How do tariffs work? | CNBC Explains

Summary

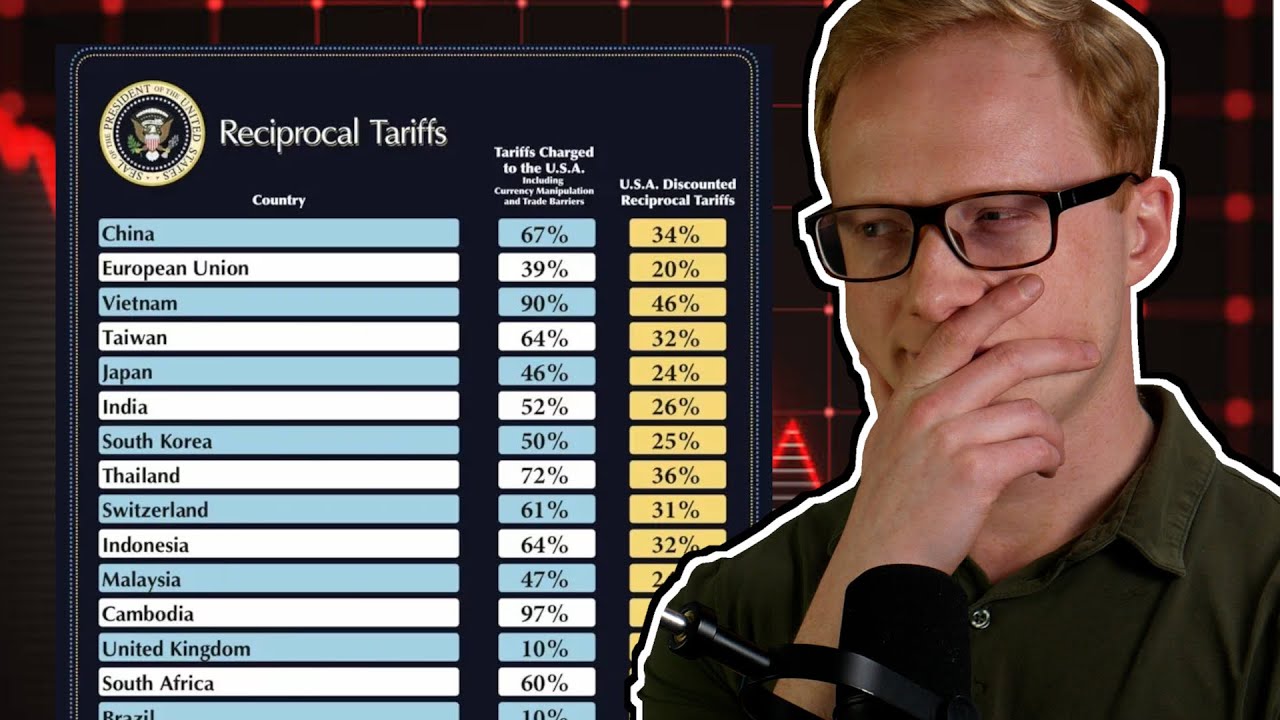

TLDRThis video explains the impact of tariffs on U.S. imports, particularly focusing on goods from China. It breaks down how tariffs work, their economic implications, and why they are implemented, such as raising revenue and protecting domestic industries. The video highlights the potential challenges businesses face with increased costs due to tariffs and the effects on consumers, as well as the U.S.-China trade deficit. Despite pushback from economists and trade partners, President Trump's tariff policies remain a central point of controversy in international trade discussions.

Takeaways

- 😀 Tariffs are taxes imposed on goods entering or leaving a country, collected by customs authorities.

- 😀 The U.S. collected $33.1 billion in import duties last year, which accounts for 1.4% of the total value of all imported goods.

- 😀 U.S. tariff rates are among the lowest globally, but they vary widely by product, with some items facing up to 30% tariffs.

- 😀 The example of watches shows how a 20% tariff can raise the cost of goods substantially, impacting businesses' bottom lines.

- 😀 Tariffs serve two main purposes: raising revenue for the U.S. government and protecting domestic industries from foreign competition.

- 😀 The increased cost of imports can lead businesses to explore alternative sources, like buying from countries not subject to tariffs (e.g., India or Vietnam).

- 😀 Higher tariffs on foreign goods can also make domestic products more competitive, encouraging local manufacturing.

- 😀 Retaliatory tariffs from other countries, like China, target U.S. goods, leading to losses for American companies (e.g., Boeing's decreased sales to China).

- 😀 President Trump's goal with tariffs is to reduce the U.S.'s trade deficit, especially with China, which was estimated at $370 billion.

- 😀 Despite concerns from economists, who argue tariffs harm the economy, President Trump stands firm in his strategy to reduce the trade deficit with China.

- 😀 The impact of tariffs on U.S. consumers is significant, with higher prices on everyday products like household goods and food, as companies pass on the increased costs.

Q & A

What is a tariff?

-A tariff is a tax imposed on goods entering or leaving a country. It is collected by the customs authorities, such as the U.S. Customs and Border Protection.

What is the purpose of tariffs?

-Tariffs serve two main purposes: raising revenue for the government and protecting domestic industries by making foreign goods more expensive, thereby encouraging consumers to buy locally produced items.

How much revenue did the U.S. collect from tariffs last year?

-Last year, the U.S. collected $33.1 billion in import duties, which amounted to about 1.4% of the total value of all imported goods.

How do tariffs affect the price of imported goods?

-Tariffs increase the cost of imported goods. For example, a 20% tariff on a $10 watch would raise the cost to $12, adding $2 to the total price.

Why are some products subject to higher tariffs than others?

-Different products are subject to different tariff rates. For example, shoes are taxed at around 11%, while other products like electronics may have higher or lower tariffs based on their trade agreements and perceived importance for domestic industry protection.

What happens if a company faces higher tariffs on imported goods?

-Companies may either absorb the additional cost or pass it onto consumers in the form of higher prices. For example, a 20% tariff on watches could lead to a $30,000 increase in cost for a large order of 15,000 watches.

How do tariffs affect domestic manufacturing?

-Tariffs can make domestic products more competitive by increasing the price of foreign goods. In some cases, businesses may move production to the U.S. to avoid tariffs, though they may still face additional costs for materials and supplies that are imported and also subject to tariffs.

Why did President Trump impose tariffs on China?

-President Trump imposed tariffs on China as part of his strategy to reduce the U.S.-China trade deficit, which was estimated at $370 billion. He hoped that the tariffs would lower the trade imbalance and encourage U.S. companies to shift production back to the U.S.

What impact did tariffs have on U.S. businesses and consumers?

-Increased tariffs led to higher prices on everyday goods, such as canned drinks and household products. Some businesses, like Kimberly-Clark, even lowered their annual forecasts due to the impact of tariffs on their costs.

How did other countries respond to U.S. tariffs?

-Countries like Canada, Mexico, and the European Union retaliated by imposing their own tariffs on U.S. goods, including items like U.S.-made airplanes, which had a direct impact on companies like Boeing.

What is a trade deficit, and how is it related to tariffs?

-A trade deficit occurs when a country imports more than it exports. President Trump aimed to reduce the U.S.-China trade deficit by implementing tariffs, hoping that this would decrease imports and encourage more domestic production.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآن5.0 / 5 (0 votes)