What Is RESERVE REQUIREMENT? RESERVE REQUIREMENT Definition & Meaning

Summary

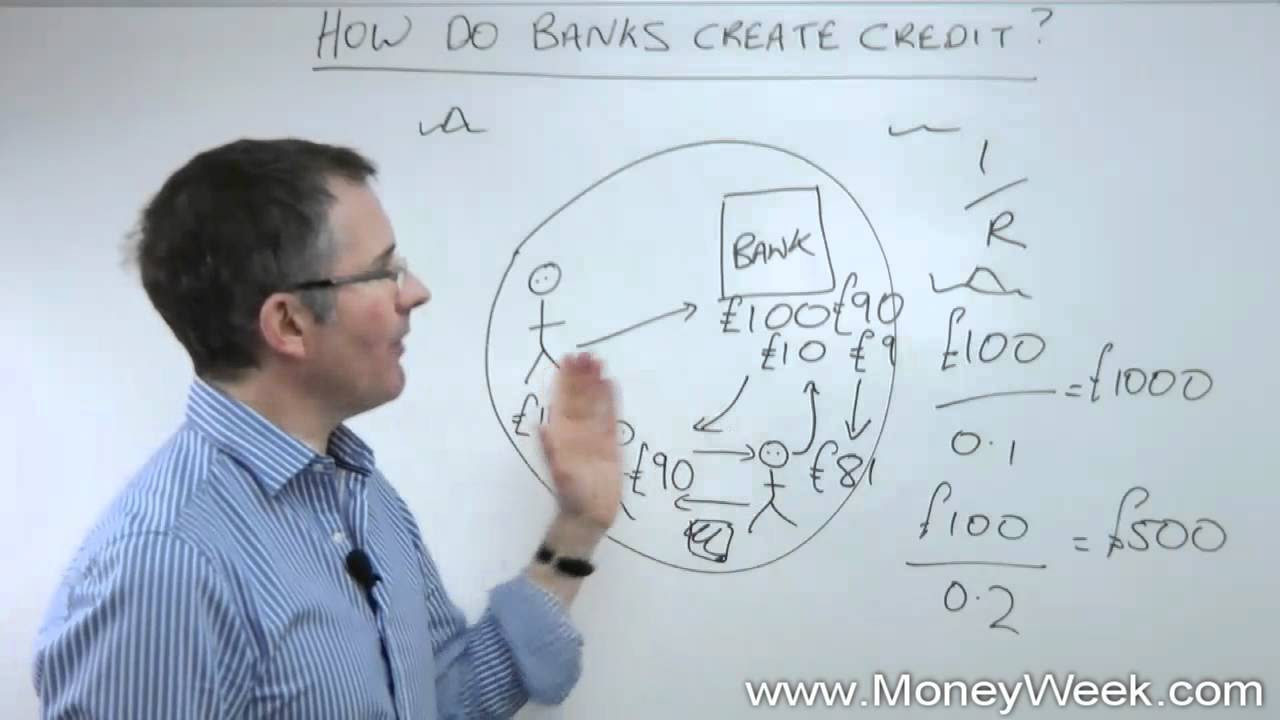

TLDRThe reserve requirement ratio is a central bank regulation that mandates the minimum reserves commercial banks must hold against deposit liabilities. These reserves consist of cash stored in vaults and balances at the central bank. The ratio is a crucial tool in monetary policy, affecting borrowing and interest rates by influencing the funds available for lending. While most central banks avoid increasing reserve requirements to prevent liquidity issues, the People's Bank of China utilizes it as an inflation control measure, having adjusted the requirements multiple times since 2007. Institutions holding more than required are classified as having excess reserves.

Takeaways

- 🏦 The reserve requirement is a regulation set by central banks that dictates the minimum reserves commercial banks must hold against their deposit liabilities.

- 📊 This requirement is typically expressed as a percentage of the bank's total deposits, determined by the central bank.

- 💰 Reserves consist of cash in the bank's vault and the balance in the bank's account at the central bank.

- 📉 The required reserve ratio is a tool for monetary policy, influencing borrowing and interest rates by adjusting funds available for loans.

- 🚫 Central banks rarely increase reserve requirements due to potential liquidity issues for banks with low excess reserves.

- 📈 Instead of raising reserve requirements, central banks often use open market operations to implement monetary policy.

- 🇨🇳 The People's Bank of China frequently adjusts reserve requirements as a strategy to control inflation, having raised them multiple times in recent years.

- 📆 In 2007, the People's Bank of China raised the reserve requirement ten times, with additional increases in subsequent years.

- 🔒 Banks that hold reserves beyond the required amount are referred to as holding excess reserves, which can help them manage liquidity.

- 🔍 Understanding reserve requirements is crucial for grasping how central banks influence the economy and stabilize financial systems.

Q & A

What is a reserve requirement?

-A reserve requirement is a regulation set by central banks that specifies the minimum amount of reserves that commercial banks must hold against their deposit liabilities.

How are reserves typically composed?

-Reserves generally consist of cash physically held in the bank vault and the bank's balance at the central bank.

What role does the required reserve ratio play in monetary policy?

-The required reserve ratio is used as a monetary policy tool to influence borrowing and interest rates by changing the amount of funds available for banks to make loans.

Why do central banks rarely increase reserve requirements?

-Central banks rarely increase reserve requirements because doing so can lead to immediate liquidity problems for banks that have low excess reserves.

What alternative method do central banks prefer for implementing monetary policy?

-Central banks generally prefer using open market operations, such as buying and selling government-issued bonds, to implement their monetary policy.

How does the People's Bank of China approach reserve requirements?

-The People's Bank of China utilizes changes in reserve requirements as a tool to combat inflation, having raised the reserve requirement multiple times in recent years.

What does it mean for a bank to hold excess reserves?

-A bank holds excess reserves when it maintains reserves that exceed the amount required by the central bank.

What impact do reserve requirements have on commercial banks?

-Reserve requirements impact commercial banks by determining how much money they can lend out, which in turn affects their liquidity and overall lending capacity.

Can changes in reserve requirements affect interest rates?

-Yes, changes in reserve requirements can influence interest rates, as they alter the amount of money available for banks to lend, affecting the supply of credit in the economy.

What has been the trend in reserve requirement adjustments in China since 2007?

-Since 2007, the People's Bank of China has raised the reserve requirement ten times in 2007 and eleven times since early 2010 as part of its inflation control measures.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahora5.0 / 5 (0 votes)