ICT Concepts - Refined Dealing Ranges 🤫

Summary

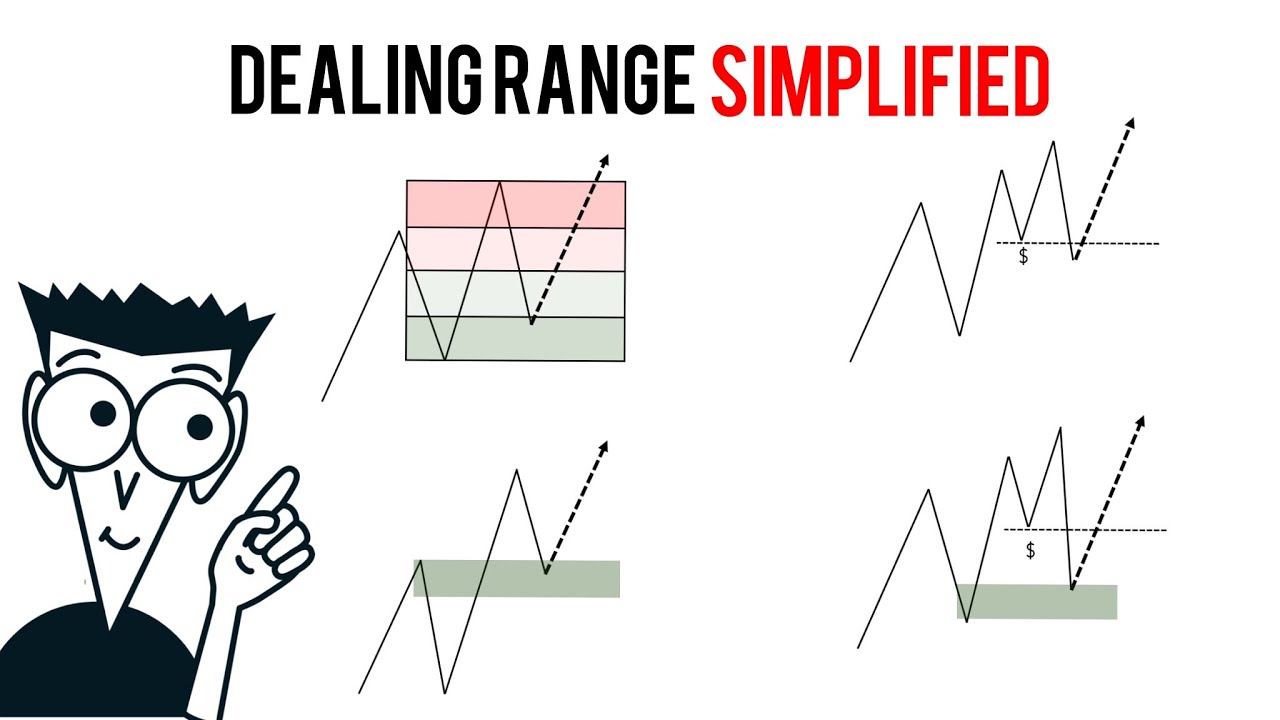

TLDRThis video delves into the concept of dealing ranges in trading, emphasizing how they help identify key price levels such as premium, discount, and equilibrium. The speaker outlines how to operate within different time frames to refine trading strategies, particularly focusing on the hourly and 15-minute ranges. Key strategies include identifying liquidity pools, analyzing market strength, and using precise trade confirmations. The importance of manipulation before entering trades and leveraging lower time frame signals for accurate entries is discussed, providing actionable insights for traders looking to refine their approach to market analysis and execution.

Takeaways

- 😀 The concept of dealing ranges is crucial but often misunderstood in ICT (Inner Circle Trader) analysis, and it's important to know how to find the proper discount or premium.

- 😀 Operating between multiple time frames is essential for selecting the correct dealing range, with specific focus on the hourly, 15-minute, and 1-minute time frames.

- 😀 A bullish trend typically involves sweeping sell-side liquidity followed by a sweep of buy-side liquidity, which anchors the dealing range.

- 😀 In a bullish trend, prices typically move from discount levels to equilibrium, then to premium levels, with the goal being to hit buy-side targets.

- 😀 The larger dealing range can be defined on the hourly chart, with equilibrium serving as a key reference for price action.

- 😀 Refined dealing ranges, such as those on the 15-minute or 1-minute charts, help gauge strength and offer better entry points by pinpointing internal levels within the larger range.

- 😀 Understanding liquidity draws (such as new day opening gaps) helps in developing a bullish bias and pinpointing where price is likely to go next.

- 😀 When looking for bullish setups, it’s important to first observe some form of manipulation to the downside before price starts expanding higher.

- 😀 The 15-minute refined dealing range is useful for observing short-term swings and internal liquidity pools, helping identify precise entry points for trades.

- 😀 Price is unlikely to spend much time in a discount when the market is strong; it will quickly bounce back from key levels like the equilibrium of the refined dealing range, signaling a continuation of the bullish trend.

Q & A

What is a dealing range in trading?

-A dealing range refers to the price range between key liquidity levels (highs and lows) within a specific timeframe. It helps traders determine whether the market is in a discount or premium zone, which aids in identifying potential reversal or continuation points.

Why are multiple timeframes important when analyzing dealing ranges?

-Using multiple timeframes allows traders to identify broader market context on higher timeframes (e.g., hourly) and refine entry points using lower timeframes (e.g., 15-minute, 1-minute). This ensures more accurate trading decisions and better confirmation of trends and strength.

What is the significance of equilibrium in a dealing range?

-Equilibrium is the midpoint of a dealing range, and it represents a neutral zone between premium and discount levels. Traders use this level to determine potential price reversals. In a bullish market, price often bounces off equilibrium or discount levels before expanding upwards.

How does the concept of liquidity pools impact trading decisions?

-Liquidity pools are areas in the market where a large amount of orders accumulate, such as previous swing highs or lows. These pools are important because price tends to gravitate toward them, and traders watch these levels to identify potential price reversals or breaks.

What is the difference between a 'larger' dealing range and a 'refined' dealing range?

-A larger dealing range is the broader range defined by higher timeframes (like hourly or 4-hour), while a refined dealing range is a smaller, more specific range identified on lower timeframes (like the 15-minute or 1-minute). Refined ranges help with pinpointing precise entry points and assessing market strength.

What is meant by a 'bullish order flow' and how does it influence trade decisions?

-A bullish order flow refers to the prevailing upward momentum in the market, indicated by price moving higher and clearing buy-side liquidity. Traders look for bullish order flow to confirm their bullish bias and enter long trades when price comes back to discount or equilibrium levels.

How can traders use the concept of 'manipulation' in price action to time their entries?

-Manipulation refers to price testing or briefly moving beyond key liquidity levels (such as lows or highs) before reversing. Traders use this as a sign that price is ready to return to a primary direction (e.g., bullish), confirming entry points after such a manipulation.

Why is it important to monitor the New Day opening Gap and how does it relate to liquidity?

-The New Day opening Gap represents a potential liquidity pool, especially in a bullish market. Traders watch for price to gravitate toward this gap as part of liquidity draw, helping to identify areas of price reversal or continuation based on the gap’s position relative to the current price action.

What does a reaction at a refined dealing range’s equilibrium level indicate?

-A reaction at a refined dealing range’s equilibrium level suggests a significant price point where market participants may show signs of reversal. This is often a point where price may either bounce and continue the trend or fail and break lower, signaling strength or weakness in the market.

How does the use of lower timeframes, like the 1-minute chart, enhance the analysis of market strength?

-Lower timeframes, such as the 1-minute chart, help to provide finer details of price action, allowing traders to confirm entries after price reaches key levels like equilibrium. They also help identify quick reversals or continuations, providing immediate confirmation of a larger trade idea developed from higher timeframes.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

You Are Using Discount and Premium Wrong! - EQ For Expansions

ICT Dealing Range Theory (DRT) Simplified & Explained - How to Find ICT Dealing Range

ICT Mentorship Core Content - Month 1 - Equilibrium Vs. Premium

Dealing Range Simplified

The ONLY Way to Trade Reversals and Retracements (That Actually Works)

Predict Market Reversals Before Everyone Else - CISD

5.0 / 5 (0 votes)