[MEET 10] AKUNTANSI EKUITAS & PELAPORAN KEUANGAN - PERUBAHAN AKUNTANSI & ANALISIS KESALAHAN #2

Summary

TLDRThis video script delves into the correction of accounting errors, highlighting different types of mistakes such as changes in accounting principles, mathematical errors, and misclassifications. It explains the impact of material and non-material errors on financial statements, emphasizing the importance of making proper journal entries to adjust prior period balances. The script also discusses the difference between counterbalancing and non-counterbalancing errors, and provides practical examples of correcting depreciation, tax, and salary misstatements. The focus is on ensuring the accuracy of financial reporting through effective error identification and correction.

Takeaways

- 😀 Errors in accounting can include incorrect journal entries, misclassifications, and mistakes in applying accounting principles.

- 😀 Material errors in financial statements must be corrected through prior period adjustments (PPAs) to ensure accurate reporting.

- 😀 Counterbalancing errors self-correct over time and don't require immediate adjustments, but non-counterbalancing errors need correction in the current or subsequent periods.

- 😀 Companies need to adjust prior period errors in the retained earnings and relevant accounts, often with journal corrections.

- 😀 When correcting errors, companies must restate prior financial statements for comparison purposes.

- 😀 Materiality is key in determining whether an error should be corrected. If an error is immaterial, it may not need adjustment.

- 😀 Common examples of accounting errors include depreciation miscalculations, tax errors, and misclassification of revenue or expenses.

- 😀 Journal entries for correcting errors typically involve adjustments to accounts like accumulated depreciation, tax liabilities, and retained earnings.

- 😀 Misstatements in income (overstated or understated) due to errors must be corrected by adjusting the related tax and expense accounts.

- 😀 Non-counterbalancing errors impact the financials over multiple periods and require long-term correction, often influencing reporting for years.

- 😀 Proper classification of assets, liabilities, and expenses is crucial for accurate financial reporting and ensuring the integrity of the balance sheet and income statement.

Q & A

What is the main focus of the lecture in the provided transcript?

-The lecture focuses on accounting errors, their types, and how they should be corrected. The primary topics include error correction, prior period adjustments, and specific examples of errors such as depreciation mistakes and misclassifications.

Why is error correction important in accounting?

-Error correction is crucial in accounting because errors, especially material ones, can significantly distort financial statements, affecting a company's financial position and performance. Correcting errors ensures accurate and reliable financial reporting.

What are some common types of accounting errors mentioned in the lecture?

-The lecture mentions several types of accounting errors, including changes in accounting principles (e.g., switching from cash basis to accrual basis), mathematical errors, estimation errors (e.g., depreciation), revenue and expense adjustment errors, and misclassification errors.

How should companies correct material errors in accounting?

-Material errors should be corrected through prior period adjustments. This involves adjusting the retained earnings for the period in which the error is identified, ensuring the financial statements reflect the correct information.

What is the difference between counterbalancing and non-counterbalancing errors?

-Counterbalancing errors are those that correct themselves over time. For example, an under-accrued expense in one period might adjust in the following period. Non-counterbalancing errors, on the other hand, do not self-correct and require ongoing adjustments until fully rectified.

Can you give an example of a counterbalancing error?

-An example of a counterbalancing error is when a company fails to accrue an expense at the end of one period. In the next period, the expense is correctly recognized, effectively balancing out the error from the previous period.

What is the significance of 'materiality' in the context of accounting errors?

-Materiality refers to the importance of an error in influencing the financial statements. Companies only need to correct errors that are material, meaning those that would impact the decision-making of users of the financial statements, such as investors or creditors.

How should a company adjust its financial statements when it discovers an error affecting both the income statement and balance sheet?

-If an error affects both the income statement and balance sheet, the company must correct the error by making necessary adjustments to the affected accounts. These adjustments might include restating prior period financial statements or adjusting journal entries to reflect the accurate balances.

What is a non-counterbalancing error, and how does it affect financial reporting?

-A non-counterbalancing error is one that does not correct itself in subsequent periods. For example, an error in capitalizing an asset that affects depreciation will not be corrected in future periods. This type of error requires adjustments over multiple periods until fully corrected.

What is the process for making a prior period adjustment when a material error is found?

-The process involves adjusting the retained earnings for the period in which the error was identified. The error is corrected by making journal entries to update the financial statements, ensuring that the company's financial position is presented accurately in the current and past periods.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

[MEET 9] AKUNTANSI EKUITAS & PELAPORAN KEUANGAN - PERUBAHAN AKUNTANSI & ANALISIS KESALAHAN

Trial Balance and Accounting Errors|| Grade 11 || Account(HSEB/NEB)

Audit Investment and Cash Balance Kelompok 9 5C Akuntansi

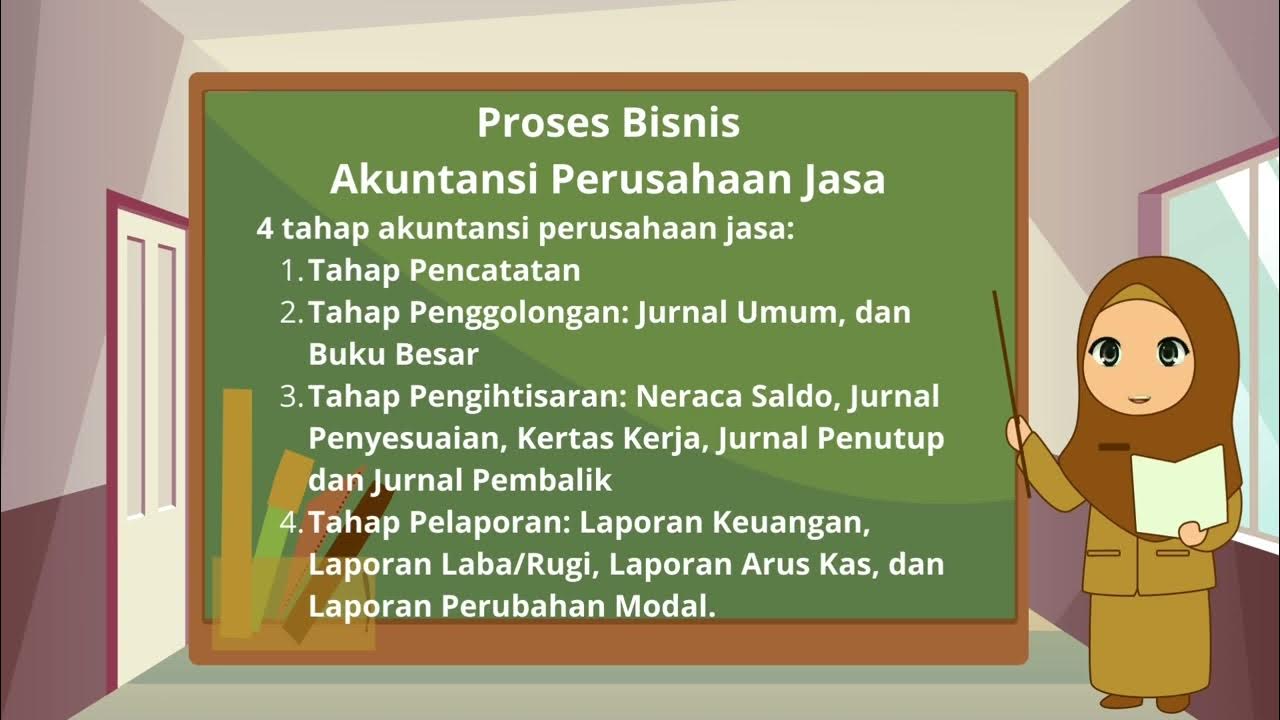

[PENGANTAR AKUNTANSI] MODUL 1 MATA KULIAH PENGANTAR AKUNTANSI (EKMA 4115) UNIVERSITAS TERBUKA

Proses Bisnis di Bidang Akuntansi-SMK Kelas X Fase E

Chapter 1, Part 1 - Introduction to Accounting

5.0 / 5 (0 votes)