FA30 - Merchandiser's Financial Statements - Balance Sheet

Summary

TLDRIn this instructional video, the presenter guides viewers through the creation of a balance sheet for Julie's Plumbing Supplies as of March 31, 2024. They begin by listing assets, including cash, receivables, inventory, and equipment, and then move on to liabilities such as accounts payable, wages payable, and a bank loan. Shareholders' equity is derived from the statement of changes in equity, with common shares and retained earnings totaling the equity amount. The presenter emphasizes the importance of accuracy, demonstrates how to correct mistakes, and concludes with a balanced sheet, highlighting the process's educational value.

Takeaways

- 📋 The script is a tutorial on creating a balance sheet for Julie's Plumbing Supplies as of March 31, 2024.

- 💼 The balance sheet is structured with assets on the left, liabilities on the right, and shareholders' equity listed later on the right.

- 💰 The company's most current asset is cash, amounting to $24,000.

- 📈 Accounts receivable are calculated by subtracting the allowance for doubtful accounts from the total receivables, resulting in a net of $15,000.

- 🔄 Prepaid insurance, inventory, and equipment (net of depreciation) are included in the current and long-term asset calculations.

- 🧮 Total current assets are calculated to be $99,000, and total assets are $214,000 after adding the net equipment value.

- 📉 Liabilities include accounts payable, wages payable, unearned revenues, and a long-term bank loan, totaling $111,000.

- 🏦 The long-term liability is a bank loan payable amounting to $84,000.

- 📊 Shareholders' equity is derived from the statement of changes in equity, with common shares and retained earnings totaling $93,000.

- 🔄 There was a moment of doubt regarding the total assets and liabilities summing up to $204,000, but it was quickly corrected.

- 👍 The video encourages viewers to like and subscribe if they find the tutorial helpful.

Q & A

What is the purpose of the balance sheet being discussed in the script?

-The purpose of the balance sheet is to provide a snapshot of Julie's Plumbing Supplies' financial position as of March 31st, 2024, by listing the company's assets, liabilities, and shareholders' equity.

What is the total amount of cash that Julie's Plumbing Supplies had according to the script?

-Julie's Plumbing Supplies had a total cash amount of twenty-four thousand dollars.

How does the script handle accounts receivable and the allowance for doubtful accounts?

-The script calculates net receivables by subtracting the allowance for doubtful accounts ($3,000) from the total accounts receivable ($18,000), resulting in a net of $15,000.

What is the total of current assets calculated in the script?

-The total of current assets is calculated by adding cash ($24,000), net receivables ($15,000), inventory ($54,000), and prepaid insurance ($6,000), which equals $99,000.

What is the process for determining the net value of equipment in the script?

-The net value of equipment is determined by subtracting the accumulated depreciation ($20,000) from the gross value of equipment ($125,000), resulting in a net value of $105,000.

What is the total value of assets listed in the balance sheet according to the script?

-The total value of assets is the sum of current assets ($99,000) and net equipment ($105,000), which equals $204,000.

What are the current liabilities listed in the script for Julie's Plumbing Supplies?

-The current liabilities listed include accounts payable ($15,000), wages payable ($7,000), and unearned revenues ($5,000), totaling $27,000.

What is the total amount of long-term liabilities mentioned in the script?

-The total amount of long-term liabilities is a bank loan payable, which is $84,000.

How is the shareholders' equity calculated in the script?

-Shareholders' equity is calculated by considering the common shares ($1,000) and retained earnings ($92,000), totaling $93,000.

What is the grand total of liabilities and shareholders' equity in the balance sheet as per the script?

-The grand total of liabilities and shareholders' equity is the sum of total liabilities ($111,000) and total shareholders' equity ($93,000), which equals $204,000.

What mistake was made in the script regarding the total calculation and how was it corrected?

-Initially, the script incorrectly calculated the total liabilities and shareholders' equity as $200,000. The mistake was corrected by recalculating the sum of $111,000 (total liabilities) and $93,000 (total shareholders' equity), which correctly equals $204,000.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

FA29 - Merchandiser's Financial Statements - Stmt of Changes in Equity

PART 8 PEMBUATAN APLIKASI EXCEL AKUNTANSI 2023 | NERACA - POSISI KEUANGAN

FA23 - Accounts Receivable - Percentage of Sales Method Example

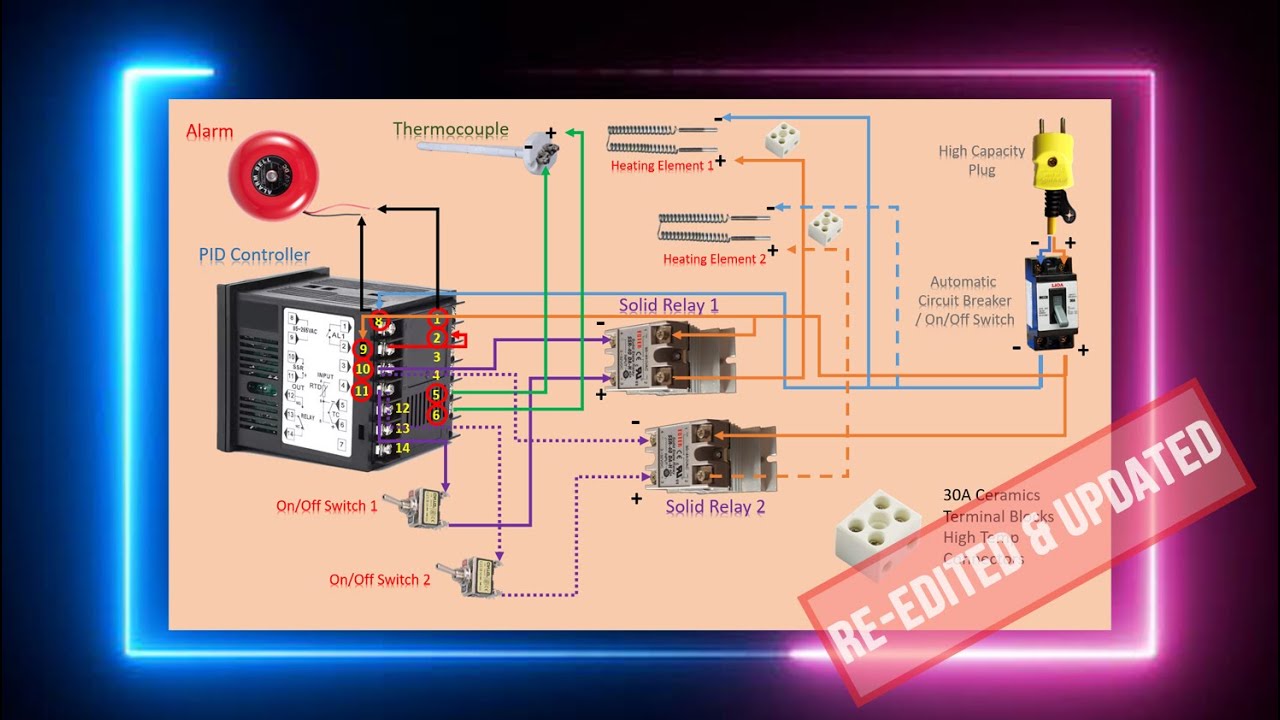

HOW TO WIRE PID FOR SINGLE OR MULTIPLE HEATING ELEMENTS | RE-EDITED & UPDATED

Build a Dynamic 3 Statement Financial Model From Scratch

Accurate 5 UD Buana_Setup Database

5.0 / 5 (0 votes)