The ONLY Candlestick Patterns You Need To Know

Summary

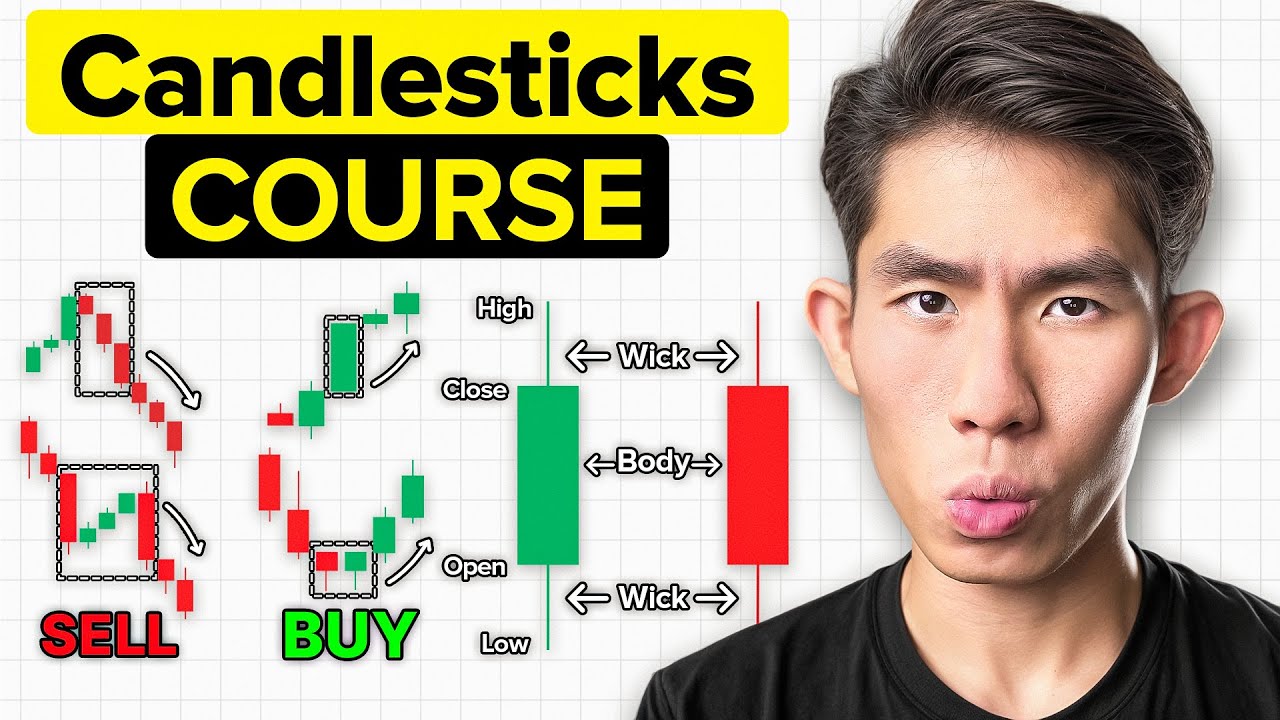

TLDRThis video masterclass delves into the art of candlestick trading, unveiling seven top patterns ranging from basic to advanced. It explains the significance of candlestick components like wicks and bodies, and how they reflect market sentiment. The video demonstrates how to identify high-probability trade opportunities by combining candlestick patterns with price action, using support and resistance levels and trend lines for trade entry confirmation.

Takeaways

- 📈 Candlesticks are a method for visualizing the historical price movement of an asset, with each candlestick representing the price action over a specific time period.

- 🟢 A green candle indicates a higher closing price than opening price, suggesting stronger buyers.

- 🔴 A red candle indicates a lower closing price than opening price, suggesting stronger sellers.

- 🕊 The body and wicks of a candlestick provide insight into the strength and control of buyers and sellers during the period.

- 📊 A large body compared to wicks indicates control by either buyers or sellers, while a small body suggests a contest between the two.

- 🔍 Large wicks above or below the body signal strong selling or buying pressure at those levels, respectively.

- 📌 The 'bullish pin bar' is a reversal pattern signaling potential upward movement, characterized by a small green body and a large wick below it.

- 📉 The 'bearish pin bar' is the opposite of the bullish pin bar, indicating a potential downward reversal with a small red body and a large wick above it.

- 🌀 The 'doji' pattern shows indecision in the market with equal wicks and a small body, often indicating a pause or potential upcoming breakout.

- 🌞 The 'bullish engulfing bar' is a two-candle pattern where a green candle engulfs a preceding red candle, signaling a shift from seller to buyer control.

- 🌑 The 'bearish engulfing bar' is the reverse, where a red candle engulfs a preceding green candle, indicating a shift to seller control.

- ✨ The 'Morning Star' is a three-candle bullish reversal pattern consisting of a red candle, a doji or pin bar, and a green candle that breaks above the doji's high.

- 🌒 The 'Evening Star' is the bearish counterpart to the Morning Star, indicating a potential downward reversal with a green candle, a doji, and a large red candle.

- 📈📉 Combining candlestick patterns with price action concepts like support and resistance levels and trend lines can enhance trade entry strategies.

Q & A

What are the main components of a candlestick?

-A candlestick consists of two main parts: the body, which represents the opening and closing price of an asset for a specific period, and the wicks or shadows, which indicate the highest and lowest prices achieved during that period.

How do green and red candles differ in terms of market sentiment?

-A green candle indicates that the closing price is higher than the opening price, suggesting that buyers were stronger than sellers during that period. Conversely, a red candle indicates that the closing price is lower than the opening price, implying that sellers were stronger than buyers.

What does a large wick above or below the body of a candlestick signify?

-A large wick above the body suggests strong selling pressure at higher levels, while a large wick below the body indicates strong buying pressure at lower levels, showing resistance to price movement in the respective directions.

Why are the concepts of body size and wicks important in candlestick analysis?

-The size of the body and the length of the wicks provide insights into the strength and control of buyers and sellers. A larger body compared to the wicks indicates control by either buyers or sellers, while a smaller body with larger wicks suggests a balanced contest with less control from either side.

What is a bullish pin bar and what does it indicate?

-A bullish pin bar is a reversal candlestick pattern that consists of a small green body with a large wick below and little or no wick above. It indicates a potential reversal to the upside, showing that buyers have stepped in and are attempting to push the price higher after a down move.

How is a bearish pin bar different from a bullish pin bar and what does it signify?

-A bearish pin bar is the opposite of a bullish pin bar, featuring a red candle with a small body, a large wick above, and little or no wick below. It indicates a potential reversal to the downside, showing that sellers have gained control and are pushing the price lower.

What is the significance of a doji candle in candlestick patterns?

-A doji candle, characterized by equal wicks and a small body, signifies indecision in the market, as it indicates that buyers and sellers were equally matched during the period, resulting in a price close to the opening price.

What is the bullish engulfing bar pattern and how does it reflect market sentiment?

-A bullish engulfing bar is a two-candle pattern where a large green candle completely engulfs a preceding red candle. It reflects a shift in control from sellers to buyers, indicating that buyers have taken over and are likely to push the price higher.

How does the bearish engulfing bar pattern differ from the bullish engulfing bar and what does it indicate?

-A bearish engulfing bar is a two-candle pattern where a large red candle engulfs a preceding green candle. It indicates a shift in control from buyers to sellers, suggesting that sellers have taken over and are likely to push the price lower.

What is the Morning Star pattern and what does it signify in terms of market direction?

-The Morning Star pattern is a three-candle pattern that indicates a bullish reversal. It consists of a strong red candle, followed by a small doji or pin bar, and then a large green candle that breaks above the high of the doji candle. It signifies that buyers have regained control and are likely to see an upward price movement.

What is the Evening Star pattern and what does it indicate for the market?

-The Evening Star pattern is the opposite of the Morning Star, consisting of a large green candle, followed by a small doji, and then a large red candle. It indicates a bearish reversal, showing that sellers have taken control and are likely to drive the price downward.

How can support and resistance levels be combined with candlestick patterns for trading?

-Support and resistance levels can be used in conjunction with candlestick patterns to confirm potential trade entries. For example, a reversal candlestick pattern near a support level can indicate a high-probability buy opportunity, while a bearish pattern near resistance can signal a sell opportunity.

What is the importance of combining candlestick patterns with other price action concepts?

-Combining candlestick patterns with other price action concepts, such as support and resistance levels and trend lines, can increase the reliability of trade setups. It helps traders to confirm the validity of a pattern and identify high-probability trade opportunities.

How can a trend line be used in conjunction with a bullish engulfing candle to identify a trade opportunity?

-A trend line can be used to identify resistance levels. When a bullish engulfing candle appears near a trend line, it can indicate that buyers have taken control and are likely to push the price beyond the resistance, providing a potential buy trade opportunity.

What does the size of the third candle in the Morning Star pattern indicate about the trade opportunity?

-If the third candle in the Morning Star pattern is as big as the initial red candle, it suggests a strong and reliable trade opportunity. If it is smaller, the trade is less likely to be successful.

How does the Evening Star pattern reflect the change in control from buyers to sellers?

-The Evening Star pattern reflects a change in control from buyers to sellers through its three candles: a large green candle indicating initial buyer control, followed by a doji showing a tug of war between buyers and sellers, and finally, a large red candle indicating that sellers have won and are driving the price down.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

The ONLY Candlestick Pattern Guide You'll EVER NEED

🔴 Come PREVEDERE le INVERSIONI dei mercati | STRATEGIE DI TRADING

Les FIGURES de Chandelier! | Formation Trading du Captain!

The Strategy I Wish I Knew as a Beginner

ULTIMATE Candlestick Patterns Trading Guide *EXPERT INSTANTLY*

Candle Range Theory Explained and Simplified | Easily Predict the Next Candle

5.0 / 5 (0 votes)