Statement of Financial Position (SOFP) | Laporan Posisi Keuangan | Akuntansi Keuangan Menengah

Summary

TLDRThis video script offers an in-depth discussion on the Statement of Financial Position, also known as the balance sheet in Indonesian. It explains the purpose of the statement, which is to reflect a company's assets, liabilities, and equity at a specific date, rather than over a period. The script highlights the uses of the statement for analysis, such as assessing a company's return on investment and financial structure. It also points out limitations, including the use of historical cost and the potential inaccuracies due to estimates and depreciation. The video provides a detailed breakdown of the components of the statement, including current and non-current assets, and equity, emphasizing the importance of balance and accuracy in financial reporting.

Takeaways

- 📊 The Statement of Financial Position (SFP), also known as a balance sheet, is a financial report that shows a company's assets, liabilities, and equity at a specific point in time, not over a period.

- 🔍 SFP is used by analysts to calculate the return on investment and assess the company's capital structure, as well as to identify potential risks and forecast future cash flows.

- ⚠️ Limitations of SFP include reporting assets and liabilities at historical cost, which may not reflect current market values, and the inclusion of estimates and judgments made by management that can affect accuracy.

- 🏢 SFP does not report certain components that have monetary value, such as brand recognition or employee skills, which can contribute to a company's value but are not financially measurable.

- 📈 SFP is structured to show assets, liabilities, and equity, with the basic accounting equation that assets equal liabilities plus equity, ensuring the balance of the statement.

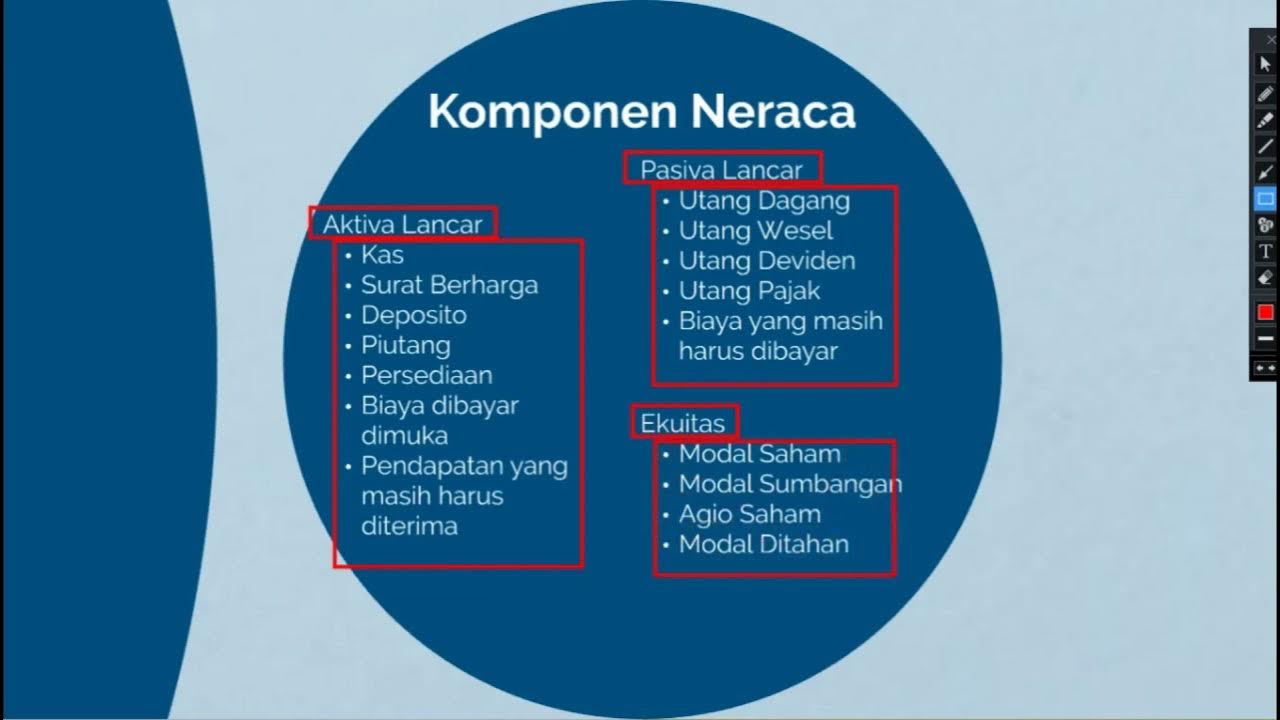

- 📋 SFP is divided into current assets (short-term, less than one year) and non-current assets (long-term, more than one year), with further breakdowns into categories like investments, property, plant, and equipment.

- 💼 Non-current assets include long-term investments, assets held for speculation, sinking funds, and investments in unconsolidated subsidiaries or associated companies.

- 🛠️ Property, plant, and equipment are tangible fixed assets used in operations, and it's important to account for accumulated depreciation, except for land, which does not depreciate.

- 📝 Intangible assets, such as copyrights, patents, trademarks, and goodwill, are also part of the SFP, with the note that goodwill should generally not be amortized but may be subject to impairment.

- 💼 Equity includes various accounts like share capital, share premium, retained earnings, and comprehensive income, with adjustments for treasury shares and dividends.

- 📉 Non-controlling interests, or minority interests, are also part of equity and represent the portion of equity in a subsidiary not owned by the parent company.

Q & A

What is the Statement of Financial Position?

-The Statement of Financial Position, also known as the balance sheet, is a financial report that shows the value of a company's assets, liabilities, and equity at a specific date, rather than over a period of time.

What is the purpose of the Statement of Financial Position?

-The Statement of Financial Position serves as a tool for analysts to calculate the returns generated by a company, assess the company's capital structure, identify potential risks, and prospectively determine the company's future cash flow.

What are the limitations of the Statement of Financial Position?

-The limitations include reporting assets and liabilities at historical cost, which may not reflect current market values; the presence of estimates and judgments made by management that can affect accuracy; and not reporting certain components that have monetary value, such as brand recognition or employee skills.

Why is the historical cost method a limitation in the Statement of Financial Position?

-The historical cost method reports the value of assets at the cost of acquisition, which may not be updated to reflect current market conditions, thus not accurately representing the true state of the company's assets.

What is the difference between current assets and non-current assets?

-Current assets are those expected to be converted to cash or used up within one year or less, while non-current assets, also known as long-term assets, are expected to be used for more than one year.

What are some examples of non-current assets?

-Examples of non-current assets include long-term investments, fixed assets such as furniture, vehicles, buildings, computers, machinery, and intangible assets like copyrights, patents, trademarks, and goodwill.

What is the significance of the term 'amortization' in the context of intangible assets?

-Amortization refers to the process of gradually writing off the cost of intangible assets over their useful life, except for assets like goodwill, which are typically not amortized but may be subject to impairment testing.

How is the Statement of Financial Position structured?

-The Statement of Financial Position is structured to show assets on one side, liabilities on the other, and equity in the middle. It follows the fundamental accounting equation: Assets = Liabilities + Equity, and must be balanced.

What is the difference between equity and non-controlling interest in the Statement of Financial Position?

-Equity represents the ownership interest of the parent company in the subsidiary, while non-controlling interest, or minority interest, represents the ownership interest of minority shareholders in the subsidiary that is not controlled by the parent company.

Why is it important to distinguish between current and non-current liabilities?

-Distinguishing between current and non-current liabilities is important because it provides insight into the company's ability to meet its short-term obligations and its long-term financial commitments.

What are some examples of current liabilities?

-Examples of current liabilities include accounts payable, short-term loans, current maturities of long-term debt, and other short-term obligations that are due within one year or less.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

Fundamentals of Accountancy, Business and Management 2 for Grade 12 - Module 1 (Chapter 1/Week 1)

Profit & Loss Account, Preparation of Final Accounts, Format of Profit and Loss Account, Accounting

Vid # 5 BUSINESS MANAGEMENT ACCOUNTING Module 3 Part 1

11 Financial Analyst Interview Questions - Concepts to Practical Implications | Conceptual Interview

Video Pembelajaran Jenis Laporan keuangan

The Financial Statements & their Relationship / Connection | Explained with Examples

5.0 / 5 (0 votes)