15 Strategies To Reduce Your Year-End Taxes IMMEDIATELY

Summary

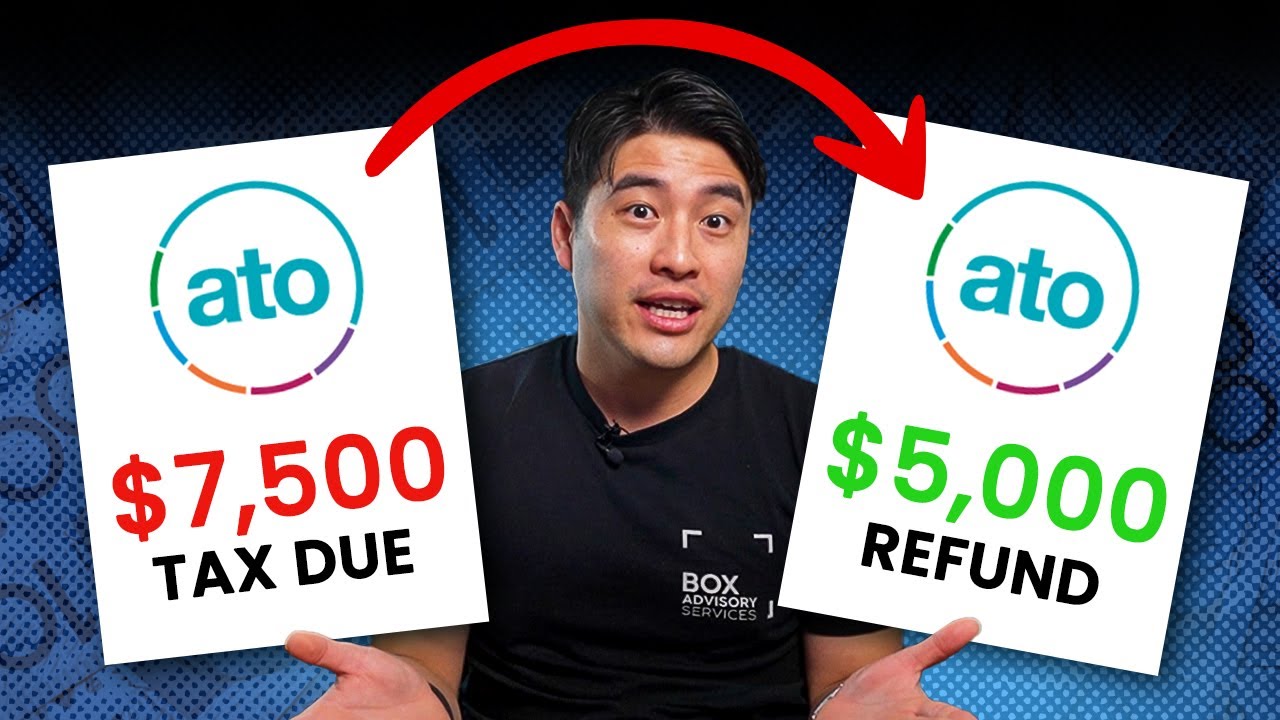

TLDRThe video presents 25 essential year-end tax strategies aimed at individuals and business owners seeking to optimize their tax situation before the year's end. Strategies include maximizing contributions to retirement accounts, leveraging deductions and credits, and employing tools like the Charitable Remainder Trust to manage appreciated assets while minimizing tax burdens. The speaker emphasizes the importance of proactive financial planning and encourages viewers to consult tax advisors to uncover potential savings that can exceed consultation costs. Overall, the video serves as a practical guide for effective tax management and wealth building.

Takeaways

- 😀 Understanding tax strategies is essential for maximizing financial savings, especially at year-end.

- 📈 A Charitable Remainder Trust (CRT) can provide tax deductions, income for life, and asset protection for appreciated assets.

- 💼 Selling appreciated property before year-end can lead to significant tax implications; utilizing a CRT can mitigate these effects.

- 🧮 Actuarial tables help determine how much income you can receive from a CRT based on age and gender.

- 💡 Professional tax advisers can save you money in the long run by identifying strategies to optimize your tax situation.

- 🏦 Rich individuals often invest in professional services to enhance their financial outcomes, illustrating the importance of expert advice.

- 📺 The speaker encourages viewers to access more educational content on their YouTube channel to expand their financial knowledge.

- ⏰ Scheduling an appointment with a tax adviser within the next two months is recommended to improve tax management.

- 💬 Sharing valuable financial information with friends can help them benefit from effective tax strategies as well.

- 🌟 Building wealth requires understanding and implementing various financial strategies, including proactive tax planning.

Q & A

What is a Charitable Remainder Trust (CRT)?

-A CRT is a financial vehicle that allows individuals to donate appreciated assets to a trust, receive a tax deduction, and generate income for life while avoiding immediate capital gains taxes on the sale of the asset.

Who can benefit from a CRT?

-Individuals with appreciated property, business interests, or stock who wish to sell these assets before year-end while minimizing their tax liabilities can benefit from a CRT.

How does a CRT help with tax liabilities?

-By placing appreciated assets in a CRT, individuals can sell them without incurring immediate taxes, receive a tax deduction, and have the assets protected from taxes in the future.

What kind of income can one expect from a CRT?

-The income generated from a CRT depends on the value of the assets placed in the trust and is calculated using actuarial tables based on the individual's age and gender.

What should individuals do before establishing a CRT?

-It is crucial to consult with a professional, such as a tax advisor or an attorney specializing in estate planning, to understand the implications and benefits of a CRT.

What are the key advantages of consulting a tax advisor?

-A tax advisor can provide tailored strategies for tax savings, helping individuals understand complex tax laws and potentially saving them more than the cost of the consultation.

Why does the speaker emphasize the importance of taking action?

-The speaker encourages proactive financial planning, suggesting that seeking professional advice can lead to significant tax savings and better financial management.

What is the speaker's overall message regarding tax strategies?

-The speaker's overall message is that there are various effective tax strategies available, such as the CRT, that can help individuals save money, build wealth, and achieve financial goals.

How can viewers learn more about the topics discussed?

-Viewers can explore more resources and videos on the speaker's YouTube channel by searching for relevant topics related to tax and financial strategies.

What homework assignment does the speaker give to the audience?

-The speaker suggests that all viewers should schedule an appointment with a tax advisor within the next two months to discuss their financial situations and potential tax savings.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

KENAPA GAJI ORANG TERKAYA DUNIA HANYA $1 PER TAHUN?

Do this To Legally Pay LESS TAXES in Australia

Trump’s New Tax Law: Retirees Can’t Afford to Waste the Next Four Years

TAX PLANNING! Strategi Memecah Badan Usaha Untuk Mengurangi Beban Pajak Yang Harus Dibayar

3 Money Moves You Must Make BEFORE 2026

[TIPS PRAKTIS] 5 Cara Mengelola Keuangan Usaha, Supaya Bisnis Bisa Maju

5.0 / 5 (0 votes)