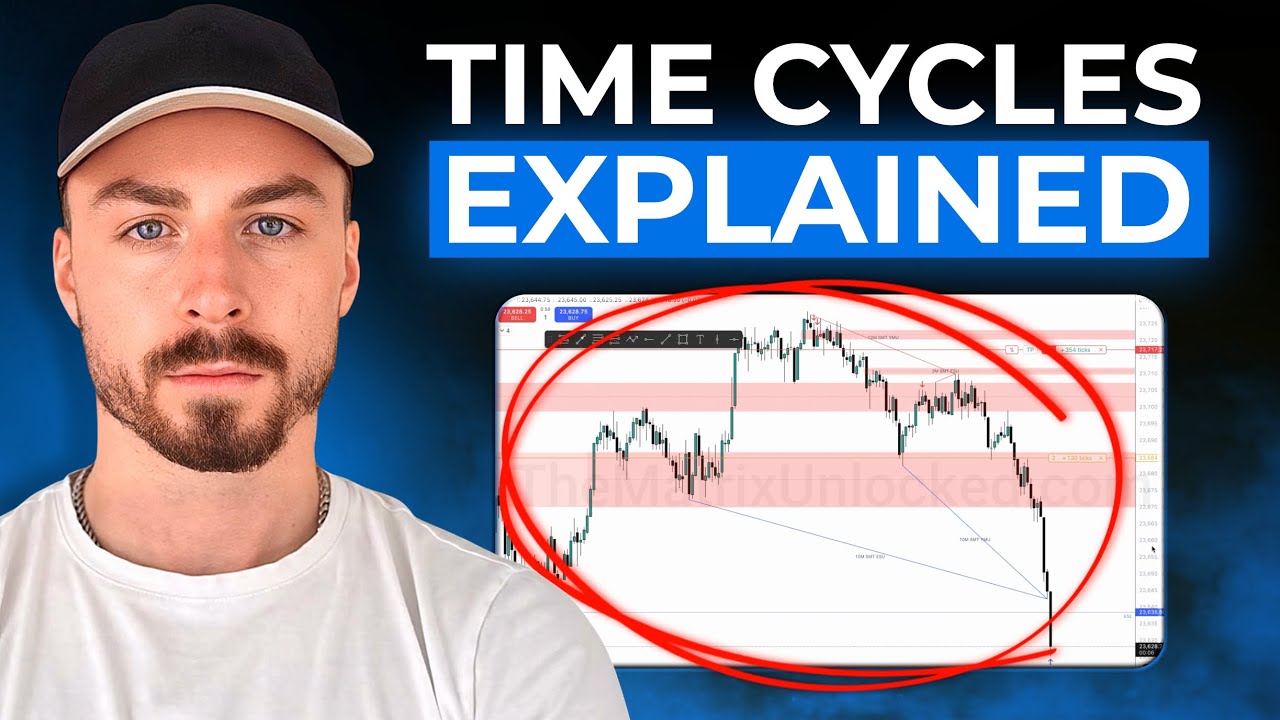

I Studied Every Price Action Strategy, These 3 Made Me PROFITABLE (Full Course)

Summary

TLDRIn this informative video on price action trading, the presenter emphasizes three key concepts: liquidity, price control, and execution. By understanding external and internal liquidity, traders can identify optimal entry points. Observing market dynamics reveals who controls price movements, guiding strategic decisions. The video advocates for a reactive approach, where traders execute based on confirmed price action rather than predictions. A practical example illustrates the process of entering a long position with precise stop-loss and profit targets, showcasing a successful trade. Overall, the content aims to simplify day trading strategies and enhance viewer understanding.

Takeaways

- 😀 Understanding liquidity is crucial for effective trading, encompassing both external and internal liquidity.

- 📊 External liquidity involves identifying swing highs and lows on the chart to set profit targets.

- 🔄 Internal liquidity focuses on pivot highs and lows, guiding entry points for trades.

- 🚀 Successful trading often requires entering positions when prices retrace to internal liquidity levels after breaking external liquidity.

- 🔍 Price control can be assessed through candlestick patterns, indicating whether buyers or sellers dominate the market.

- 📉 A candle with a long upper wick suggests selling pressure, while a strong bullish candle indicates buyer control.

- ⏳ Execution should be based on reacting to market conditions, rather than making predictions.

- 💡 Establish a trading thesis based on market behavior, such as a break and retest of key levels.

- ⚠️ Waiting for price action confirmations before entering trades helps improve trading accuracy and success rates.

- 💰 Mastering liquidity, price control, and execution leads to greater consistency and profitability in trading.

Q & A

What is the main focus of the video?

-The video focuses on price action trading, specifically three key concepts: liquidity, price control, and execution.

How does the speaker define liquidity in trading?

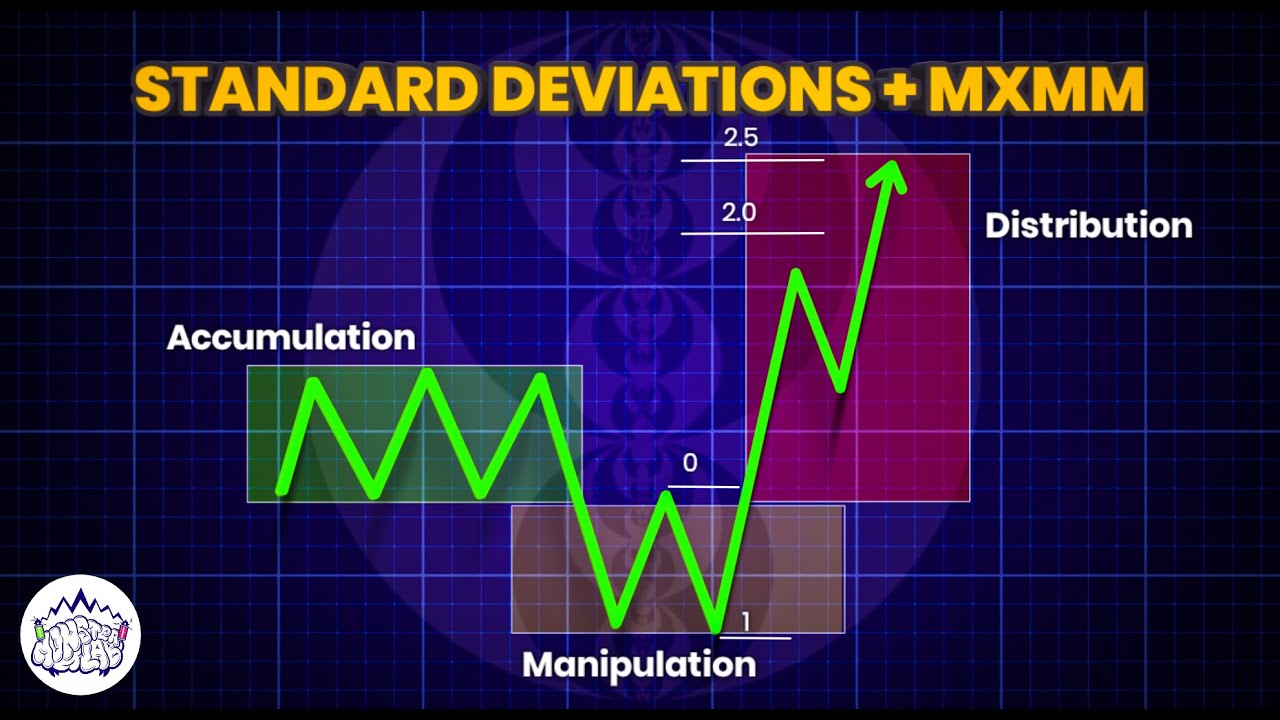

-Liquidity is defined as the difference between external liquidity (swing highs and lows) and internal liquidity (pivot highs and lows), where external liquidity targets internal liquidity.

What are the two types of liquidity mentioned?

-The two types of liquidity mentioned are external liquidity, which refers to swing highs and lows, and internal liquidity, which refers to pivot highs and lows.

Why is understanding price control important?

-Understanding price control is important because it helps traders determine whether buyers or sellers are in control, allowing for better trading decisions.

What does the speaker suggest traders should wait for before entering a trade?

-The speaker suggests that traders should wait for confirmation of trends based on price action before executing trades.

What is the significance of candlestick patterns in price action trading?

-Candlestick patterns are significant as they indicate whether buyers or sellers are dominating the market, guiding traders on their entry points.

What is the difference between a thesis and a bias in trading?

-A thesis is an if-then statement based on market conditions, while a bias is a fixed belief that can lead to missed opportunities. Traders are encouraged to develop a thesis instead of holding a bias.

Can you explain the execution process the speaker describes?

-The execution process involves reacting to price action rather than predicting it, ensuring traders adapt their strategies based on market movements.

What example does the speaker provide to illustrate these concepts?

-The speaker provides a live trading example where they entered a long position based on price action analysis, leading to a $55 gain after reaching their profit target.

What is the speaker’s goal for their YouTube channel?

-The speaker's goal is to provide valuable day trading content in a simplified manner and to grow the channel towards 100,000 subscribers.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

5.0 / 5 (0 votes)