Changes To Social Security Under Trump | Be Prepared

Summary

TLDRThe video script explores proposed changes to Social Security under President-elect Donald Trump, including promises to eliminate taxes on Social Security benefits and reduce taxes on tips and overtime. The potential impact of these policies on the Social Security trust fund is discussed, with experts warning that the fund could become insolvent sooner than expected. The video also covers political challenges, such as the lack of a supermajority in Congress, and state-level tax policies. While significant changes are expected, the exact outcome remains uncertain, as the policies' full effects depend on broader economic strategies and political negotiations.

Takeaways

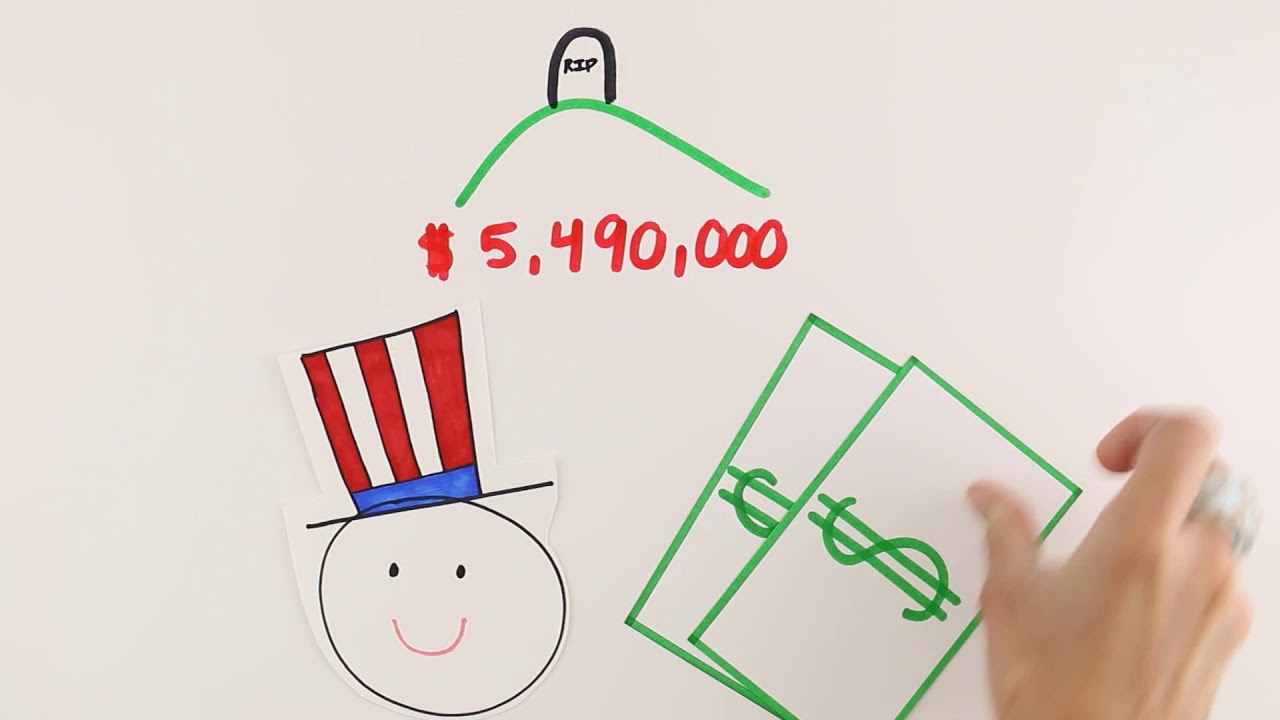

- 😀 President-elect Donald Trump has promised to eliminate taxes on Social Security benefits, which would increase payouts for seniors, but this could speed up the insolvency of the Social Security Trust Fund.

- 😀 Financial experts predict that the Social Security Trust Fund could become insolvent by 2030 if Trump’s tax cuts for seniors are implemented.

- 😀 In 2025, Social Security payments will be made on the first of each month, with payment dates adjusted if the first falls on a holiday or weekend.

- 😀 9 states still tax Social Security benefits, even though federal taxes may be eliminated, creating a discrepancy for beneficiaries in those states.

- 😀 Trump’s proposals include imposing tariffs on foreign goods and mass deportations, which he argues could generate revenue for the Social Security Trust Fund.

- 😀 The maximum taxable earnings for Social Security will increase from $168,600 in 2024 to $176,100 in 2025, but experts suggest raising it to $300,000 or more to protect the fund.

- 😀 Trump's tax reform plans face hurdles due to the need for broad support in Congress, with some Republicans questioning the reliability of financial reports used for decision-making.

- 😀 A proposed bill called the Social Security Fairness Act would repeal provisions that reduce Social Security benefits for those receiving government pensions, potentially increasing payouts for 2 million beneficiaries.

- 😀 If Social Security taxes on higher-income individuals and businesses are extended under Trump’s tax cuts and jobs act, it could provide more revenue but also complicate negotiations.

- 😀 While Trump’s administration may push for tax cuts and economic reforms, the timeline for significant changes to Social Security remains uncertain, with many political challenges ahead.

Q & A

What is President-elect Donald Trump's stance on Social Security taxes?

-Trump has promised to eliminate taxes on Social Security benefits. This would provide tax relief to beneficiaries, but experts warn it could hasten the depletion of the Social Security Trust Fund.

How could Trump's proposed tax cuts affect the Social Security Trust Fund?

-Cutting taxes on Social Security benefits would reduce the revenue going into the Social Security Fund, potentially causing it to become insolvent much sooner than projected. Some experts predict the fund could run out as early as 2030 instead of 2034.

What is the issue with state-level taxation of Social Security benefits?

-While the federal government may eliminate taxes on Social Security benefits, many states will continue to tax them. By 2025, nine states will still impose taxes on Social Security benefits, creating an additional tax burden for beneficiaries.

Which states will still tax Social Security benefits in 2025?

-In 2025, the nine states that will continue to tax Social Security benefits are Colorado, Connecticut, Minnesota, Montana, New Mexico, Rhode Island, Utah, Vermont, and West Virginia.

What is the Social Security Fairness Act, and who does it impact?

-The Social Security Fairness Act seeks to repeal provisions that reduce Social Security benefits for individuals receiving pensions from state or local governments, such as police officers or teachers. It could impact around 2 million beneficiaries by increasing their Social Security payments.

What are the predicted consequences of Trump's tax cuts on Social Security?

-If Trump’s tax cuts for seniors are implemented, Social Security recipients would receive more money each month. However, this could lead to a reduction in the fund's reserves, potentially resulting in a 23% benefit cut around 2034 if the fund becomes insolvent.

What is the current Social Security tax rate, and how will it change in 2025?

-The current Social Security tax rate is 12.4%, with 6.2% paid by the employee and 6.2% by the employer. In 2025, the taxable maximum income for Social Security taxes will increase from $168,600 to $176,100.

Why is there debate over increasing the Social Security tax maximum?

-There is a debate over whether to raise the Social Security tax maximum to $300,000 or $400,000. However, President Biden has promised not to raise taxes on individuals earning less than $400,000, creating a conflict between maintaining that promise and addressing the Social Security fund's solvency.

What other economic policies does Trump propose to address Social Security funding?

-Trump has proposed tariffs on imported goods and mass deportations of illegal immigrants. These policies could generate additional revenue for the U.S. government, which could be used to help fund Social Security.

What is the expected change in the payment schedule for Social Security in 2025?

-In 2025, Social Security payments will be issued on the first day of each month. If the first day falls on a holiday or weekend, beneficiaries will receive their payments on the preceding business day.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

Donald Trump & Kamala Harris: Economic Proposals Compared

No Tax on Social Security Income? The Truth About Trump's Plan and What It Means for You

Viral, Trump Picu Kontroversi dengan Bagikan Peta Kanada sebagai Bagian dari AS | KONTAN News

Is the US running out of Social Security?

Types of Taxes in the United States

Trump’s Tax Bill Advances – But Can Republicans Stick Together?

5.0 / 5 (0 votes)