Proses Bisnis di Bidang Akuntansi-SMK Kelas X Fase E

Summary

TLDRThis video script delves into the business processes in the accounting field, outlining the interconnected activities that produce a product or service. It highlights the benefits of business processes, such as emphasizing expenses and risks, avoiding human errors, and improving efficiency. The script also explains the characteristics of service companies and the four stages of the accounting cycle for service businesses, including recording, classification, adjustment, and reporting. It concludes with the importance of financial reports like the balance sheet, income statement, cash flow statement, and equity statement, offering a comprehensive understanding of business processes in accounting.

Takeaways

- 📚 The script discusses the business process in the field of accounting, emphasizing the sequence of activities that work together within an entity to produce a product or service.

- 🔍 The benefits of business processes include emphasizing expenditure and risk, avoiding human errors, increasing productivity, satisfying customers, efficient use of time, and following technological developments.

- 🚫 Failure in business processes can lead to issues such as not identifying the root cause of problems, demotivated employees, waste of time, and increased expenses.

- 🏢 A service company, according to Kotler, offers intangible actions that do not result in the transfer of ownership and has characteristics such as requiring equipment, expertise, and varying services without a fixed cost.

- 🔢 The accounting process for a service company involves four stages: recording, classification, adjustment, and reporting.

- 📝 In the recording stage, transaction proofs are saved and recorded to avoid errors, with examples including invoices, notes, and receipts.

- 📊 The classification stage involves recording in the general journal and the ledger, where transactions are chronologically analyzed and grouped by type into accounts.

- 💼 The adjustment stage includes the preparation of the balance sheet and adjustment journal, which adjusts account balances and prepares for the final accounting cycle.

- 📋 The reporting stage involves preparing financial statements such as the balance sheet, income statement, cash flow statement, and statement of changes in equity.

- 📈 The balance sheet describes the financial position of a company at a specific point in time, while the income statement shows the company's activities over a period, considering revenues and expenses to determine profit or loss.

- 💧 The cash flow statement contains the inflow and outflow of cash during a period, and the statement of changes in equity shows the changes in equity capital over an accounting period.

- 👍 The video encourages viewers to like, comment, and subscribe for more educational content, ending with a farewell greeting.

Q & A

What is the definition of business processes in accounting?

-Business processes in accounting refer to a series of interrelated and collaborative activities within an entity to produce a product or service.

What are the benefits of business processes?

-The benefits of business processes include emphasizing expenditure and risk, avoiding human errors, increasing productivity, satisfying customers, efficient use of time, and following technological developments.

What are the impacts of failing business processes?

-Failure in business processes can lead to issues such as not identifying the root cause of problems, demotivated employees, wasted time, and increased expenses for the company.

What is a service company according to Kotler?

-A service company is one that offers or provides intangible actions that do not result in the transfer of ownership, characterized by the need for equipment, expertise, and the variability of services without a fixed cost.

What are the four stages in the accounting cycle for a service company?

-The four stages in the accounting cycle for a service company are the recording stage, the classification stage, the adjustment stage, and the reporting stage.

What is the purpose of the recording stage in accounting?

-The purpose of the recording stage is to store and record transaction evidence to prevent errors in recording or journaling.

What are examples of transaction evidence in the recording stage?

-Examples of transaction evidence in the recording stage include invoices, notes, and receipts.

What is a general journal in accounting?

-A general journal is a place to record all transaction evidence chronologically, analyzing transactions in order of occurrence during a specific period.

What is the purpose of the adjustment stage in the accounting cycle?

-The purpose of the adjustment stage is to prepare the balance sheet and income statement by adjusting account balances to reflect the true financial position of the company for the period.

What is the purpose of the reporting stage in the accounting cycle?

-The purpose of the reporting stage is to present financial statements such as the balance sheet, income statement, cash flow statement, and statement of changes in equity to provide a comprehensive view of the company's financial health.

What are the types of financial reports mentioned in the script?

-The types of financial reports mentioned are the balance sheet, income statement, cash flow statement, and statement of changes in equity.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Proses Bisnis di Bidang Akuntansi (Part1) #kurikulummerdeka

Penjelasan Diagram Konteks & Diagram Arus Data Tingkat 0 Siklus Produksi

#1.1 Konsep Dasar Manjemen Rantai Pasok (Pengantar SCM)

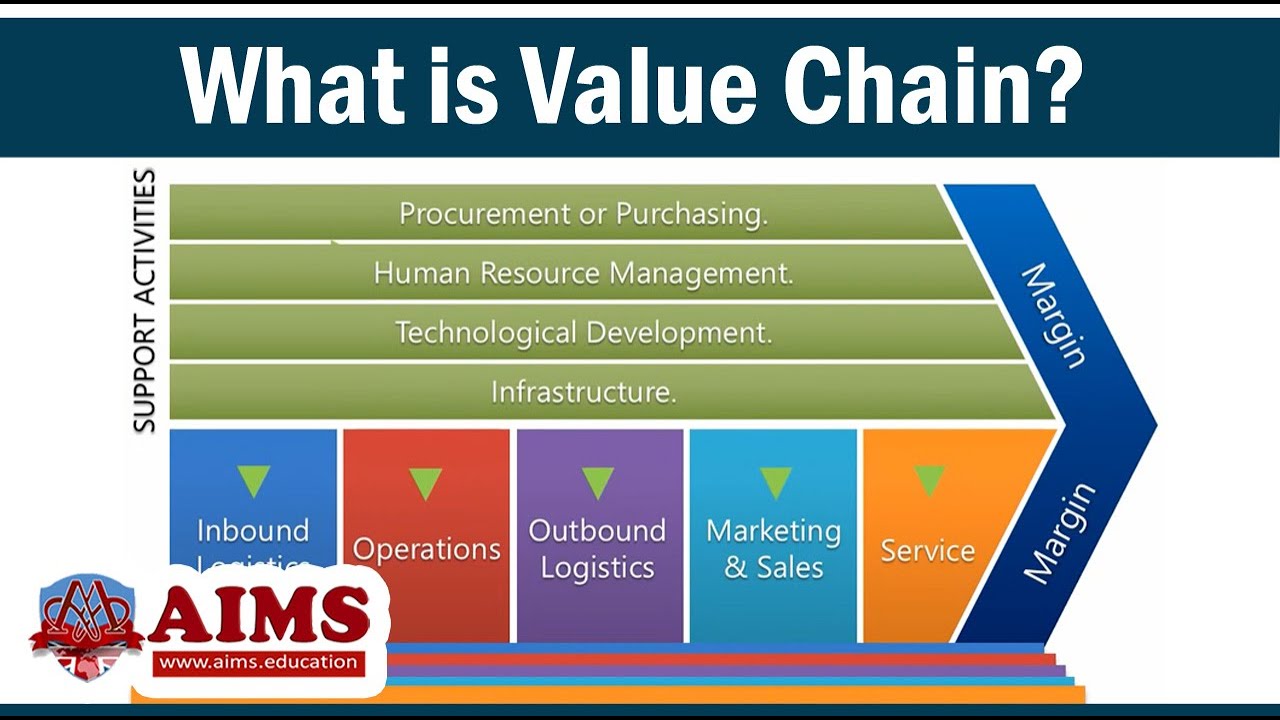

Value Chain Management - Meaning, Definition, Differences with Supply Chain & Porter's VC | AIMS UK

10 Most Practical Pricing Strategies (with real world examples) | From A Business Professor

COMO DESENVOLVER A MENTALIDADE DE UM MILIONÁRIO | Paulo Vieira

5.0 / 5 (0 votes)