Dividend based Models || Equity || CFA Level-1

Summary

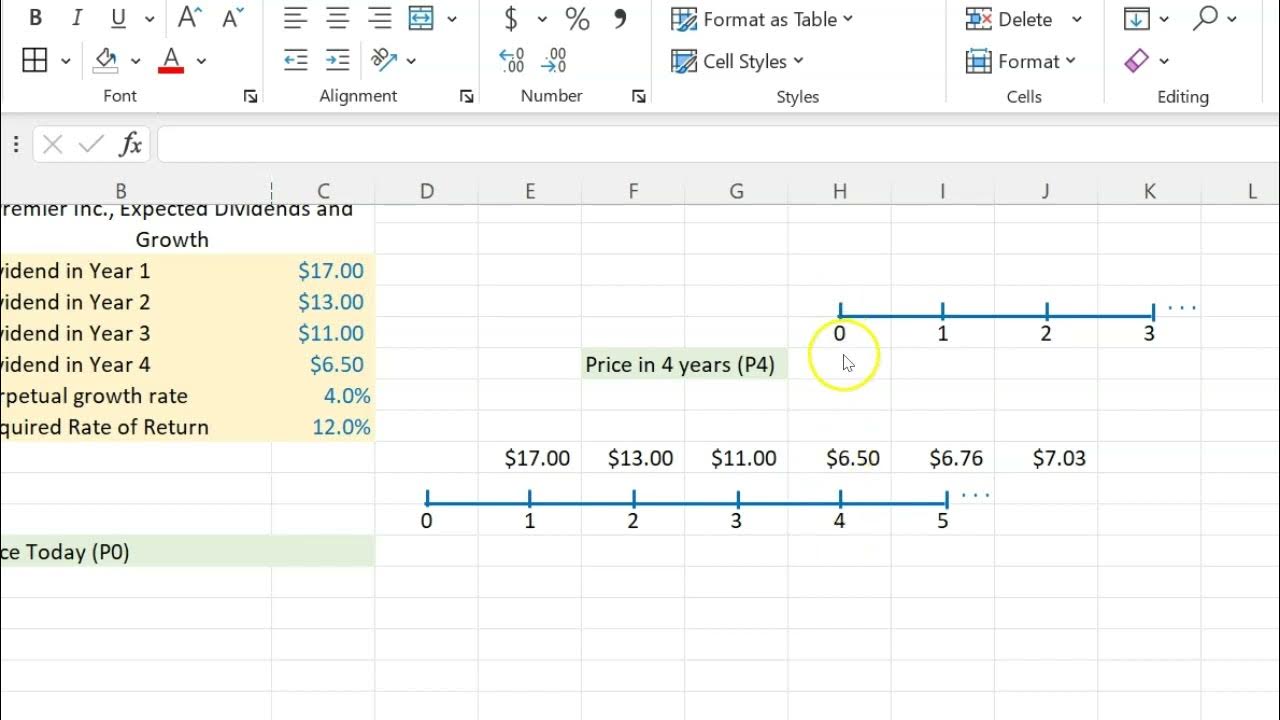

TLDRThis video discusses the limitations and assumptions of the Dividend Discount Model (DDM), emphasizing the sensitivity of the model to input values like growth rates. While the DDM is widely accepted in the financial world, its reliance on assumptions such as consistent dividend growth and the focus on dividends as a measure of shareholder wealth can lead to significant pricing changes if these inputs vary. The video also highlights the alternative approaches like the RFC model and the importance of understanding the fundamental assumptions that drive the DDM’s accuracy and relevance.

Takeaways

- 😀 The dividend-based model is highly sensitive to input values such as growth rates and expected dividends.

- 😀 Small changes in inputs (like growth rates) can lead to significant shifts in the model's output, including calculated share prices.

- 😀 The core assumption of the model is that dividends are the primary measure of shareholder wealth.

- 😀 The dividend-based model assumes that dividends will grow at a constant rate, which may not always reflect real-world scenarios.

- 😀 Sensitivity to changes in inputs is a major limitation of the dividend model, especially with small fluctuations in growth rates.

- 😀 The model assumes that dividends will remain stable and consistent, which might not hold true in all cases.

- 😀 The value of the model can change drastically if the assumptions about growth rates or dividends are altered.

- 😀 Financial models based on dividends are widely accepted in the industry, despite their inherent limitations.

- 😀 Although the model relies on assumptions like constant growth, these assumptions are fundamental to financial theory and common in practice.

- 😀 The speaker highlights the potential need for alternative approaches, such as the RFC approach, to address limitations in the dividend model.

- 😀 While dividend-based models are widely used, they may not always be the most accurate for evaluating shareholder wealth, especially if assumptions do not hold.

Q & A

What is the main focus of the dividend-based model discussed in the transcript?

-The dividend-based model focuses on estimating the value of an investment based on the expected dividends that shareholders will receive. It assumes that dividends are the primary measure of shareholder wealth.

Why is the dividend-based model considered sensitive to input values?

-The model is highly sensitive to input values, such as growth rate and dividend expectation. A small change in these values, like a slight adjustment in the growth rate, can significantly impact the model’s output, leading to a large change in the estimated price of the investment.

What assumption does the dividend-based model rely on?

-The model relies on the assumption that dividends are a consistent and accurate measure of shareholder wealth. It assumes that the dividends will grow consistently over time, and the value of an investment can be derived from these dividends.

What issue does the model face with regard to dividend growth?

-The model assumes that dividends will grow consistently, but this assumption is not always accurate. If the growth rate changes or if dividends do not grow as expected, the model's output can be significantly affected.

How does the growth rate affect the model's output?

-The growth rate is a crucial input in the dividend-based model. A small change in the growth rate, even by 1% or 2%, can result in a significant change in the estimated value of the investment, demonstrating the model's sensitivity to this input.

What is the limitation of assuming dividends are the primary measure of shareholder wealth?

-Assuming dividends are the primary measure of shareholder wealth may not always be correct. In some cases, shareholders may derive value from other factors, such as capital gains or stock price appreciation, rather than just dividends.

What is the alternative approach mentioned in the transcript to address the limitations of the dividend-based model?

-The alternative approach mentioned is the 'RFC approach,' which may offer a different way of assessing shareholder wealth and addressing the limitations of the dividend-based model, particularly its sensitivity to input assumptions.

Why is the dividend-based model still widely accepted in the financial world?

-The dividend-based model is widely accepted because it is simple, straightforward, and based on fundamental principles like the time value of money. It provides a basic, easy-to-understand way to value investments using dividends as a primary measure of value.

How does the model's reliance on assumptions affect its accuracy?

-The model's reliance on assumptions, such as constant dividend growth, can reduce its accuracy if these assumptions do not hold true. Small errors in assumptions or changes in input values can lead to large discrepancies in the model’s output.

What does the transcript suggest about the role of inputs in financial models?

-The transcript suggests that inputs in financial models are critical and must be handled with care. Since financial models like the dividend-based model are highly sensitive to changes in inputs, it is important to accurately estimate factors like dividend growth, holding period, and other assumptions to avoid large errors in the final value estimate.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

Dividend Discount Gordon Model || CFA Level-1 || Equity

Stock Valuation With Non-Constant Dividends (Using Excel)

Dividend Discount Model || Equity || CFA Level-1

Analisis Dividen Tunai hingga Tips Menghindari Dividen Trap

Valuation based on FCFF & FCFE || Equity || CFA Level-1

Dividend Discount Model (DDM)

5.0 / 5 (0 votes)