[MEET 10-1] AKUNTANSI SEKTOR PUBLIK - AKUNTANSI ASET & KEWAJIBAN

Summary

TLDRIn this public sector accounting lecture, Nilam Kemala delves into the key components of assets and liabilities, specifically focusing on cash, receivables, and inventory. The discussion includes the classification and recognition of cash and its equivalents, the intricacies of managing receivables, and the accounting for inventory in the public sector. Through practical examples and journal entries, the session provides a comprehensive understanding of financial transactions and reporting in public administration, highlighting the importance of accurate accounting for effective government operations.

Takeaways

- 😀 Public sector accounting focuses on managing assets and liabilities, including cash, receivables, inventories, and fixed assets.

- 😀 Cash is defined as liquid assets, including cash on hand and deposits, which can be readily used for government activities.

- 😀 There are six main cash accounts in public sector accounting, each with specific codes for identification.

- 😀 Transactions involving cash and cash equivalents are recorded when cash is received, and foreign currency is converted to local currency at the central bank's rate.

- 😀 Receivables represent the government's right to collect payments and are recorded when a valid claim arises, like tax assessments.

- 😀 Measurement of receivables varies based on the nature of the claim, including unpaid taxes, loans, and sales agreements.

- 😀 Inventory includes supplies and goods intended for public services and is classified differently from corporate inventory.

- 😀 Inventory is recognized using either a consumption approach or an asset approach, depending on its intended use.

- 😀 The recognition and measurement of inventory involve tracking the purchase price, production costs, and fair value assessments.

- 😀 Proper documentation and journal entries for all financial transactions are crucial for accurate public sector accounting.

Q & A

What is considered cash in public sector accounting?

-Cash includes cash on hand and bank deposits that are readily available to finance local government activities, and it is characterized as highly liquid with minimal risk of value change.

How is cash measured in public sector accounting?

-Cash is recognized when received and measured at nominal value; foreign currency cash is converted to local currency using the central bank's exchange rate.

What are the main accounts under the cash category?

-The main accounts include cash in local government, cash in the collection treasury, cash in the disbursement treasury, cash in BLUD, other cash, and cash equivalents.

How are receivables classified in public sector accounting?

-Receivables are classified into revenue receivables, other receivables, and an allowance for uncollectibles, and they are presented in the balance sheet at their net realizable value.

What conditions must be met for receivables to be recognized?

-Receivables are recognized when there is a right to collect, which can occur when a tax assessment or billing notice is issued, and payments are due.

How is inventory defined in the context of public sector accounting?

-Inventory refers to current assets in the form of goods or supplies meant to support government operations, including consumables and goods for public service.

What methods can be used for inventory valuation?

-Inventory can be valued using various methods, including FIFO (First In, First Out), LIFO (Last In, First Out), and average cost methods.

What is the approach for recognizing inventory in public sector accounting?

-Inventory is recognized using either the expense approach if it is meant for immediate consumption or the asset approach if it is held for future use.

How should transactions involving cash and cash equivalents be recorded?

-Transactions are recorded with journal entries that reflect the cash received or paid out, along with corresponding adjustments in the budget execution journal.

What is the significance of SP2D in cash management?

-SP2D (Surat Perintah Pencairan Dana) is a document used for the transfer of funds from one entity to another within public sector accounting, often relating to daily operational needs.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

VIDEOAULA | Composição Patrimonial (Elementos e contas)| Profa.-Tutora Kessyane Horbucz

[MEET 9] AKUNTANSI SEKTOR PUBLIK - AKUNTANSI PEMBIAYAAN

[MEET 7] AKUNTANSI SEKTOR PUBLIK - AKUNTANSI UNTUK BELANJA & BEBAN

Giải thích BẢNG CÂN ĐỐI KẾ TOÁN - Ví dụ BCĐKT của Vinamilk và Vingroup

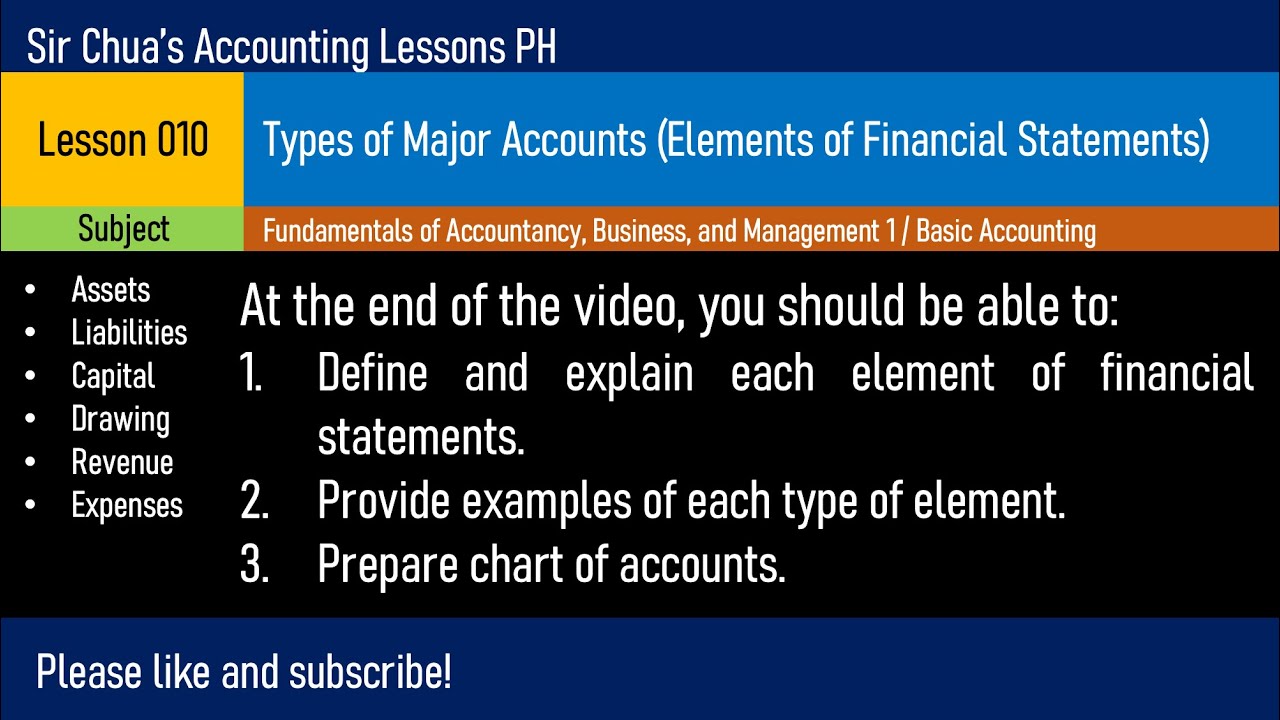

Lesson 010 - Types of Major Accounts (Elements of Financial Statements)

Konsep Dasar Akuntansi: Cara Memahami Dasar Dasar Akuntansi dengan Mudah

5.0 / 5 (0 votes)