Boot Camp Day 20: Order Blocks

Summary

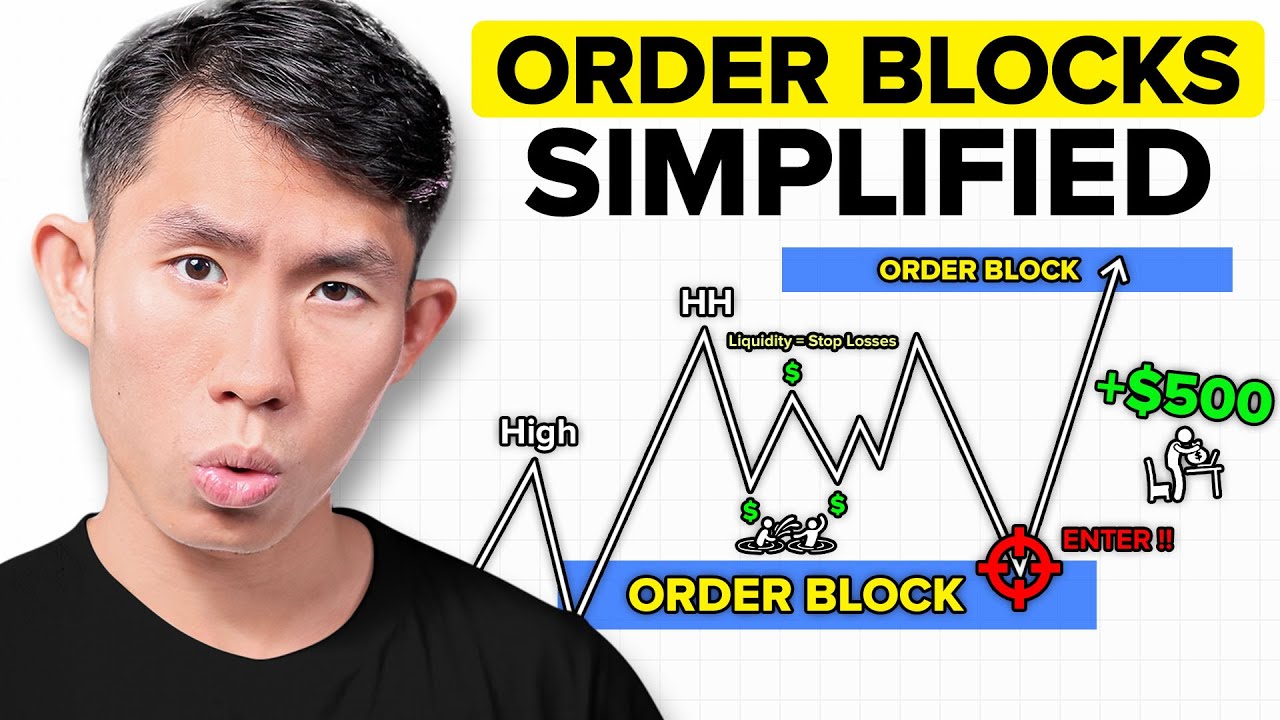

TLDRIn this educational video, the speaker introduces the concept of 'order blocks' in trading, explaining their significance and how they function within market trends. The video is part of a boot camp series, focusing on day one with an overview of order blocks, their formation post-liquidity sweep, and their role in retracement plays. The speaker emphasizes the importance of understanding order blocks for strategic trading, promising further insights on spotting them in subsequent sessions. The summary also touches on the importance of avoiding trades during high-impact news events to prevent unnecessary risks.

Takeaways

- 📘 The speaker is introducing a boot camp focused on learning about 'order blocks' in trading.

- 🎯 Order blocks are significant price movements that precede liquidity sweeps and are where orders get filled, causing a shift in market structure.

- 🔑 Understanding order blocks is beneficial for traders as it helps in identifying accumulation areas and potential retracement points in the market.

- 📈 The concept of order blocks is applicable across all time frames, making it a versatile tool for traders.

- 🚫 There is typically only one order block within a trend as it forms from a liquidity sweep and the start of a new trend.

- 🔍 The speaker plans to teach how to spot order blocks in the following days, emphasizing their importance in trading strategies.

- 📉 Order blocks can indicate potential areas where the market may retrace, providing opportunities for re-entry or new trades.

- 📝 The speaker mentions that there will be no homework for this session, focusing instead on understanding the concept of order blocks.

- 🗓 The boot camp includes a series of days dedicated to different aspects of trading, including psychology and practical application of concepts learned.

- ⏰ The speaker warns against trading during high volatility news events, using GBP/JPY as an example of market movement during such times.

- 👋 The session concludes with a reminder for attendees to join the next session, which will cover psychological aspects of trading.

Q & A

What is the main focus of the boot camp being discussed in the script?

-The main focus of the boot camp is to learn about order blocks, their significance, and how they can be used in trading strategies.

What is an 'order block' in the context of trading?

-An 'order block' is a price range where orders were filled, typically resulting from a move up or down that causes a liquidity sweep, leading to a break of structure in the market.

Why are order blocks beneficial for traders?

-Order blocks are beneficial because they provide a visual representation of where orders were filled, allowing traders to anticipate potential retracements and re-entry points in the market.

What is the relationship between order blocks and liquidity sweeps?

-Order blocks form as a result of liquidity sweeps, where a move up or down takes out a high or a low, causing orders to be filled and potentially leading to a market structure break.

How does the speaker rank order blocks in terms of retracement play opportunities?

-The speaker ranks order blocks as the first point of interest for retracement plays, often providing better entries than liquidity sweeps and break of structure alone.

What is the significance of the number '44' mentioned in the script?

-The number '44' appears to be a personal preference or a reference to a specific item or concept, but its significance is not clearly explained in the provided script.

Why is it important to understand the terminology and concepts like order blocks in trading?

-Understanding terminology and concepts like order blocks helps traders to better analyze market movements, make informed decisions, and develop effective trading strategies.

How does the speaker plan to cover the topic of order blocks in the boot camp?

-The speaker plans to cover the topic over three days: the first day is an overview of why order blocks are useful, the second day is about spotting them, and the third day is about putting the knowledge into practice.

What is the speaker's view on the applicability of order block concepts across different time frames?

-The speaker loves the way they trade because the concepts, including order blocks, are applicable across all time frames, from one-minute to larger time frames.

What advice does the speaker give regarding trading during news events?

-The speaker advises against trading during news events, as illustrated by the example of GBP/JPY's volatility during PPI and FOMC news, to avoid unnecessary risks.

What is the speaker's approach to teaching the boot camp participants about order blocks?

-The speaker's approach involves a step-by-step explanation, starting with the definition and benefits of order blocks, followed by practical examples and strategies for spotting and utilizing them in trading.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

How To Select The Best Between Orderblock and a Fair Value Gap for Trade Entry

How to Identify Best Order Blocks to Trade?

🔴 1-2-3 ORDER BLOCKS Trading Strategy Banks Don’t Want You To Know About

Master Order Blocks to Trade like Banks (no bs guide)

Order Blocks Simplified - ICT Concepts

1722681018149453

5.0 / 5 (0 votes)