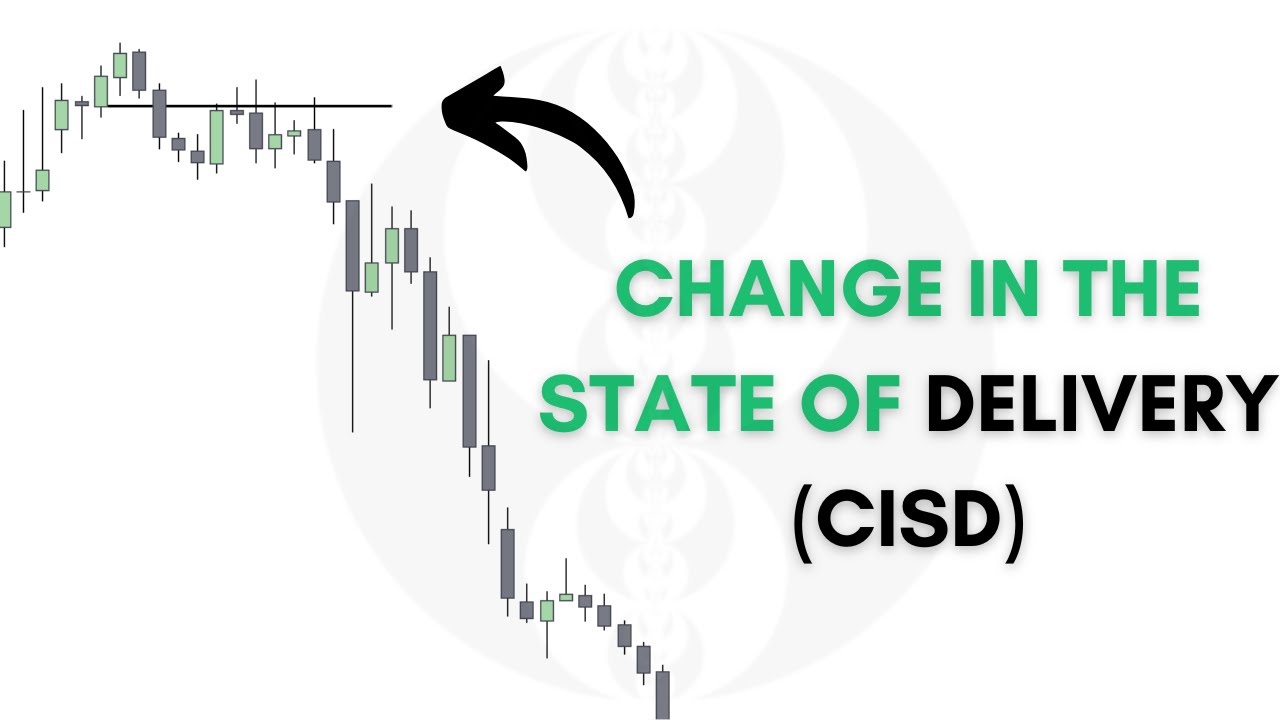

Predict Market Reversals Before Everyone Else - CISD

Summary

TLDRThis script delves into the concept of 'change in state of delivery' in trading, a method to identify high-probability reversals. It emphasizes the importance of displacement, key price level reactions, and the interaction with premium and discount ranges. The speaker illustrates how recognizing these patterns can allow traders to enter the market early with a favorable risk-reward ratio, using both bullish and bearish scenarios as examples. The video aims to educate traders on anticipating market reversals without waiting for traditional market structure confirmations.

Takeaways

- 📈 A 'Change in State of Delivery' (CSOD) is a trading concept used to identify high-probability reversals in the market.

- 🔍 CSOD requires observing price action for displacement and respecting or disrespecting certain price levels, known as PD arrays.

- 🐂 For a bullish scenario, traders look for the price to respect discount arrays and disrespect premium arrays, and vice versa for a bearish scenario.

- 📊 CSOD is confirmed when the price action shows heavy displacement past the open of a candle, indicating a potential reversal.

- 🏗️ The concept involves identifying key higher time frame levels where price action can validate or invalidate the CSOD.

- ⏳ After a CSOD, traders should look for a retracement to a bearish or bullish order block, indicating further price movement in the anticipated direction.

- 🎯 The strength of a CSOD increases when it occurs off a key higher time frame level, with significant displacement and the disrespect of discount and respect of premium arrays.

- 📉 In a bearish trend, a CSOD can be identified by price action that disrespects the open of an up candle, signaling a potential continuation of the downtrend.

- 📈 In a bullish trend, a CSOD is confirmed when the price action sweeps through lows, indicating a potential reversal to the upside.

- 📝 Traders can refine their CSOD strategy by choosing how many up candles to include in their analysis, depending on market experience and the size of the price range.

- 💡 CSOD provides early signs of a market reversal, allowing traders to enter positions with a better risk-to-reward ratio compared to waiting for a market structure shift or break.

Q & A

What is a change in state of delivery in trading?

-A change in state of delivery is a concept in trading that signifies a potential market reversal. It occurs when the price action disrespects the open of the last significant candle in the current trend direction, indicating a shift in the market's momentum.

Why is displacement important in identifying a change in state of delivery?

-Displacement is crucial because it validates the change in state of delivery. It refers to the price moving significantly past the open of a key candle, which helps confirm the potential reversal and increases the probability of the change in state of delivery.

What are PD arrays and how do they relate to the change in state of delivery?

-PD arrays, or Price Development arrays, are areas on a price chart that represent potential support or resistance levels. In the context of a change in state of delivery, respecting or disrespecting these levels can either solidify or contradict the potential reversal signal.

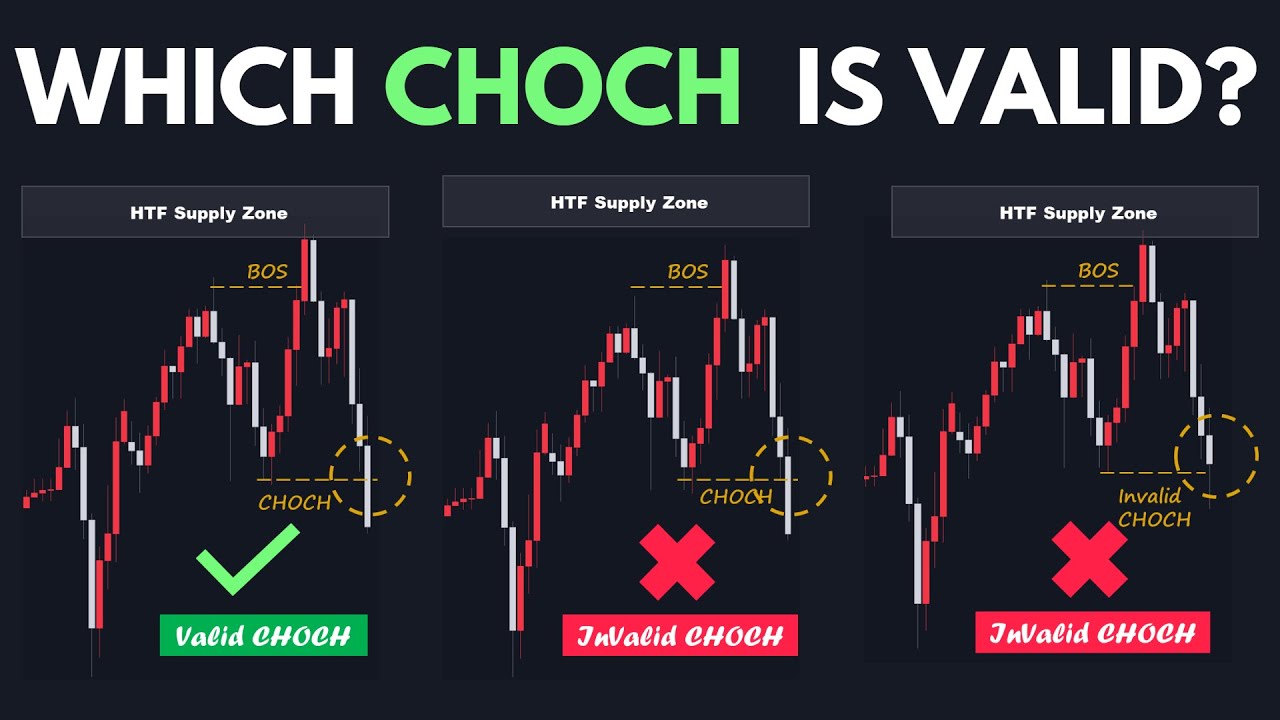

How does the time frame level impact the change in state of delivery?

-The time frame level is important because it provides context for the change in state of delivery. A change that occurs off a key higher time frame level is more significant and carries more weight, thus increasing the probability of the change in state of delivery being valid.

What is the significance of respecting and disrespecting premium and discount arrays after a change in state of delivery?

-After a change in state of delivery, if the price respects discount arrays (for a bullish scenario) or premium arrays (for a bearish scenario), it reinforces the change in state of delivery. Disrespecting the opposite array further solidifies the potential reversal, making the change in state of delivery more probable.

How can a change in state of delivery be used to enter trades early in the market?

-A change in state of delivery allows traders to anticipate market reversals before they are confirmed by other indicators like market structure shifts or breaks. By identifying early signs of reversal, traders can enter trades with a better risk-to-reward ratio and potentially catch larger moves.

What is the difference between a change in state of delivery and a market structure shift?

-A change in state of delivery is an early sign of a potential market reversal, whereas a market structure shift is a confirmation of a trend change that typically occurs later. A change in state of delivery can be used to enter trades earlier than waiting for a market structure shift.

How does the higher time frame direction influence the change in state of delivery?

-The higher time frame direction is crucial as it sets the overall market context. A change in state of delivery that aligns with the higher time frame direction is more likely to be valid and have a higher probability of success.

What is the role of key levels in the change in state of delivery strategy?

-Key levels, such as significant support or resistance zones, play a critical role in the change in state of delivery strategy. The interaction of price with these levels can either confirm or invalidate the change in state of delivery signal.

Can the change in state of delivery be used on different time frames?

-Yes, the change in state of delivery can be applied to various time frames, from daily to intraday charts. It allows traders to identify potential reversals and enter trades with a higher probability of success across different time scales.

How does the number of up or down candles used in the change in state of delivery affect the strategy?

-The number of up or down candles used can refine the change in state of delivery signal. Using fewer candles can provide earlier signals, but using too many might delay the entry until a market structure shift occurs. It's subjective and depends on the trader's experience and the specific market conditions.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Time & Price Algorithmic Trading: Intermarket Relationship

Change In The State Of Delivery (CISD) - Reversal Confirmation

Change of Character Simplified - Smart Money Course

Change in State of Delivery (CISD) - Understanding Reversals

Change In State Of Delivery | CISD Simplified

The ONLY Way to Trade Reversals and Retracements (That Actually Works)

5.0 / 5 (0 votes)