Will Markets Hit All-Time Highs This Week? (SPY/QQQ/BTC Analysis)

Summary

TLDRThe video focuses on options trading strategies, particularly the timing and choice between shorter and longer-dated VIX calls. The speaker explains how short-term options respond more sharply to volatility, offering better opportunities for quick gains. They also highlight key economic events, such as Japan’s GDP, US CPI and PPI data, and upcoming earnings reports. The video emphasizes the potential market impacts of these events, with a special focus on next week’s FOMC interest rate decision and the options triple witching event. The speaker encourages viewers to subscribe for further analysis and updates.

Takeaways

- 😀 Shorter-dated VIX options (e.g., a few weeks out) are more likely to see quick price movements compared to longer-dated options.

- 😀 Longer-dated VIX calls might not move much even if the VIX spikes sharply, due to the time premium built into them.

- 😀 Zero DTE options, like short-term VIX calls, have less time for the market to move out of the money, leading to more sensitive price action.

- 😀 Japan's GDP report tonight could impact the market, especially in relation to potential interest rate decisions in Japan.

- 😀 On Wednesday, the U.S. CPI report will be released, which could cause significant market movement, given the current inflation narrative.

- 😀 Thursday's PPI report will also be important for market volatility due to its implications on inflation.

- 😀 Earnings reports this week include GameStop (Tuesday), Oracle and Chewy (Wednesday), and Adobe (Thursday), though not much else is expected.

- 😀 Next week, significant market events include Japan's interest rate decision, the FOMC interest rate decision, and the quarterly options triple witching event on Friday.

- 😀 The options triple witching event, happening four times a year, can create immense market volatility.

- 😀 The speaker encourages viewers to stay updated via StockTwits, X (formerly Twitter), and YouTube community tab for in-depth market analysis and engagement.

- 😀 The speaker offers motivational closing remarks and urges viewers to subscribe for future updates and trading advice.

Q & A

Why is shorter-dated options considered more responsive to market movements than longer-dated ones?

-Shorter-dated options are more responsive because they have less time to revert to out-of-the-money levels, meaning they can move faster with short-term market fluctuations. In contrast, longer-dated options have more time for the price to potentially revert, making them slower to respond to volatility.

What is the significance of the VIX in the context of options trading?

-The VIX represents market volatility, and options traders use it to gauge the expected level of market movement. VIX calls are options that benefit from spikes in volatility. However, the price of longer-dated VIX calls doesn't move much even if the VIX spikes sharply, as they are priced in the expectation of volatility over a longer time frame.

What are Zero-DTE options, and how are they similar to shorter-dated options?

-Zero-DTE options are options that expire on the same day they are traded. These options are similar to shorter-dated options because they both have little time until expiration, meaning their price moves more rapidly in response to market fluctuations.

What key economic events are expected to affect the markets this week?

-This week, important economic events include Japan's GDP report (which could influence their interest rate decision), the U.S. CPI report on Wednesday, and the U.S. PPI report on Thursday. These reports are significant due to their potential impact on inflation concerns, which are central to market movements.

How could Japan’s GDP numbers affect global markets?

-Japan's GDP numbers could influence the country's interest rate decision in the following week. If the GDP shows a strong economy, it may lead to an interest rate hike, while weak GDP numbers could suggest the opposite. Such decisions can affect global market sentiment, especially in Asia and globally interconnected economies.

What impact do the CPI and PPI reports have on the market?

-The Consumer Price Index (CPI) and Producer Price Index (PPI) are critical measures of inflation. Higher-than-expected inflation figures can lead to market volatility, as they may prompt central banks to tighten monetary policy. Given the ongoing inflation narrative, these reports are expected to have a significant market impact.

What is Triple Witching, and how does it affect the market?

-Triple Witching is an event that happens four times a year when stock options, stock index futures, and stock index options all expire on the same day. This can lead to increased volatility due to the large volume of options being exercised or settled, and the corresponding adjustments made by traders and institutions.

Why is the FOMC interest rate decision so crucial for market movements?

-The Federal Open Market Committee (FOMC) interest rate decision is crucial because it directly influences the cost of borrowing and economic activity. A rate hike can signal a more aggressive stance on controlling inflation, while a rate cut may suggest concerns about economic slowdown. These decisions significantly impact investor sentiment and market direction.

What earnings reports are noteworthy this week?

-Notable earnings reports this week include GameStop's earnings after the bell on Tuesday, Oracle’s earnings after the bell on Wednesday, Chewy’s earnings before the bell on Wednesday, and Adobe's earnings after the bell on Thursday. These companies' reports are highly anticipated, with GameStop being especially notable for its loyal 'ape' investor community.

How can traders prepare for upcoming events like the Japan interest rate decision and the FOMC meeting?

-Traders can prepare by analyzing economic data releases, monitoring market sentiment around inflation concerns, and staying informed about central bank decisions. Planning for volatility, especially around high-impact events like the FOMC meeting and Japan’s interest rate decision, is crucial for adjusting strategies or hedging positions.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

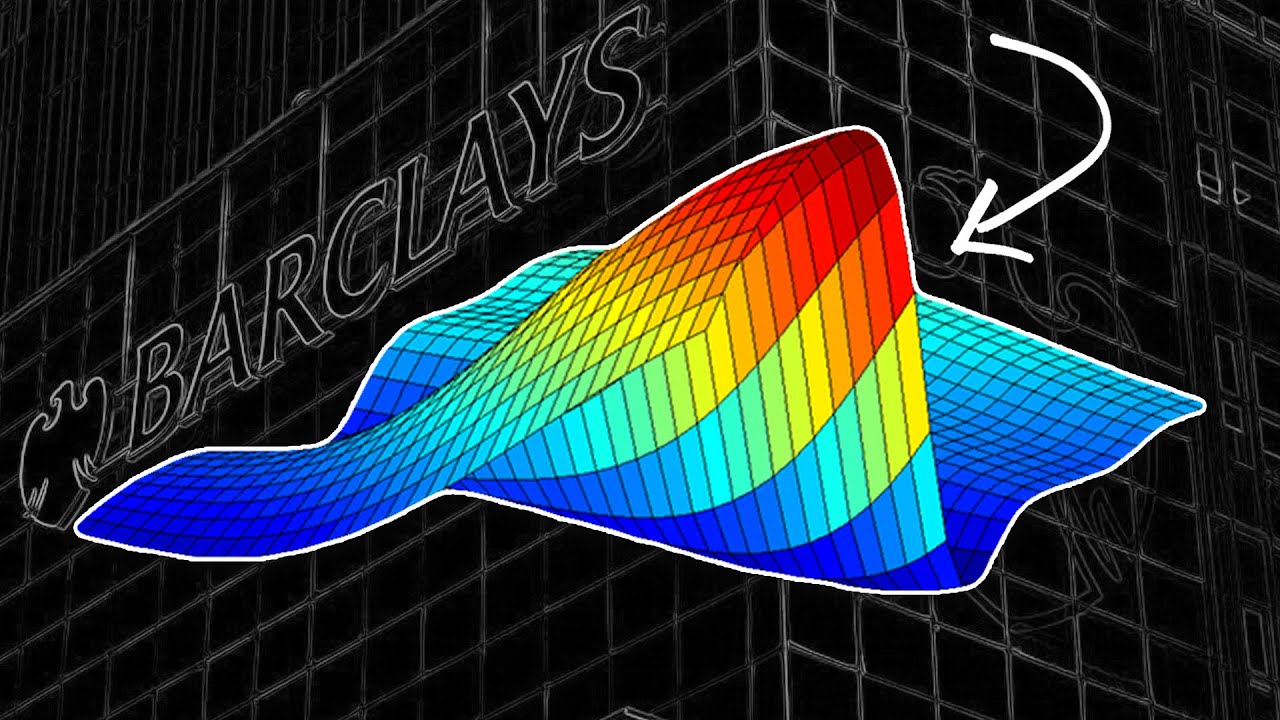

The Barclays Trading Strategy that Outperforms the Market

US-Wahl 2024 - Effektive Hedging-Strategien für Optionshändler

How to Find Zero Hero Trades on Expiry Day ? Gamma Blast Strategy for Beginners

Cboe Unlocks Global Market Access with Powerful New VIX Options

INDEX OPTIONS EXPLAINED: What Are They & How Are They NOT Stock/Equity Options?

Spot Vol Correlation - SPX, QQQ, GME, TSLA, AAPL, MSFT - Actionable Data with Volland Workspaces

5.0 / 5 (0 votes)