Choosing Dealing Ranges & Displacement Ranges - ICT Concepts

Summary

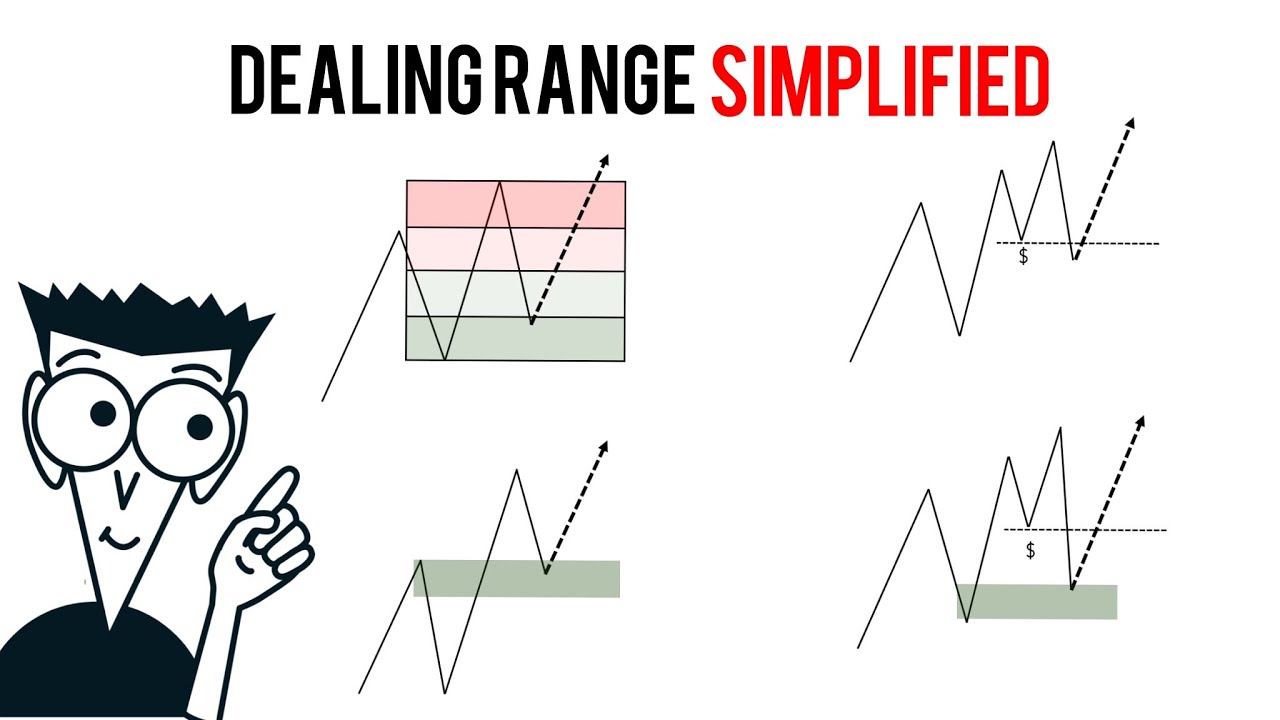

TLDRThis video provides an in-depth explanation of dealing ranges and displacement ranges in trading. It covers how to identify key highs and lows, zooming in and out to visualize dealing ranges, and understanding external versus internal liquidity. The video also explores displacement ranges, how aggressive price action can break structures, and the importance of retracements into discounts before making trades. The presenter demonstrates how to use Fibonacci retracements, order blocks, and optimal trade entry points (OTE) to identify long opportunities and optimize trading strategies. It’s a practical guide for better understanding price action in different market scenarios.

Takeaways

- 😀 Dealing ranges are identified by marking the high and low points of price action on a chart.

- 😀 You can use Fibonacci retracement to map out the dealing range between the high and low points.

- 😀 Zooming out can turn external liquidity into internal liquidity, which is important when observing larger time frames.

- 😀 Displacement ranges are identified by aggressive price movements breaking through structure (e.g., support or resistance).

- 😀 After a displacement leg, traders look for a retracement into a discount zone before considering a trade entry.

- 😀 Price action during the New York session should be analyzed for valid dealing ranges, especially after significant moves.

- 😀 Traders need to consider whether the price is in a premium or discount zone of a dealing range when making decisions.

- 😀 An order block is a point of interest where price previously reversed, and it can act as a key level for trade entries.

- 😀 To trade long, a trader looks for price to retrace into a discount zone of both the displacement range and the dealing range.

- 😀 In case the initial entry is missed, traders should look for another opportunity within the discount of the dealing range or displacement range.

- 😀 Short trades are considered when price reaches a premium zone of the dealing range, and the trader is looking for price to reverse.

Q & A

What are dealing ranges in trading, and how do you identify them?

-Dealing ranges are the high and low points in a specific price range. To identify them, simply zoom in on the chart to find the high and low where price is currently trading. A Fibonacci retracement can then be drawn from the high to the low to define the dealing range.

What is the difference between external and internal liquidity?

-External liquidity refers to the liquidity outside of the current dealing range, whereas internal liquidity refers to the liquidity within the dealing range. It's important to understand that liquidity can shift from external to internal as you zoom out on the chart.

How does zooming out affect your perception of liquidity?

-Zooming out allows you to see the broader market structure. What might initially appear as external liquidity can become internal liquidity when considering a larger price range. This shift emphasizes the importance of looking at price action over different timeframes.

What are displacement ranges, and how do they differ from dealing ranges?

-Displacement ranges refer to aggressive price movements that break through structure. These differ from dealing ranges because displacement ranges focus on rapid moves in the market, whereas dealing ranges are based on highs and lows that are more stable.

What role do displacement ranges play in identifying trade opportunities?

-Displacement ranges indicate where significant price action has occurred, often breaking market structure. Traders can look for retracements into these displacement ranges to find potential entry points for trades, especially when seeking to enter at a discount.

Why is it important to look for a retracement into a discount of a displacement range?

-A retracement into a discount of a displacement range allows traders to enter the market at a better price, potentially reducing risk and improving the risk-to-reward ratio. It provides a favorable entry after an initial aggressive move.

What is the concept of 'OTE' in trading, and how does it relate to displacement and dealing ranges?

-OTE stands for 'Optimal Trade Entry,' which is typically a specific point of interest, like an order block, where the market is expected to reverse. It relates to displacement and dealing ranges because traders look for these points of interest within the discount zones of these ranges.

What is an order block, and how does it influence trade decisions?

-An order block is a price level where institutions are likely to have placed large orders, often leading to a reversal in the market. Traders look for price to return to these levels, especially when within the discount zone of a displacement or dealing range, to enter trades with higher probability.

How can traders use Fibonacci retracements in conjunction with dealing and displacement ranges?

-Fibonacci retracements are used to identify key levels within both dealing and displacement ranges. By drawing a Fibonacci from the high to low of a range, traders can identify areas where price may retrace, such as the 50% or 62% levels, which are ideal for entering trades at a discount.

How do you determine whether to look for long or short opportunities when working with dealing and displacement ranges?

-To identify whether to look for long or short opportunities, traders analyze whether price is trading in a premium or discount within the dealing range. For long opportunities, traders look for price to retrace into a discount, and for short opportunities, they look for price in a premium, offering a better entry for a reversal.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

2 Powerful 'RANGES' that Control Every BIG Move🔥| Dealing & Displacement Ranges | SMC | ICT

ICT Concepts - Identifying Dealing Ranges CORRECTLY 💎

ICT Concepts: How to Choose and Use Dealing Ranges

Dealing Range Simplified

Full Trading Plan using Dealing Ranges - Ep 21

ACL: Access Control List | Lecture 14 | IP Trainers | CCNA | CCNP | CCIE [Urdu/Hindi]

5.0 / 5 (0 votes)