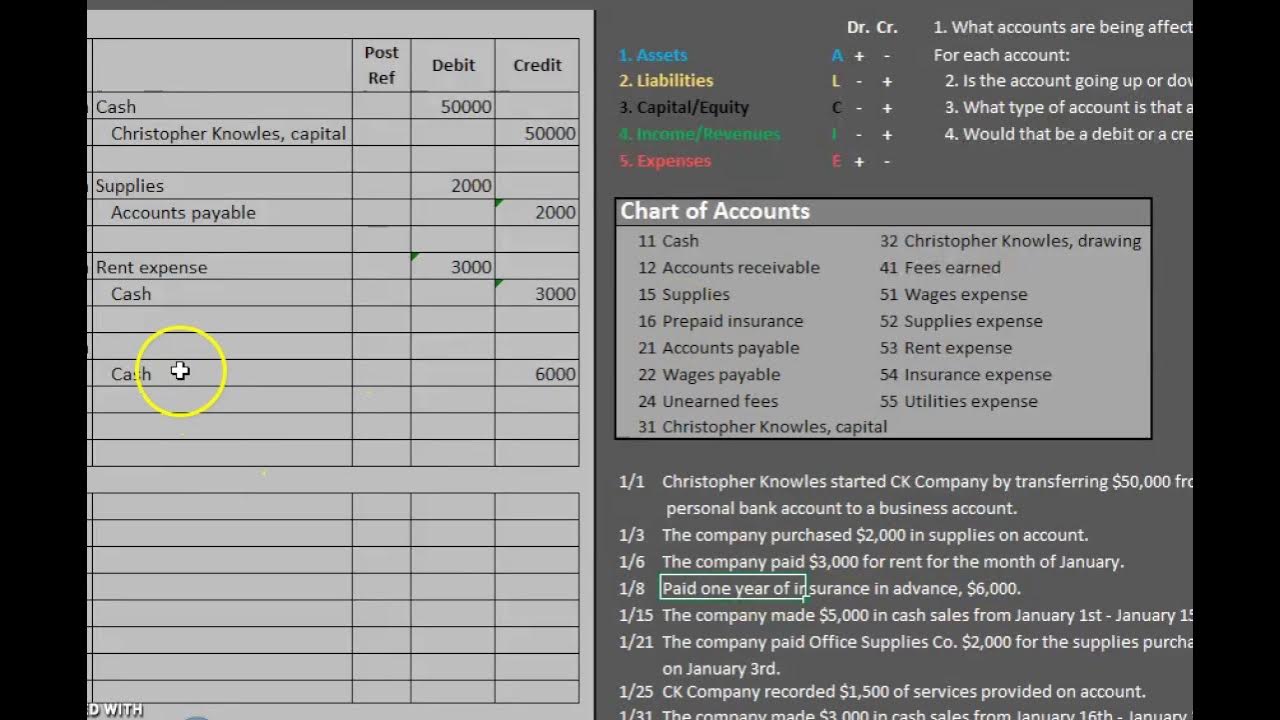

Journal Entries: The Basics and Analyzing Business Transactions

Lecture 04: Share Capital. [Corporation Accounting]

PENGANTAR AKUNTANSI 1 - JURNAL

Issue of Shares | Journal Entries | Class 12 | Part 2 | Accounts

5.0 / 5 (0 votes)