Form 10IEA Filing for AY 2024-25

Summary

TLDRThe video script is a comprehensive tutorial on the new Form 10 IE for Indian taxpayers. It explains the necessity of filing Form 10 IE if one has income from business or profession under the old tax regime and wishes to claim deductions and exemptions. The presenter, Vivek from Fixpr, guides viewers on how to file the form on the income tax portal, emphasizing the importance of meeting the due date to opt for the old tax regime. The script also touches on the consequences of missing the deadline and how it affects tax calculations under the new regime. It concludes with a reminder to check the benefits of opting for the old regime before filing.

Takeaways

- 😀 Form 10 IE is an important form for taxpayers who wish to opt into the old tax regime.

- 📈 The new tax regime has become the default, but many taxpayers prefer to claim deductions and exemptions under the old regime.

- 🏠 Home loan interest, ATCS (Alternate Tax Computation Scheme), and medical expenses are some of the deductions available under the old regime.

- 💼 If you have income from business and profession (PGBP), you are mandatorily required to file Form 10 IE to claim deductions under the old regime.

- 📅 The form must be filed before the due date, which varies depending on whether the taxpayer is under audit or subject to transfer pricing provisions.

- ⏰ It's crucial to file Form 10 IE before the due date to ensure the benefits of the old tax regime are applied.

- 🚫 Filing after the due date will result in the new tax regime being applied, and the benefits of the old regime will not be available.

- 💻 The process of filing Form 10 IE is straightforward and can be done online through the Income Tax Portal.

- 🔍 Taxpayers need to answer a few simple questions on the form to opt into the old regime and claim the intended benefits.

- 📝 It's essential to review the form carefully before submission to ensure it's filed correctly and benefits are not inadvertently waived.

Q & A

What is Form 10 IEI and why is it important?

-Form 10 IEI is a new form introduced in the Indian tax regime. It is important for taxpayers who wish to opt for the old tax regime, as it allows them to claim deductions and exemptions that are not available under the new tax regime.

What are the significant changes introduced from assessment year 2025?

-From assessment year 2025, there is a significant shift to the new tax regime, which becomes the default for taxpayers. However, taxpayers can still opt for the old tax regime by filing Form 10 IEI to claim certain deductions and exemptions.

Who needs to file Form 10 IEI?

-Taxpayers who have income from business or profession (PGBP) and wish to claim deductions, exemptions, and other benefits under the old tax regime need to file Form 10 IEI.

What are the consequences of not filing Form 10 IEI?

-If Form 10 IEI is not filed, taxpayers will automatically be considered under the new tax regime and will not be able to claim the deductions and exemptions available under the old tax regime.

How can one file Form 10 IEI on the Income Tax Portal?

-To file Form 10 IEI, one must log in to the Income Tax Portal, navigate to the 'e-File' section, select the appropriate form, and fill in the required details. The form is quite simple and can be completed in a few minutes.

What are the two key questions asked in Form 10 IEI?

-The two key questions in Form 10 IEI are: 1) Do you have any income under the head PGBP during the assessment year? 2) What is your due date for filing the return of income?

What are the due dates for filing Form 10 IEI?

-The due dates for filing Form 10 IEI are 31st July for regular taxpayers, 30th September for those under tax audit, and 31st October for taxpayers under transfer pricing provisions.

What is the warning given before proceeding with Form 10 IEI filing?

-The warning states that before proceeding with the filing of Form 10 IEI, taxpayers should be sure of their intended regime of taxation and that the form should be filed before the due date applicable to them.

What should taxpayers ensure before filing Form 10 IEI?

-Taxpayers should ensure that they are eligible for the deductions and exemptions they intend to claim under the old tax regime and that they file Form 10 IEI before the due date.

What are the three sections in Form 10 IEI that need to be filled?

-The three sections in Form 10 IEI that need to be filled are: 1) Basic Information, where details auto-populate, 2) Additional Information, which is not applicable for IFSC units, and 3) Declaration and Verification, where taxpayers need to place their declaration and submit the form.

Why is it crucial to file Form 10 IEI before the due date?

-Filing Form 10 IEI before the due date is crucial because filing after the due date may result in taxpayers not being able to opt for the old tax regime, and their tax will be calculated as per the new tax regime.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

Cara Lapor SPT Tahunan untuk Orang Pribadi Pengusaha dan Pekerja Bebas

GST ITC big update - Claim your Old ITC | File Application to claim Old Input Tax Credit under GST

Cara Lapor Dokumen Tertentu yang Dipersamakan Sebagai Faktur Pajak | Tutorial Lengkap

Tutorial Pelaporan SPT Tahunan 1770 | Bagi WP Orang Pribadi dengan e-Form

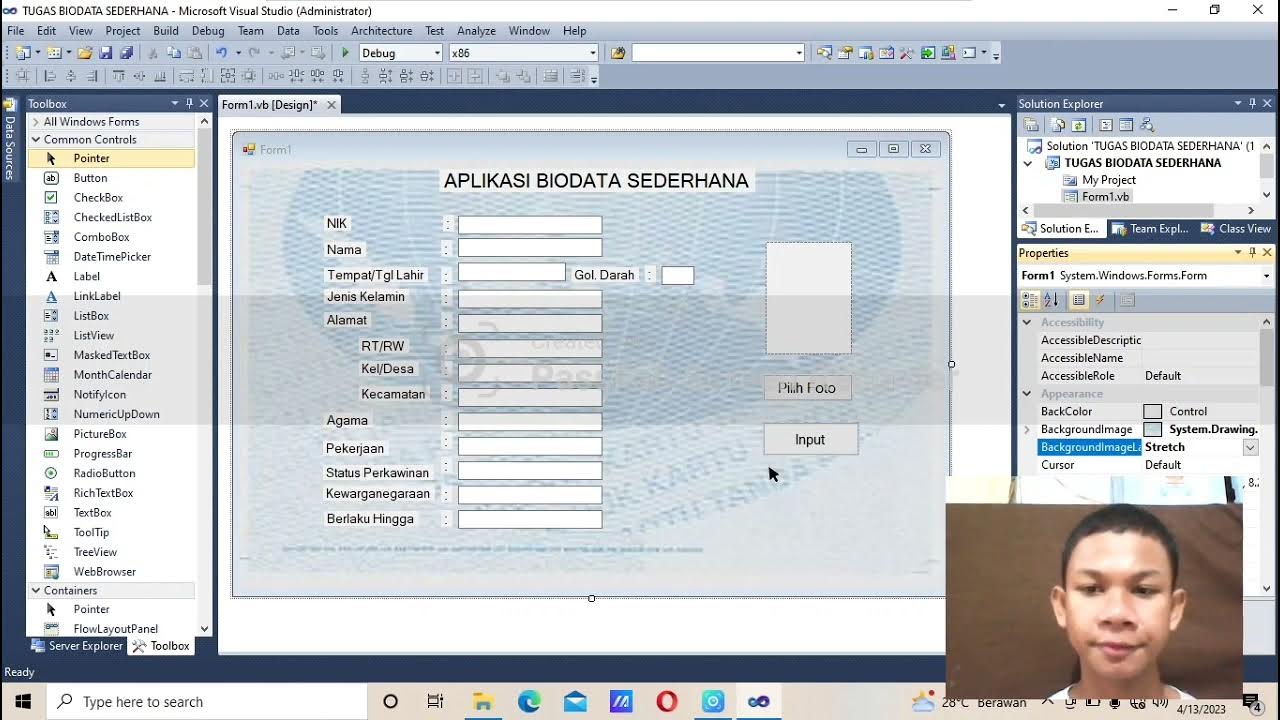

(Tugas 1 VB. Net) Membuat aplikasi biodata sederhana (KTP) dengan menggunakan visual basic 2010!!

How to Create a Google Sheet from a Form | Complete Data Analysis Guide! Part 2

5.0 / 5 (0 votes)