Compound Interest (Higher & Foundation) | GCSE Maths Revision | GCSE Maths Tutor

Summary

TLDRThis video focuses on solving compound interest problems, demonstrating the use of powers, square roots, and cube roots on a calculator to determine interest rates. It covers various scenarios, including calculating the interest rate from a given investment over multiple years and using the formula for compound interest to solve for unknown rates. Key examples involve Joe's investment with a 2.5% annual interest rate, Kaler's investment with a 1.8% rate, and Sofia's compound interest with both 2.4% and 1.8% rates for different periods. The video emphasizes careful calculation and testing different powers for accuracy.

Takeaways

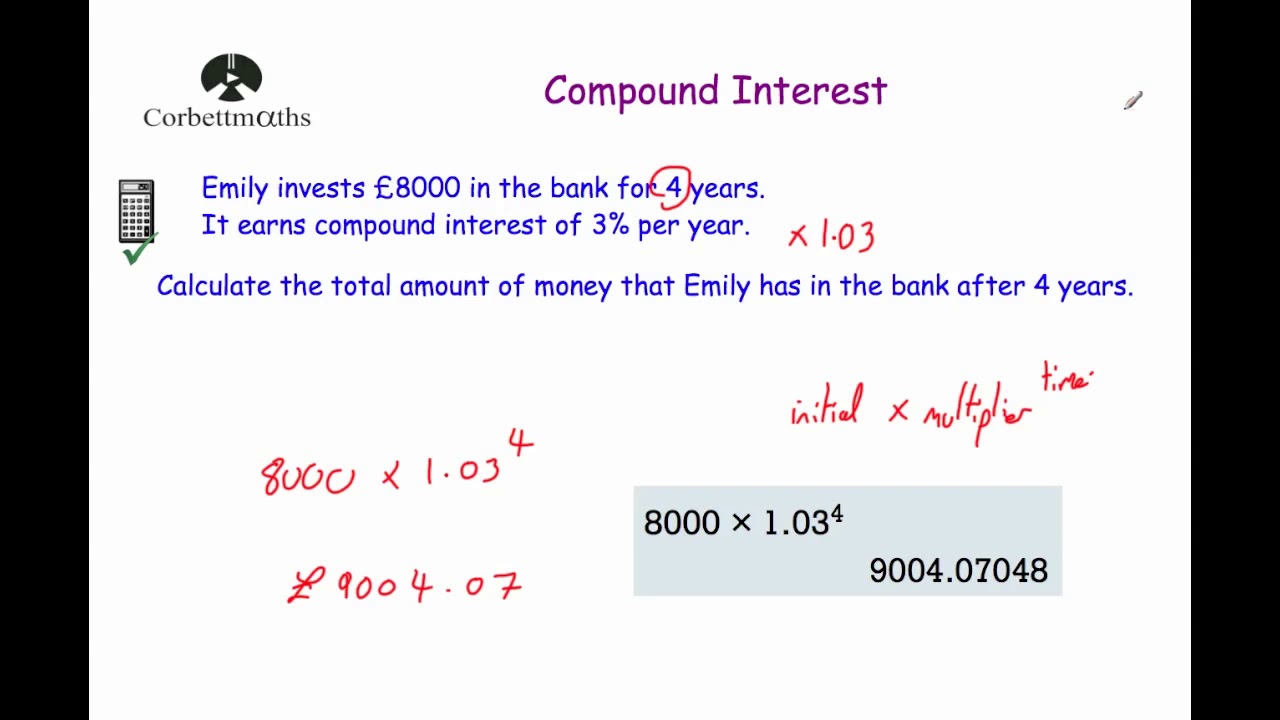

- 😀 Compound interest calculations involve multiplying the initial investment by a growth factor raised to the power of the number of years.

- 😀 To find the interest rate, it can be helpful to test out different values for the growth factor and check which one gives the correct final amount.

- 😀 Rounding values in financial calculations is important, and understanding how to round to the nearest decimal or penny is key to getting the right result.

- 😀 The growth factor for compound interest is calculated as (1 + interest rate). For example, 2.4% interest is represented as 1.024.

- 😀 In the case of Joe's investment, testing the growth factor for different years helped find the correct final amount for a 6-year investment.

- 😀 For a 3-year investment, Kaler's interest rate was determined to be 1.8%, showing how small percentage changes compound over time.

- 😀 When solving for an unknown interest rate, the cube root or square root of the growth factor can be used, depending on the number of years involved.

- 😀 Using a calculator to test different values and compare the results helps identify the correct rate of interest for an investment.

- 😀 Compound interest requires applying the interest rate to the value after each year, not just once at the start, as shown with Sofia's investment scenario.

- 😀 In some cases, initial interest rates are provided, and the remaining years use a different rate, requiring multiple steps in the calculation process to determine the total amount.

Q & A

What is the main method used in the script to determine the percentage interest rate in compound interest problems?

-The main method used is to test different values for the percentage interest rate by raising a multiplier to a power, adjusting it to match the final value, and checking if it closely matches the expected result. This process involves trial and error with small changes to the multiplier until the correct result is achieved.

How does the speaker explain the process of finding the interest rate for a compound interest investment?

-The speaker demonstrates this by using the formula for compound interest, testing different values for the interest rate, and adjusting the multiplier until the final value matches the result. In one example, the speaker uses trial and error to find a rate close to 2.4% by checking powers of 1.025 and 1.03.

In the first example, what steps did the speaker take to calculate the interest for an investment of £6,000 at 2.5% per annum for 10 years?

-The speaker tested different powers of 1.025 and 1.03 to find the correct compound interest rate. They started by testing 1.025 raised to the power of 4 and adjusted it until the result was closer to the target value, finally finding the correct answer with 1.025.

What approach does the speaker use to calculate the interest rate for an investment that grows to £3,164.93 after 3 years?

-The speaker divides the final amount (£3,164.93) by the initial investment (£3,000) to find the growth factor. Then, they take the cube root of the result to determine the annual interest rate, which is found to be approximately 1.8%.

What is the significance of using cube roots and square roots in compound interest calculations?

-Cube roots and square roots are used to extract the interest rate from the compound interest formula when the time period is 3 years or 2 years, respectively. The cube root is used for a 3-year investment period, while the square root is used for a 2-year investment period to solve for the interest rate.

In the third example, how does the speaker solve for the unknown interest rate (X%) for an investment that grows to £4,244.78 after 3 years?

-The speaker first calculates the value after 1 year by applying a 2.4% interest rate. Then, they divide the final value (£4,244.78) by the value after the first year (£4,096). After this, they take the square root to determine the interest rate for the remaining two years, which is found to be approximately 1.8%.

Why does the speaker use trial and error with different powers of interest rates?

-The trial and error method helps to approximate the correct interest rate. By adjusting the powers slightly, the speaker can quickly find the value that results in a final amount close to the expected value, improving the accuracy of the calculation.

What did the speaker mean by saying the interest rate could be 'hidden' within a value like 1.025 or 1.03?

-The speaker means that the interest rate is embedded within the multiplier (e.g., 1.025 for a 2.5% interest rate). By raising this multiplier to a power, the compound interest accumulates, and the interest rate is indirectly represented in the multiplier, which is then adjusted to find the correct rate.

What role does rounding play in the final answers for these compound interest problems?

-Rounding is important to ensure that the final answers are presented in a clear and concise manner, often rounded to the nearest penny or decimal. For instance, after finding the interest rate, the speaker rounds the result to one decimal place to match the standard way interest rates are displayed.

How does the speaker verify the accuracy of the final compound interest calculation?

-The speaker verifies the accuracy by plugging the interest rate back into the formula and checking if it produces the correct final amount. For example, in the second investment example, they recalculate the amount with the determined interest rate and compare it to the expected final value to confirm the result.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآن5.0 / 5 (0 votes)