Lesson 027 - Accounting for Merchandising Operations 1: Sales and Purchases

Summary

TLDRThis video from Search was Accounting Lessons PH delves into the intricacies of accounting for merchandising operations. It explains the concept of inventory as a current asset, the operating cycle of a merchandising entity, and the importance of understanding gross invoice price, including trade and chain discounts. The lesson further explores sales transactions, including credit terms, sales returns, and allowances, providing examples of journal entries for various scenarios. It also covers purchase transactions, emphasizing the periodic inventory system and illustrating how to record purchases, returns, and discounts. The video concludes with a problem on computing net sales and purchases, offering practical insights into the accounting process for businesses dealing in goods.

Takeaways

- 😀 Merchandising operations involve buying and selling goods rather than providing services.

- 📦 Merchandise inventory, or simply inventory, is a company resource and is considered an asset, reported as a current asset on financial statements.

- 🔄 The operating cycle of a merchandising entity typically starts with cash, involves purchasing inventory, making sales (either for cash or on credit), and ends with collecting accounts receivable to regain cash.

- 📝 The gross invoice price in accounting for merchandising operations is recorded at the original list price before any trade discounts are applied.

- 💰 Trade discounts are deductions from the list price that encourage buyers to purchase more merchandise, but they do not affect the gross invoice price recorded.

- 🛒 Examples of merchandising operations include grocery stores, department stores, online retailers, and appliance centers.

- 📉 Sales returns and allowances are important aspects of merchandising; returns imply a cancellation of sale with a refund, while allowances are granted if the customer keeps the merchandise despite dissatisfaction.

- 📋 Sales transactions involve the transfer of legal ownership of goods from the seller to the buyer, and they are the main revenue-producing activity for merchandising operations.

- 📝 In sales transactions, terms of payment such as '2/10, net 30' are specified on the invoice, offering discounts for early payment and setting a deadline for the full amount.

- 🛍️ Purchase transactions, from the buyer's perspective, involve recording purchases and accounts payable, and may include purchase discounts and returns.

- 📊 To calculate net sales and net purchases, one must consider gross amounts, sales and purchase discounts, and returns and allowances, which are subtracted from the gross figures to arrive at net totals.

Q & A

What is the definition of merchandising operations?

-Merchandising operations refer to the business activity of buying and selling goods. It involves purchasing goods first to be sold in a retail store, rather than providing services.

What is the term used for the goods that a merchandising company sells to its customers?

-The goods that a merchandising company sells to its customers are called merchandise inventory or simply inventory.

How is inventory classified in financial statements?

-Inventory is classified as a current asset in financial statements because it is a company resource that is expected to be converted into cash within a short period.

What is the operating cycle of a merchandising entity?

-The operating cycle of a merchandising entity starts with cash, then to inventory from purchase transactions, followed by sales transactions, which may include accounts receivable, and finally, the collection of receivables leading back to cash.

What is the gross invoice price in the context of merchandising operations?

-The gross invoice price is the original price of the merchandise before any trade discounts are applied. It is the amount recorded in the books before considering any deductions that may encourage the buyer to purchase more.

How do you calculate the gross invoice price when given a list price and a trade discount?

-The gross invoice price is calculated by subtracting the trade discount from the list price or by multiplying the list price by the complement percentage of the trade discount (100% - trade discount percentage).

What is the significance of sales transactions in merchandising operations?

-Sales transactions are significant in merchandising operations as they represent the transfer of legal ownership of goods from the seller to the buyer, and they are the main revenue-producing activity for a merchandising business.

What are the terms of payment called when goods are sold on account?

-The terms of payment when goods are sold on account are called credit terms, which may include specific discount percentages and payment deadlines, such as '2/10 net 30'.

What are sales returns and allowances in the context of merchandising operations?

-Sales returns are merchandise returned to the seller, implying a cancellation of the sale, while sales allowances are granted to customers who keep the merchandise despite being unsatisfied with their purchase.

How are sales transactions recorded in the books when goods are sold on account and a customer pays within the discount period?

-When goods are sold on account and a customer pays within the discount period, the sales transaction is recorded with a debit to cash for the amount received minus the discount, a credit to sales discount for the discount amount, and a credit to accounts receivable for the original sales amount.

What is the difference between the periodic and perpetual inventory systems in recording purchases?

-In the periodic inventory system, inventory accounts are updated only periodically, usually at the end of an accounting period, whereas in the perpetual inventory system, inventory accounts are updated with each purchase and sale transaction.

How are purchase transactions recorded in the books when a company buys merchandise on credit?

-When a company buys merchandise on credit, the transaction is recorded with a debit to purchases for the amount of the purchase and a credit to accounts payable for the same amount, indicating the obligation to pay the seller in the future.

What is the process for recording purchase returns and allowances in the books?

-Purchase returns and allowances are recorded with a debit to cash for the amount of the refund and a credit to purchase returns and allowances, indicating the reduction in the purchase amount due to returned goods.

How are net sales and net purchases calculated for a merchandising company?

-Net sales are calculated by subtracting sales discounts and sales returns and allowances from gross sales. Net purchases are calculated by subtracting purchase discounts and purchase returns and allowances from gross purchases.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

Lesson 030 - Accounting for Merchandising Operations 4: Periodic and Perpetual Inventory System

Accounting for Merchandising operation

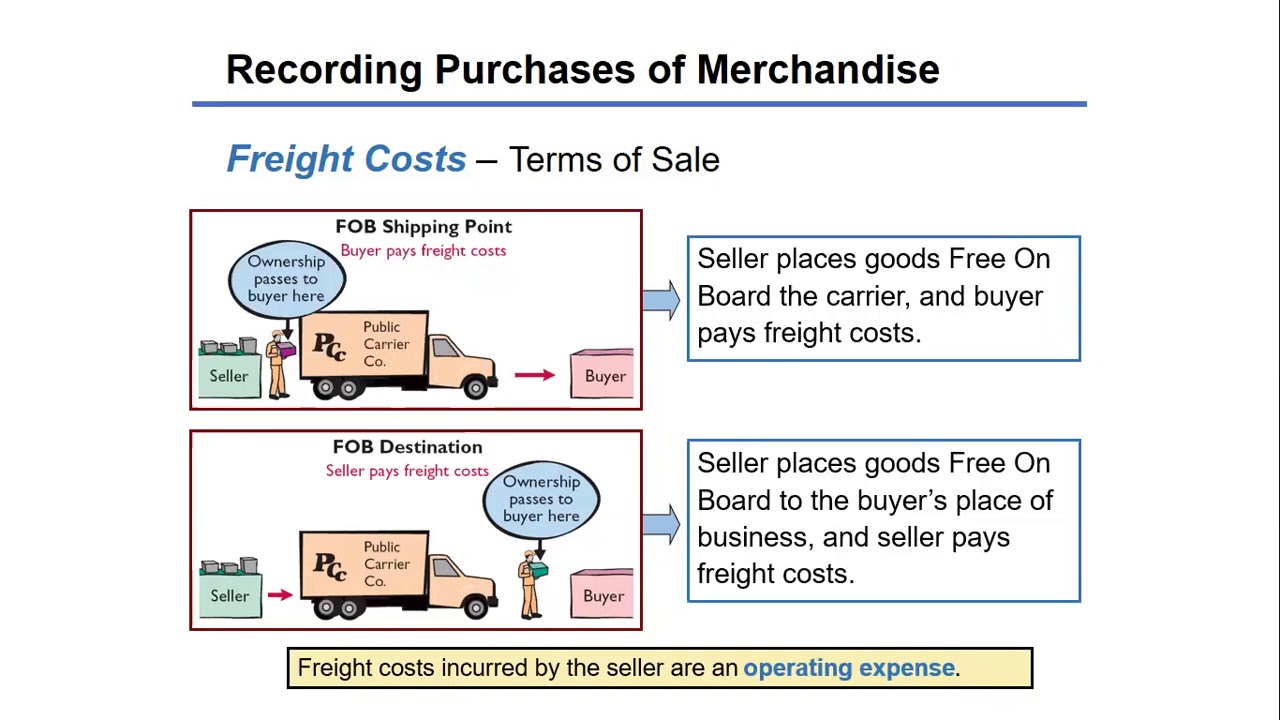

Accounting for Merchandising Operations Recording Purchases of Merchandise

[MEET 10-1] AKUNTANSI SEKTOR PUBLIK - AKUNTANSI ASET & KEWAJIBAN

Chapter 5 - Service vs Merchandisers EXPLAINED!

Lesson 031 - Accounting for Merchandising Operations 5: Special Journals and Subsidiary Ledgers

5.0 / 5 (0 votes)