I Found an Upgraded Version of The MACD [INSANE]

Summary

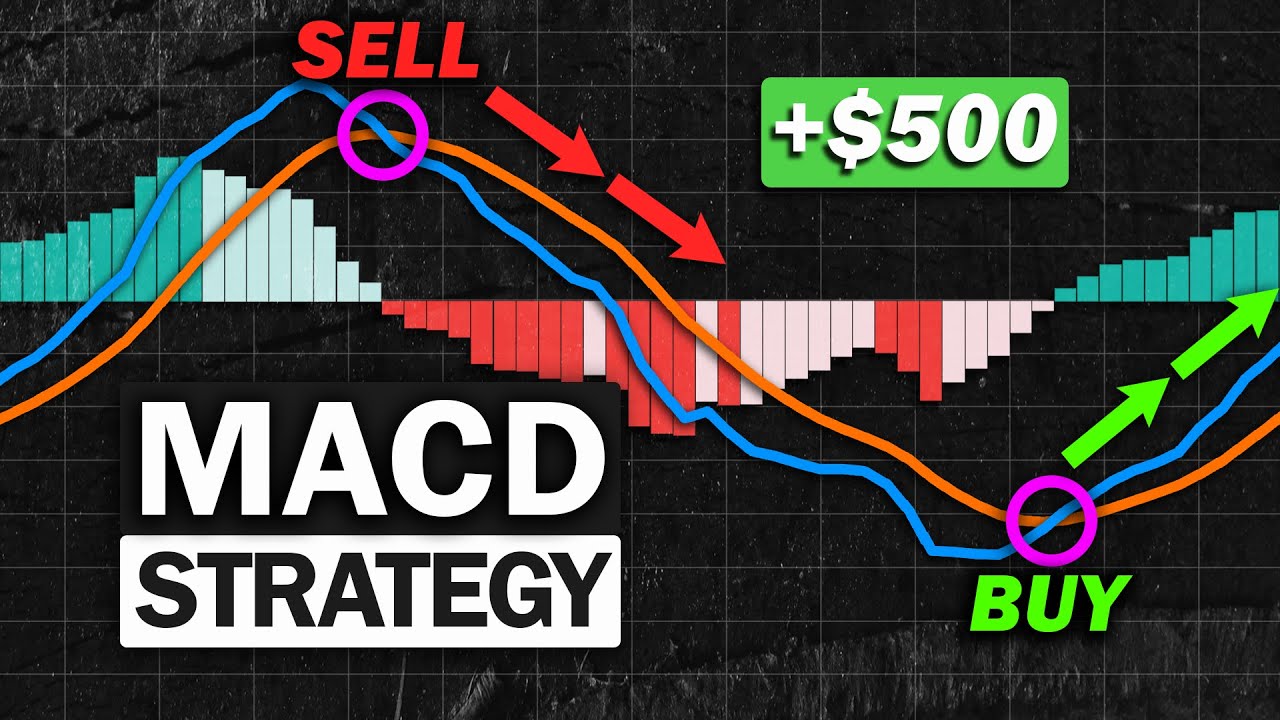

TLDRIn this video, the presenter critiques the MACD indicator, highlighting its limitations during market consolidation. They introduce an upgraded version, the Impulse MACD, which significantly reduces false signals and enhances trading accuracy. Viewers are guided through setup, signal interpretation, and a dynamic trading strategy that incorporates overbought and oversold zones. The video emphasizes the importance of market conditions for optimal trading and suggests using additional tools for breakout confirmations. Ultimately, this approach promises improved profitability and a more effective trading experience.

Takeaways

- 😀 The MACD indicator is widely used but struggles during market consolidation.

- 😀 The new 'Impulse MACD' claims to outperform the traditional MACD by avoiding false signals.

- 😀 Setting up the Impulse MACD involves changing color settings to match the original MACD for easier reading.

- 😀 The new indicator only provides signals during trending markets, improving accuracy.

- 😀 A buy signal occurs when the blue line crosses above the orange line in the oversold zone, while a sell signal occurs when it crosses below in the overbought zone.

- 😀 Adding overbought and oversold zones helps filter weak signals and improve trade entries.

- 😀 The speaker suggests setting stop losses and take profits at specific ratios for risk management.

- 😀 For breakouts, look for strong market consolidation and confirm with additional tools.

- 😀 A dynamic take profit strategy allows traders to maximize potential gains by exiting based on indicator signals.

- 😀 The speaker offers links for further resources, including a private indicator for enhanced trading strategies.

Q & A

What is the primary drawback of the traditional MACD indicator?

-The traditional MACD indicator performs poorly in consolidating or sideways markets, leading to false signals.

What is the name of the upgraded MACD indicator discussed in the video?

-The upgraded version is called the 'Impulse MACD' by Lazy Bear.

How does the Impulse MACD improve trading accuracy?

-The Impulse MACD only provides signals when the market is trending, eliminating false signals during consolidation.

What are the basic signals generated by the traditional MACD?

-A bullish signal occurs when the blue line crosses above the orange line, while a bearish signal happens when the blue line crosses below the orange line.

What specific settings should be adjusted for the Impulse MACD?

-Users should set the colors to blue for lines, red for the impulse histogram, and orange for the MACD signal, formatting them for clarity.

How can traders identify overbought and oversold conditions using the Impulse MACD?

-Traders can add horizontal lines to the indicator to mark overbought and oversold zones, entering trades only when signals fall outside these areas.

What is a suggested risk-to-reward ratio for setting take profits?

-A common strategy is to set the take profit at 1.5 times the stop loss, but dynamic take profit strategies can also be used.

What strategy is recommended for trading breakouts?

-Traders should look for strong market consolidation, wait for the MACD lines to cross, and confirm the breakout with additional tools like a probability indicator.

How does the dynamic take profit strategy work?

-Instead of using a fixed ratio, traders can exit positions based on signals from the MACD, allowing them to capitalize on momentum.

What additional confirmation tool is suggested to improve breakout trading success?

-Using a private indicator with a breakout probability tool can enhance the likelihood of successful trades by confirming breakout direction.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

NEVER Miss a TREND! MACD Indicator Trading Strategy | MACD Divergence

Most Effective MACD Strategy for Daytrading Crypto, Forex & Stocks (High Winrate Strategy)

Bitcoin Choppiness Index - Lots Of Fuel Left In The Tank (Premium Market Update Clip)

NVDA Stock - Are Bulls In Control Still?

4 Stages of Price Delivery (ICT Concepts)

My Boring MACD Trading Strategy Just Hit 71% Win Rate This Month

5.0 / 5 (0 votes)