4.1 Audit Objectives

Summary

TLDRIn this installment of the auditing and assurance lecture series, Christine explores the vital components of an audit, including objectives, procedures, evidence, and documentation. She revisits management assertions and their relation to audit objectives, distinguishing between general and specific objectives tailored to transaction and balance categories. The lecture aims to prepare auditors to evaluate financial statements and express an opinion on their accuracy.

Takeaways

- 📚 The lecture series focuses on auditing and assurance, covering audit objectives, procedures, evidence, and documentation.

- 🎯 Audit objectives are the goals auditors aim to achieve in conducting a financial statement (FS) audit.

- 🗣️ Management assertions are representations made by management, which auditors evaluate through audit objectives.

- 🔍 There are two categories of management assertions: those related to transactions and disclosures, and those related to balances and disclosures.

- 📈 Audit objectives are derived from management assertions and are divided into general and specific objectives for transactions and balances.

- 🔑 General audit objectives apply broadly to all clients and accounts, while specific audit objectives are tailored to particular accounts and transactions.

- 📝 Specific audit objectives are detailed and include references to particular account titles, unlike general objectives which are broad and account-agnostic.

- 📉 The script provides examples of both general and specific audit objectives, illustrating the difference in their application and specificity.

- 📋 Audit procedures are methods and techniques used by auditors to gather necessary evidence to support their audit objectives.

- 📑 Documentation is crucial in an audit, as it records the evidence collected and the procedures performed to achieve audit objectives.

- 🚀 The lecture series progresses from foundational concepts to more detailed discussions on internal controls and audit processes, building a comprehensive understanding of auditing practices.

Q & A

What are the primary topics covered in the fourth installment of the auditing and assurance lecture series?

-The fourth installment of the auditing and assurance lecture series covers audit objectives, audit procedures, types of audit evidence, and documentation.

What is the relationship between management assertions and audit objectives?

-Audit objectives represent the goals of the auditor in evaluating management assertions. There are two categories of management assertions: transactions and related disclosures, and balances and related disclosures. Each assertion has a corresponding audit objective.

What are the two categories of management assertions?

-The two categories of management assertions are transactions and related disclosures, and balances and related disclosures.

How do auditors use management assertions to design their audit objectives?

-Auditors test and evaluate management assertions by creating audit objectives that correspond to each assertion. For transactions, objectives include completeness, classification, cutoff, accuracy, presentation, and occurrence. For balances, objectives include existence, rights and obligations, and valuation and allocation.

What is the difference between general audit objectives and specific audit objectives?

-General audit objectives apply to every class of transaction, account balance, and disclosure and are stated in broad terms. Specific audit objectives, on the other hand, are stated for a specific class of transactions, account balances, and disclosures and include references to particular accounts or transactions.

Can you provide an example of a general audit objective related to the management assertion of occurrence?

-A general audit objective related to the management assertion of occurrence could be: 'Recorded or disclosed transactions exist or occurred.'

How does the concept of 'posting and summarization' relate to the audit objective of accuracy under transactions?

-The audit objective of posting and summarization tests the accuracy of transactions by ensuring that transactions are properly included in the ledgers and correctly summarized, which is crucial for mathematical accuracy and proper recording.

What is the role of 'cut off' in the context of balance-related audit objectives?

-In the context of balance-related audit objectives, 'cut off' refers to the timing detail, tie-in, and ensures that transactions are recorded in the proper period, which is essential for the accuracy, valuation, and allocation of balances.

Can you give an example of a specific audit objective for the management assertion of completeness in the context of sales transactions?

-A specific audit objective for the management assertion of completeness in the context of sales transactions could be: 'Existing sales transactions are recorded, and all sales disclosures required by accounting standards are included in the financial statements.'

How do auditors ensure that the audit objectives are effectively translated into audit procedures?

-Auditors tailor and customize specific audit objectives to the specific accounts and the risks involved, which then drive the development of audit procedures. These procedures involve the methods and techniques used to gather the necessary audit evidence.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

Belajar Singkat: Kertas Kerja Audit (Audit Working Papers)

Auditing 101 | Part 1: Starting the Audit: A Guide for CPAs & Aspiring Auditors | Maxwell CPA Review

Audit dalam Kerangka Islam - Audit Lembaga Keuangan Syariah

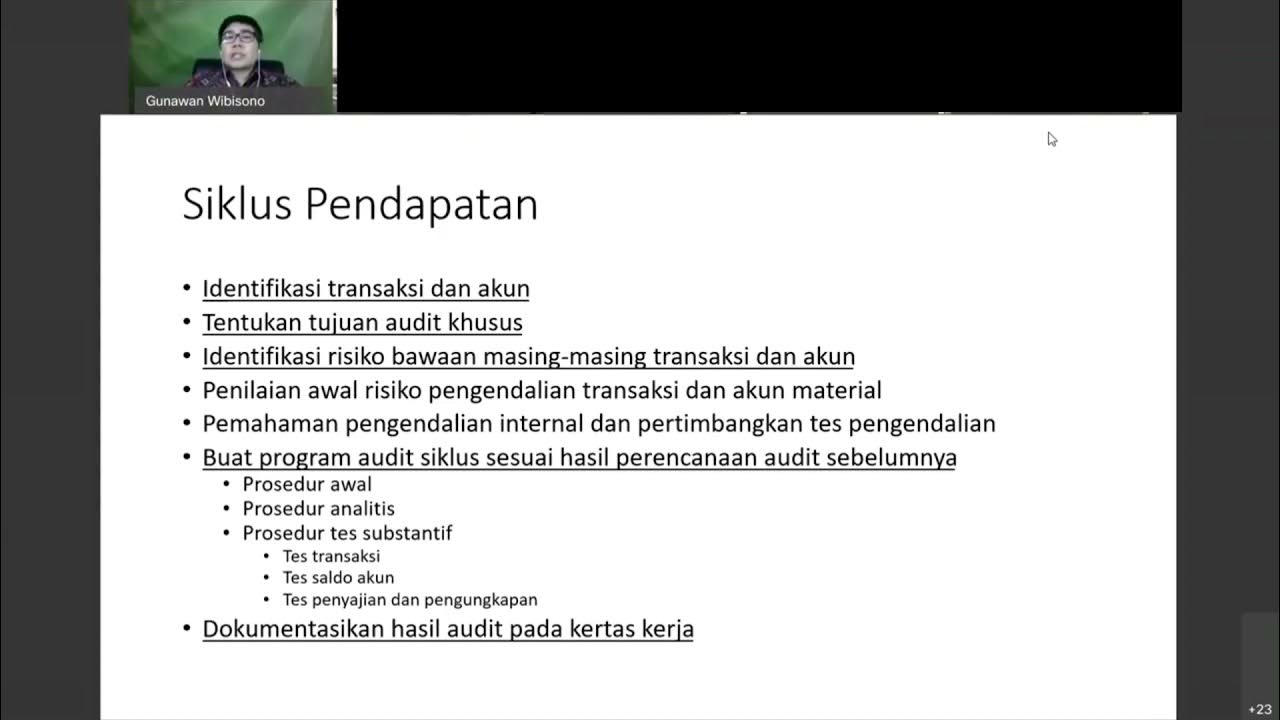

Audit Siklus Pendapatan

4.2 Audit Procedures

The CONTRACT between the Auditor & the Client | ISA/ASA 210

5.0 / 5 (0 votes)