LESSON 5: Compound Interest (Finding for the Principal, Future Value, and Time)

Summary

TLDRThis educational video explains the concepts of compound interest, including its calculation and differences from simple interest. It introduces the formula for future value and demonstrates its application through several examples, such as calculating the future value of deposits and the necessary principal for a desired amount. The video also covers how to determine the time required for an investment to reach a specific value using logarithms. Overall, it serves as a comprehensive guide for students to understand and apply compound interest in real-life financial situations.

Takeaways

- 😀 Compound interest differs from simple interest, as it involves earning interest on both the principal and accumulated interest.

- 📈 The formula for future value in compound interest is F = P × (1 + r/n)^(nt), where P is the principal, r is the annual interest rate, n is the number of compounding periods, and t is the time in years.

- 📅 Compounding periods can vary: annually (n=1), semi-annually (n=2), quarterly (n=4), or monthly (n=12).

- 💵 Example 1: A deposit of $4,000 at 6% annual interest compounded quarterly grows to approximately $5,387.42 after 5 years.

- 💰 Example 2: An investment of $6,500 at 8% annual interest compounded monthly results in a maturity value of approximately $11,358.24 after 7 years.

- 🔍 To find the principal amount needed for a future value, the formula is P = F / (1 + r/n)^(nt).

- 📉 When calculating time, the formula is T = (log(F/P)) / (n × log(1 + r/n)).

- ⏳ An example shows that a deposit of $5,000 at 6% annual interest compounded monthly will reach $8,000 in approximately 7.85 years.

- 📊 Understanding the differences in compounding periods is crucial for accurate calculations in finance.

- 💡 Always convert the annual interest rate to decimal form for calculations (e.g., 8% becomes 0.08).

Q & A

What is the primary focus of the video?

-The video focuses on explaining compound interest, specifically how to find the principal, future value, and time in a compound interest scenario.

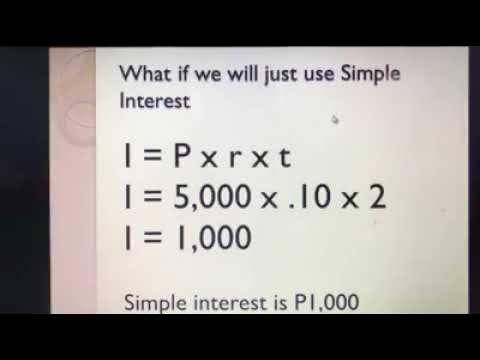

How is compound interest different from simple interest?

-Compound interest is calculated on the initial principal, which also includes all of the accumulated interest from previous periods, whereas simple interest is calculated only on the principal amount.

What is the formula for calculating future value in compound interest?

-The future value (F) is calculated using the formula F = P * (1 + r/n)^(nt), where P is the principal, r is the annual interest rate, n is the number of compounding periods per year, and t is the time in years.

If Edna deposits $4,000 at 6% annual interest compounded quarterly, how much will she have after 5 years?

-After 5 years, Edna will have approximately $5,387.42 in her account.

What is the principal if you want to have $122,000 after 6 years at a 9% annual interest rate compounded monthly?

-To have $122,000 after 6 years, the required principal is approximately $7,780.

How can you derive the formula for the principal from the future value formula?

-To derive the principal formula, rearrange the future value formula by dividing both sides by (1 + r/n)^(nt) to get P = F / (1 + r/n)^(nt).

What steps are involved in calculating how long it takes to reach a future value of $8,000 from a principal of $5,000 at a 6% interest rate compounded monthly?

-First, isolate the time variable T using logarithms, leading to the formula T = log(F/P) / log(1 + r/n). Substitute the values and solve to find that it takes approximately 7.85 years.

What is the significance of compounding periods in the calculation of compound interest?

-Compounding periods determine how often the interest is calculated and added to the principal. More frequent compounding (e.g., monthly vs. annually) generally results in a higher future value due to the effects of interest on interest.

What can you conclude about the importance of understanding compound interest?

-Understanding compound interest is crucial for effective financial planning and investment, as it significantly affects the growth of savings and investments over time.

How does the presenter encourage viewer engagement in the video?

-The presenter encourages viewer engagement by asking students to pause the video and attempt some problems on their own before reviewing the solutions together.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

COMPOUND INTEREST LONG METHOD PERSONAL FINANCE L3 Video2

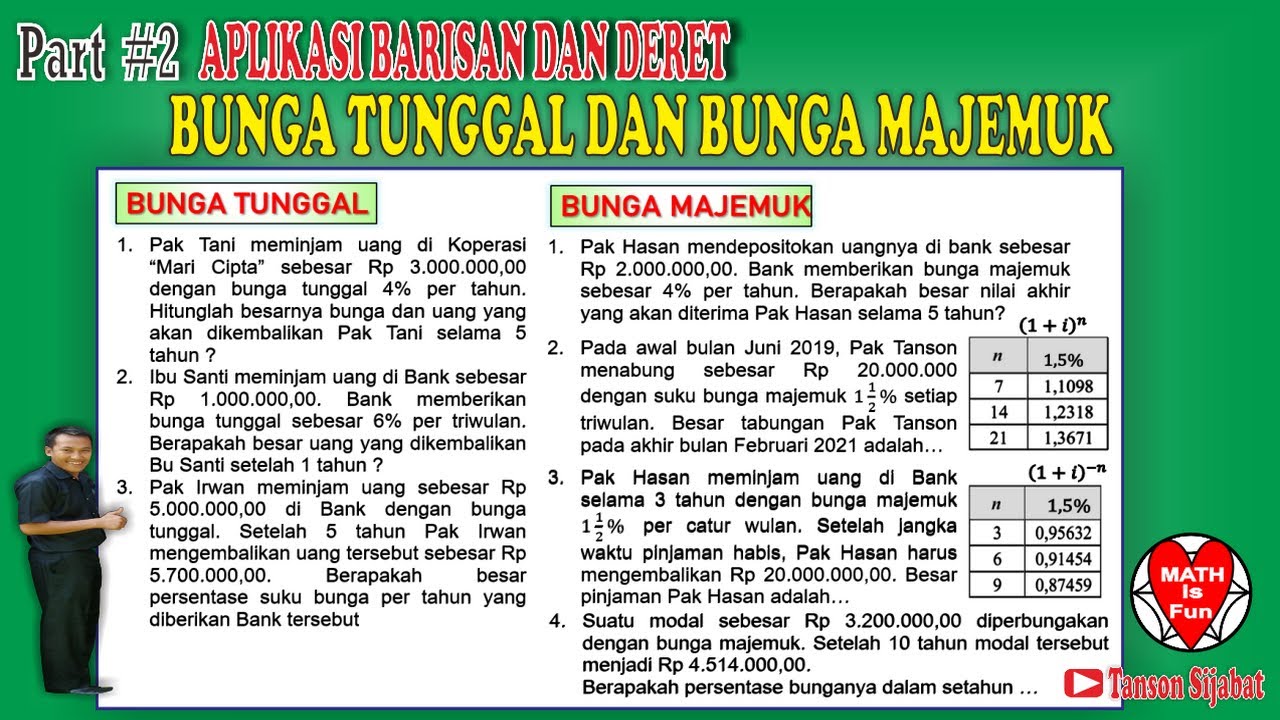

Bunga Tunggal dan Bunga Majemuk

Pertumbuhan,Peluruhan,Bunga,dan Anuitas Kelas X SMK

Bunga Tunggal dan Bunga Majemuk | Matematika SMA Kelas XI

Aptitude Preparation for Campus Placements #10 | Simple Interest | Quantitative Aptitude

BUNGA TUNGGAL DAN BUNGA MAJEMUK

5.0 / 5 (0 votes)