Audit Investment and Cash Balance Kelompok 9 5C Akuntansi

Summary

TLDRThis video script covers key aspects of financial auditing, focusing on the auditor’s processes, including verifying cash balances, confirming bank loans, and reviewing investment transactions. It details how auditors reconcile financial data, ensure correct classifications, and make comparisons between current and previous year reports. The script also provides an example of how audit working papers are used to detect errors in investment reporting, such as incorrect journal entries and misclassifications. The conclusion affirms that the investments were reported accurately according to accounting standards.

Takeaways

- 😀 The video provides an overview of auditing processes, with a focus on key tasks and documents involved in the auditing process.

- 😀 Key auditing steps include confirming cash balances, verifying bank loans, and reviewing other bank agreements.

- 😀 Auditors perform reconciliations and assessments to ensure accuracy and compliance with accounting standards.

- 😀 The importance of correctly identifying and classifying financial data in the balance sheet is emphasized for proper audit outcomes.

- 😀 Auditors use working papers to document and verify financial transactions, ensuring that audit evidence is properly recorded.

- 😀 Example working papers provided in the video highlight the reconciliation process for cash balances and the investment audit.

- 😀 The video explains a common audit mistake where investment journal entries are incorrectly recorded, especially in relation to broker fees.

- 😀 Correcting journal entries is crucial to align financial statements with accounting standards, as shown in the case of investments in 'PT Domba Kecil' and 'PT Domba Putih.'

- 😀 The correct handling of investment losses, such as recording them under the appropriate journal entries, is necessary for accurate financial reporting.

- 😀 An important conclusion from the audit is that the financial statements related to investments were fairly presented and in accordance with generally accepted accounting standards (GAAP).

- 😀 The video stresses the need for thorough documentation and reconciliation in the auditing process, which contributes to the accuracy and credibility of financial statements.

Q & A

What is the primary focus of the audit process as described in the transcript?

-The primary focus is on verifying and assessing the financial statements, ensuring correct classification and presentation of assets and liabilities, and performing detailed procedures such as confirmation of bank balances, investment validation, and reconciliation of accounts.

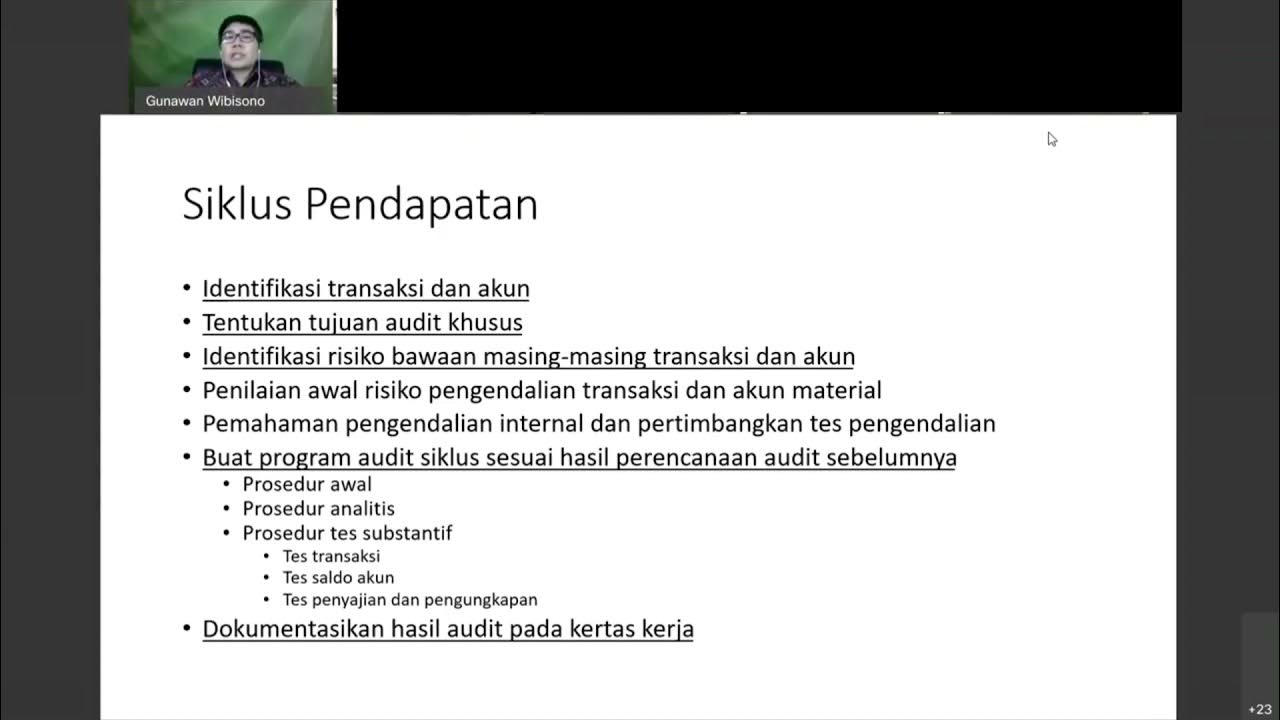

What are the five key steps mentioned in the audit process?

-The five key steps are: 1) Counting physical assets like cash, 2) Confirming bank cash and loan balances, 3) Confirming other agreements with the bank, 4) Scanning and reviewing financial documents for reconciliation, 5) Using financial reports for comparison and reconciliation.

What does the term 'tasbih tangan' likely refer to in the context of auditing?

-'Tasbih tangan' is likely a reference to the physical verification of cash or assets held in hand, possibly as part of a cash audit process.

How does the audit process handle errors in journal entries?

-When errors are found in journal entries, such as misclassifying expenses or incorrect investment valuations, the audit process requires making corrections through journal adjustments to accurately reflect the company's financial position.

What mistake did the client company make with its investment records?

-The client company mistakenly recorded brokerage fees as miscellaneous expenses rather than adding them to the value of the investment. This led to an incorrect valuation of the investment.

How should brokerage fees be recorded according to the audit guidelines?

-Brokerage fees should be added to the value of the investment, rather than being treated as a miscellaneous expense.

What correction did the auditor recommend for the investment records?

-The auditor recommended that the journal entry be adjusted to reflect the correct value of the investment, including an entry for the brokerage fees as part of the acquisition cost of the investment.

What is the significance of reconciling the financial statements with reports from previous years?

-Reconciling the financial statements with reports from previous years ensures consistency and accuracy, helping to identify discrepancies or errors in the accounting records, such as incorrect reporting of asset values or liabilities.

How does the audit process address discrepancies in cash balances?

-The audit process involves reconciling cash balances by reviewing working papers that list the relevant documentation, including cash counts and bank reconciliations, to ensure that the reported balances are accurate.

What is the final conclusion provided by the auditor regarding the client's investment records?

-The final conclusion is that, after corrections, the investment records were fairly presented and in accordance with generally accepted accounting standards (GAAP).

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade Now5.0 / 5 (0 votes)