Basic Accounting Terms | 2024-25 | Class 11 | Accountancy

Summary

TLDRThis educational video script introduces viewers to the fundamental concepts of accountancy, emphasizing the importance of understanding basic accounting terms. It covers the distinction between business and non-business entities, the nature of transactions, and the categorization of liabilities and assets. The instructor provides clear definitions and examples, aiming to build a strong foundation for further study in accountancy. The script promises a comprehensive overview in two parts, with the second part to be delivered in a follow-up video.

Takeaways

- 📚 Accountancy serves as the language of business, requiring understanding of basic terms before delving into theory and practice.

- 📈 The script introduces the concept of 'NTT' (Name of the Trading Terms), which refers to the identity of a business entity, distinguishing between business and non-business entities.

- 💼 Business entities aim to earn income through services or sales, while non-business entities focus on social service and are not for profit.

- 💱 Transactions are defined as economic activities involving the inflow and outflow of money, which are crucial for recording in accounting.

- 🔄 The nature of transactions can be both external, such as purchase and sales, and internal, like depreciation of assets within the business.

- 📝 An account is a record of all business transactions, typically structured with a debit (LHS) and credit (RHS) side to avoid confusion.

- 💰 Capital is the initial money invested by the owner to start the business and is considered a liability for the business.

- 🏠 Drawings refer to the money or value of goods withdrawn by the owner for personal use from the business's profit.

- 📉 Liabilities are obligations to pay money, either internally to the owner (like capital) or externally to creditors or other entities.

- 🏦 Assets are future economic benefits controlled by the business, categorized as current assets (easily convertible to cash) and non-current assets (long-term benefits).

- 🏢 Intangible assets, such as goodwill and copyrights, are non-physical rights that provide long-term benefits to the business.

Q & A

What is the main focus of the class being introduced in the script?

-The class focuses on accountancy for class 11th, covering both theoretical and practical portions, starting with basic accounting terms.

Why is it important to understand the basic accounting terms?

-Understanding basic accounting terms is crucial because they are the foundation of the language of business, and knowing their meanings helps in comprehending the subject effectively.

What does the term 'NTT' stand for in the context of the script?

-NTT stands for 'Name of the Trading Terms', referring to the identity of a business, which could be a business or non-business entity.

What is the difference between a business entity and a non-business entity according to the script?

-A business entity is started with the purpose of earning money by providing services or selling goods, whereas a non-business entity is focused on social service and not on earning profits.

What is a 'transaction' in the context of accountancy?

-A transaction refers to any economic activity involving the inflow or outflow of money, such as sales, purchases, or exchanges that change the financial position of a business.

What are the two types of business transactions mentioned in the script?

-The two types of business transactions are external transactions, which occur between two business entities, and internal transactions, which happen within the business itself, like depreciation.

What is the meaning of 'capital' in the context of the script?

-Capital refers to the amount invested by the proprietor in a business to start and run it, which can be in the form of cash, goods, or assets.

What is 'drawings' in the context of the script?

-Drawings refer to the cash or value of goods withdrawn by the owner from the business for personal use or private payments.

What is 'liability' and what are its two main types mentioned in the script?

-Liability is the amount a firm owes to outsiders. The two main types are internal liabilities, such as capital invested by the owner, and external liabilities, which include debts to outsiders like creditors.

What is an 'asset' and how is it related to the outflow of money?

-An asset is an outflow of money that is expected to provide future economic benefits. It can be either a long-term benefit, like purchasing a durable good, or a short-term benefit, like buying inventory.

What are the categories of assets mentioned in the script?

-The categories of assets mentioned are non-current assets, current assets, and fictitious assets. Non-current assets provide long-term benefits, current assets can be quickly converted to cash, and fictitious assets are non-physical assets that never convert into cash but are shown due to their debit balance.

What are the two types of non-current assets mentioned in the script?

-The two types of non-current assets are tangible assets, which can be seen and touched like land and buildings, and intangible assets, which do not have physical existence but provide benefits, like copyrights and patents.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

Environmental Science. Lesson 1. Definition of Basic Terms

Basic Accounting Terms | 2024-25 | Class 11 | Accountancy

1- Programming For Beginners - Introduction - البرمجة للمبتدئين

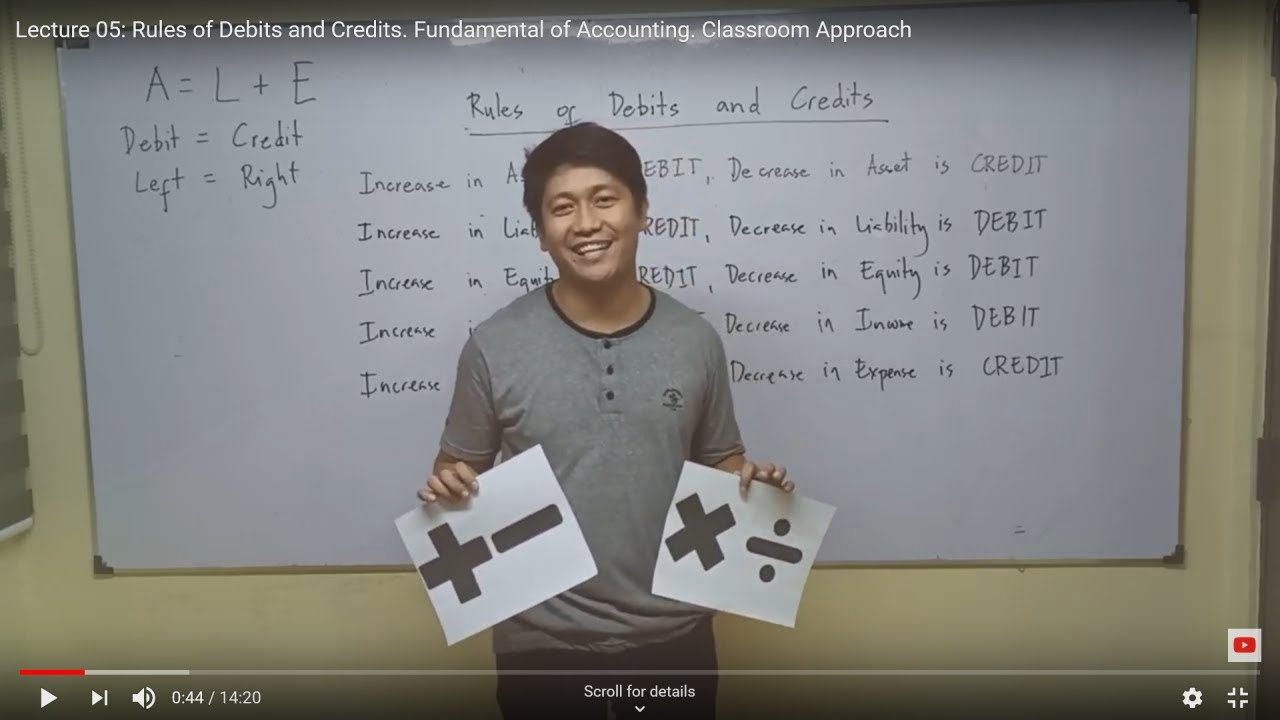

Lecture 07: Rules of Debits and Credits. [Fundamentals of Accounting]

[FABM2] Lesson 041 - Bank Transactions

Accounting Principles | Class 11 | Accountancy | Chapter 3 | Part 2

5.0 / 5 (0 votes)