🔴 1-2-3 ORDER BLOCKS Trading Strategy Banks Don’t Want You To Know About

Summary

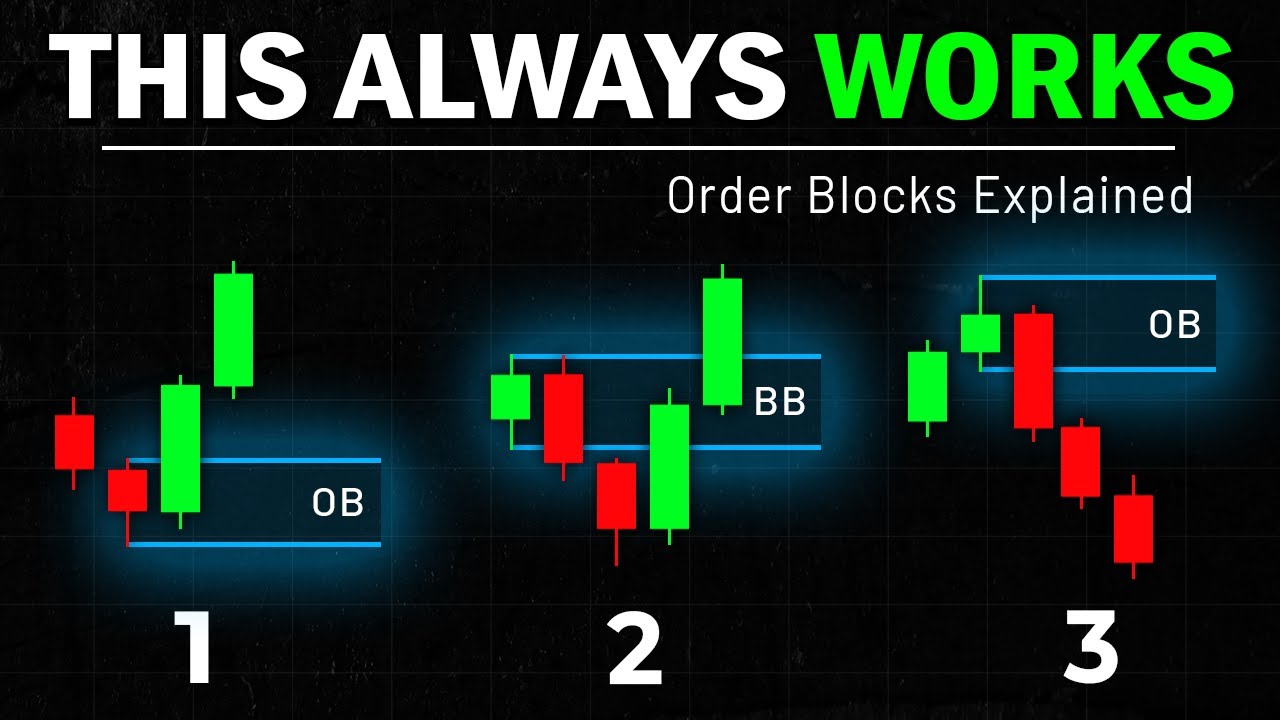

TLDRThis video offers a comprehensive guide to mastering order blocks in trading, covering everything from the basics to advanced strategies. It explains the concept of order blocks, their formation, and how they differ from support and resistance levels. The video highlights key rules for identifying valid order blocks and demonstrates how they lead to market shifts. It also introduces three powerful strategies for trading with order blocks, including multi-timeframe confirmation, inducement traps, and breaker blocks. The content is perfect for traders looking to improve their skills and profitability using order blocks.

Takeaways

- 😀 Order blocks are key zones on charts where significant money has been traded, often by large institutions, creating sharp price movements.

- 😀 There are two types of order blocks: bullish (created by large buy orders) and bearish (created by large sell orders).

- 😀 Order blocks differ from support and resistance in formation, drawing method, and how often they are retested. Order blocks are typically one-time-use levels.

- 😀 A valid order block must create a gap (inefficiency), remain untested (unmitigated), and result in a break of structure or a change of character.

- 😀 Markets move in trends, and an order block must lead to a break of structure (in an uptrend) or a change of character (signal a trend shift).

- 😀 To identify a valid order block, look for a sharp price move creating a gap, then verify a subsequent break in structure or a change of character.

- 😀 Strategy 1: Multi-timeframe confirmation involves identifying an order block on a higher timeframe and confirming it on a lower timeframe for trade entry.

- 😀 Strategy 2: Inducement traps use minor key levels near major order blocks. The price may break through the minor level and then reverse, offering high reward trades.

- 😀 Strategy 3: Breaker blocks occur when a previously valid order block is broken. A retracement to the broken order block can act as a resistance zone for short trades.

- 😀 Beginners can use an 'Order Blocks All-in-One' indicator to help spot unmitigated, mitigated, and breaker blocks, making it easier to trade with order blocks.

Q & A

What is an order block in trading?

-An order block is a key zone on the chart where a large amount of money has been traded, often by big institutions or banks. These trades can lead to noticeable price movements. Order blocks are formed from sharp price moves, either upward (bullish) or downward (bearish).

How do order blocks differ from support and resistance levels?

-Order blocks differ from support and resistance in terms of their formation, appearance, and retesting behavior. Order blocks are created by a sharp price movement from a specific area and are usually marked as thick zones, while support and resistance are formed by repeated price rejections and are often marked as thin lines. Additionally, order blocks are usually a one-time use level, whereas support and resistance can be retested multiple times.

What are the key rules for identifying a valid order block?

-The three key rules for identifying a valid order block are: 1) It must create a gap or inefficiency after the price move. 2) It must remain untested or unmitigated, meaning the price has not yet touched or tested the order block. 3) It must lead to a break of structure or a change of character in the market.

What does a break of structure or a change of character mean in market trends?

-A break of structure occurs when the price breaks above a previous high in an uptrend or below a previous low in a downtrend. A change of character signals a shift in the market direction, such as a transition from an uptrend to a downtrend or vice versa.

What is the difference between a bullish and a bearish order block?

-A bullish order block is created by large buy orders, which cause the price to move upward sharply. A bearish order block, on the other hand, is formed by large sell orders, leading to a sharp downward price movement. The distinction lies in the direction of the price movement after the order block is created.

What is the multi-timeframe confirmation strategy?

-The multi-timeframe confirmation strategy involves identifying an order block on a higher time frame and then confirming its validity on a lower time frame. For example, if you spot a bearish order block on the 4-hour chart, you would switch to a 15-minute chart to confirm bearish momentum using indicators like the MACD or a bearish engulfing candlestick pattern.

How does the inducement trap strategy work?

-The inducement trap strategy involves spotting a minor key level (inducement) above a major order block. The price often breaks through this minor level, triggering stop losses, before retracing down to the major order block for a reversal. Traders can place buy orders in the middle of the major order block for a high reward trade if the price touches that level.

What is a breaker block and how is it used?

-A breaker block is a previously valid order block that has been broken by the price. Once the price breaks through the order block, it may act as a resistance zone when the price retraces back to it. This offers a potential opportunity for a short position if the price rejects at the breaker block level.

How can you use the order blocks all-in-one indicator?

-The order blocks all-in-one indicator marks different types of order blocks (unmitigated, mitigated, and breaker blocks) on the chart. This helps traders see the market structure more clearly by labeling these areas with colored boxes, making it easier to spot potential reversal or continuation zones.

Why is it important to identify inefficiencies or imbalances when spotting order blocks?

-Inefficiencies or imbalances are crucial for spotting order blocks because they represent gaps in price movement. A valid order block must create such a gap after a sharp price move, indicating that a significant amount of trading activity has occurred, typically by institutional traders, which can lead to further price reactions when tested.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)