Lesson 021 - Adjusting Entries 5: Straight-Line Depreciation

Summary

TLDRThis lesson covers the topic of adjusting entries for depreciation in accounting, focusing on the straight-line method. The instructor explains the process of calculating asset depreciation, factoring in the asset’s cost, residual value, and useful life. The lesson includes an example of a company that purchased equipment and how depreciation is recorded annually. It also discusses the importance of adjusting entries to reflect depreciation in the accounting books and outlines how to calculate the carrying value of an asset after each year. The second example demonstrates how to prorate depreciation when assets are purchased mid-year.

Takeaways

- 😀 Depreciation refers to the decline in value of an asset over time due to wear and tear or passage of time.

- 😀 The residual value of an asset is its estimated value at the end of its useful life.

- 😀 The straight-line method of depreciation calculates depreciation by subtracting residual value from the asset's cost and dividing by its useful life in years.

- 😀 In the example provided, the cost of the asset is 500,000 with a residual value of 15,000 and a life of 5 years, resulting in an annual depreciation of 90,000.

- 😀 The journal entry for depreciation on December 31, 2020, would include a debit to depreciation expense for 90,000 and a credit to accumulated depreciation for the same amount.

- 😀 The accumulated depreciation is a contra-asset account that reduces the book value of the asset on the balance sheet.

- 😀 At the end of one year of depreciation, the carrying value of the asset would be 400,000 (500,000 - 90,000).

- 😀 Each year, depreciation accumulates, and the accumulated depreciation account grows by 90,000 annually.

- 😀 The carrying value of the asset at the end of five years, after full depreciation, is its cost minus the accumulated depreciation, with the residual value of 15,000 expected at the end.

- 😀 If an asset is purchased mid-year, depreciation should be prorated based on the months the asset was in use during the year, as shown in the second example where the asset was purchased in April and prorated for 9 months.

Q & A

What is depreciation?

-Depreciation is the decline in the value of an asset due to wear and tear, obsolescence, or the passage of time.

What is the residual value of an asset?

-Residual value is the expected value of an asset at the end of its useful life, after accounting for depreciation.

Which method of depreciation is discussed in this lesson?

-The straight-line method of depreciation is discussed in this lesson.

How is depreciation calculated using the straight-line method?

-Depreciation using the straight-line method is calculated by subtracting the residual value of the asset from its cost, then dividing the result by the asset's useful life in years.

What is the formula for calculating annual depreciation?

-The formula for calculating annual depreciation is: (Cost of the asset - Residual value) ÷ Useful life in years.

What is accumulated depreciation?

-Accumulated depreciation is a contra asset account that tracks the total depreciation of an asset over time, which reduces the asset's book value.

How do you calculate the carrying value of an asset after depreciation?

-The carrying value of an asset is calculated by subtracting the accumulated depreciation from the asset's original cost.

If an asset was purchased on April 1st, how do you adjust depreciation for the first year?

-If an asset was purchased on April 1st, depreciation for the first year is prorated based on the number of months the asset was in use. For example, in this case, depreciation for 9 months would be calculated.

How much depreciation is recognized in the first year for an asset costing 500,000 with a residual value of 15,000 and a useful life of 5 years, if purchased on April 1st?

-The depreciation for the first year, calculated for 9 months, is 67,500, based on the straight-line method.

What happens to the value of an asset each year when using straight-line depreciation?

-Each year, the value of the asset decreases by the same amount of depreciation, and the accumulated depreciation increases by the same amount, which reduces the carrying value of the asset.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

PENYUSUTAN METODE GARIS LURUS

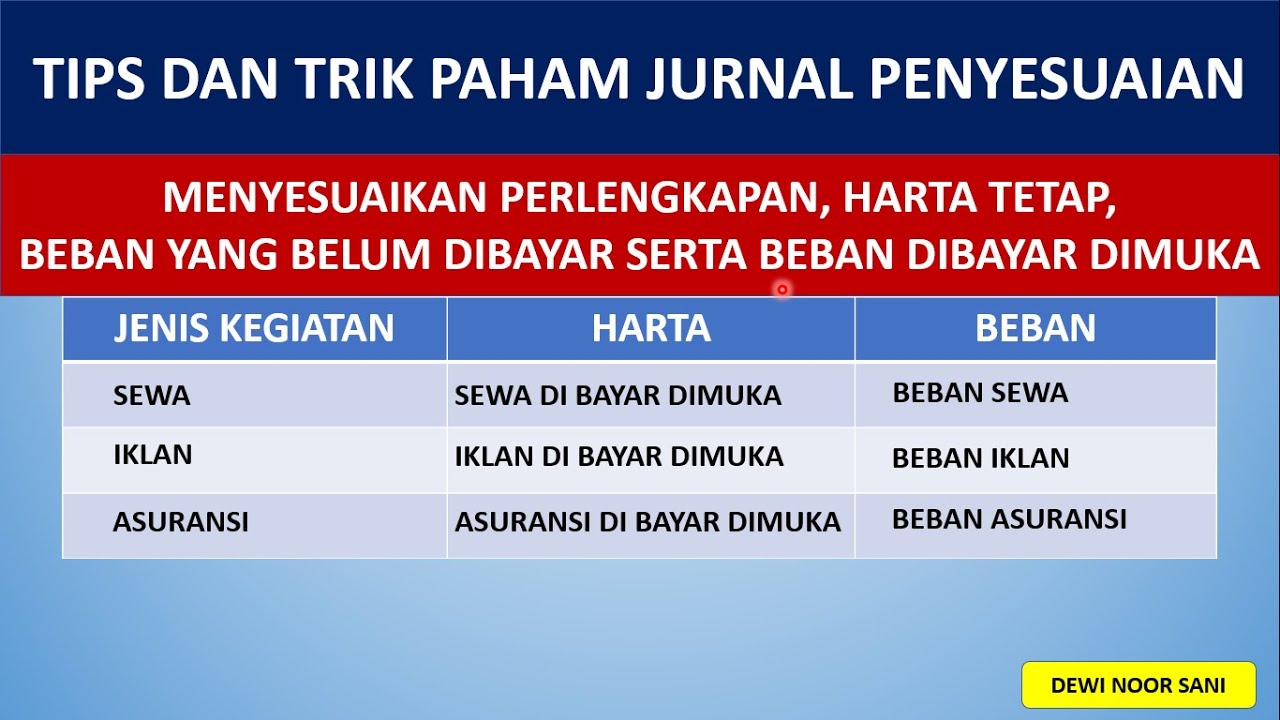

JURNAL PENYESUAIAN -Tips dan Trik Memahami dengan Cepat

Lesson 017 - Adjusting Entries 1: Prepaid Expenses (Basic Approach)

CA Foundation AVENGERS ️🔥 Depreciation All concepts - No time waste (Sep 2024 Revision Series)

Penyusutan Metode Garis Lurus, Saldo Menurun Ganda, Jumlah Angka Tahun, Dan Unit Produksi.

MENGOLAH DATA MENGGUNAKAN FUNGSI FINANSIAL | SPREADSHEET | METODE PENYUSUTAN

5.0 / 5 (0 votes)