Banking 9: More on Reserve Ratios (Bad sound)

Summary

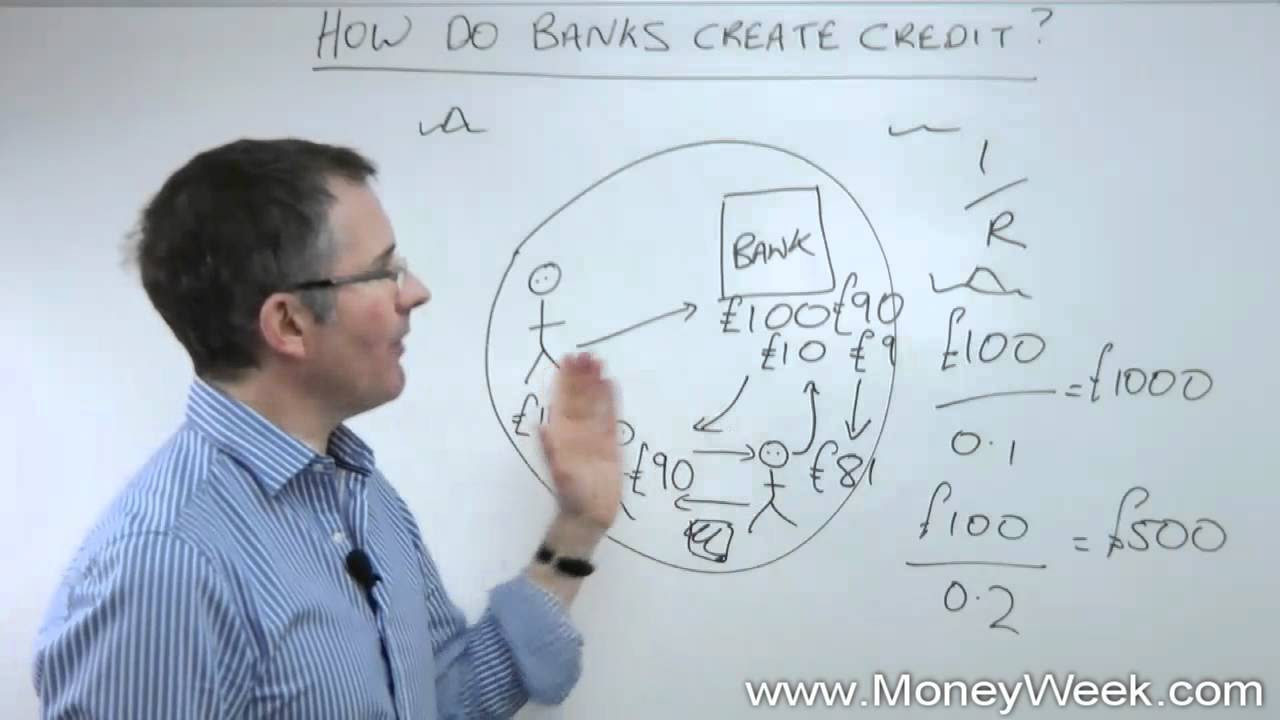

TLDRIn this video, the speaker explains the concept of reserve ratio requirements and their role in banking. Using an example based on a 10% reserve ratio, the speaker shows how banks must maintain a certain amount of reserves to back their demand deposits, ensuring liquidity. Through a simple balance sheet model, they demonstrate how much lending a bank can do under such a requirement and distinguish between liquidity (the ability to meet withdrawal demands) and solvency (the overall financial health of the bank). The video also touches upon the future discussion of leverage and its impact on solvency.

Takeaways

- 😀 Reserve ratio requirement refers to the fraction of deposits a bank must keep in reserve and not lend out, ensuring the bank can meet withdrawals.

- 😀 In the example, a reserve ratio of 10% means the bank must keep 10% of its demand deposits in reserve, allowing it to lend out the remaining 90%.

- 😀 The reserve ratio ensures a bank remains liquid, meaning it can pay out deposits when requested, even if all depositors want their money at once.

- 😀 A bank’s total reserves (equity + deposits) determine how much it can lend. In the example, the bank starts with 300 gold pieces and can expand its balance sheet up to 3,000 gold pieces in deposits.

- 😀 The bank can continue making loans until the total demand deposits reach the maximum limit, which is 3,000 gold pieces in this case, based on the 10% reserve ratio.

- 😀 Liquidity is about a bank’s ability to meet short-term obligations (like withdrawals). If too many people demand gold at once, liquidity can become a problem.

- 😀 Solvency refers to whether a bank’s total assets exceed its total liabilities. In the example, the bank has assets of 3,300 gold pieces, making it solvent.

- 😀 A bank can be solvent (assets > liabilities) but still face liquidity problems if it doesn’t have enough cash or reserves to meet immediate demands.

- 😀 If a bank is illiquid, it might need to borrow from other sources or sell its assets to meet withdrawal demands, but it can still be solvent if its overall assets exceed liabilities.

- 😀 Leverage is a related concept that determines how much debt a bank can take on. It affects solvency because high leverage increases the risk of insolvency if asset values fall.

- 😀 The reserve ratio is a tool to ensure banks are liquid, while leverage is a tool to assess a bank’s ability to absorb losses before becoming insolvent.

Q & A

What is a reserve ratio requirement in banking?

-A reserve ratio requirement is a regulation that mandates a bank to keep a certain percentage of its deposits as reserves, typically in the form of liquid assets, to ensure it can meet withdrawal demands from customers. In the script, the reserve ratio is set at 10%.

Why do banks have reserve ratio requirements?

-Banks have reserve ratio requirements to ensure they are liquid enough to meet withdrawal requests. This prevents a situation where a bank cannot pay back depositors because it has lent out too much of its available reserves.

How does the reserve ratio affect a bank's lending capacity?

-The reserve ratio limits how much a bank can lend out. For example, with a 10% reserve ratio, the bank must keep 10% of its deposits in reserves and can lend out the remaining 90%, which determines how large its balance sheet can grow.

What is the difference between liquidity and solvency?

-Liquidity refers to a bank's ability to meet short-term withdrawal requests, while solvency refers to a bank's overall financial health, meaning whether its total assets exceed its total liabilities. A bank can be solvent but still face liquidity problems.

In the example, how much could the bank expand its balance sheet if the reserve ratio is 10%?

-With 300 gold pieces in reserves and a 10% reserve ratio, the bank can expand its balance sheet up to 3,000 gold pieces in demand deposits, since 10% of 3,000 is 300, matching the bank's reserves.

What happens when a bank's reserves fall below the required level?

-If a bank’s reserves fall below the required reserve ratio, it could face a liquidity crisis, unable to meet withdrawal demands. However, it might still be solvent if its assets exceed its liabilities.

What is the purpose of the initial equity in the bank's balance sheet?

-The initial equity provides a buffer for the bank to maintain reserves. It is used to capitalize the bank and ensure it has a solid foundation before taking deposits and making loans.

How does the bank use loans to expand its balance sheet?

-The bank creates loans by giving borrowers checking accounts rather than physical cash. These loans increase the total amount of demand deposits in the bank, which expands the balance sheet but must still comply with the reserve ratio requirement.

What would happen if all depositors wanted to withdraw their funds at once?

-If all depositors wanted to withdraw their funds at once, the bank may face a liquidity issue if it does not have enough reserves. However, if the bank is solvent, it could potentially sell assets or borrow funds to meet the demand.

What is the difference between the reserve ratio requirement and leverage requirements?

-The reserve ratio requirement ensures liquidity by determining how much of a bank’s deposits must be kept in reserves. Leverage requirements, which will be discussed in the next video, focus on a bank's ability to absorb losses before it becomes insolvent, affecting its solvency.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade Now5.0 / 5 (0 votes)