The ONLY Candlestick Pattern Guide You'll EVER NEED

Summary

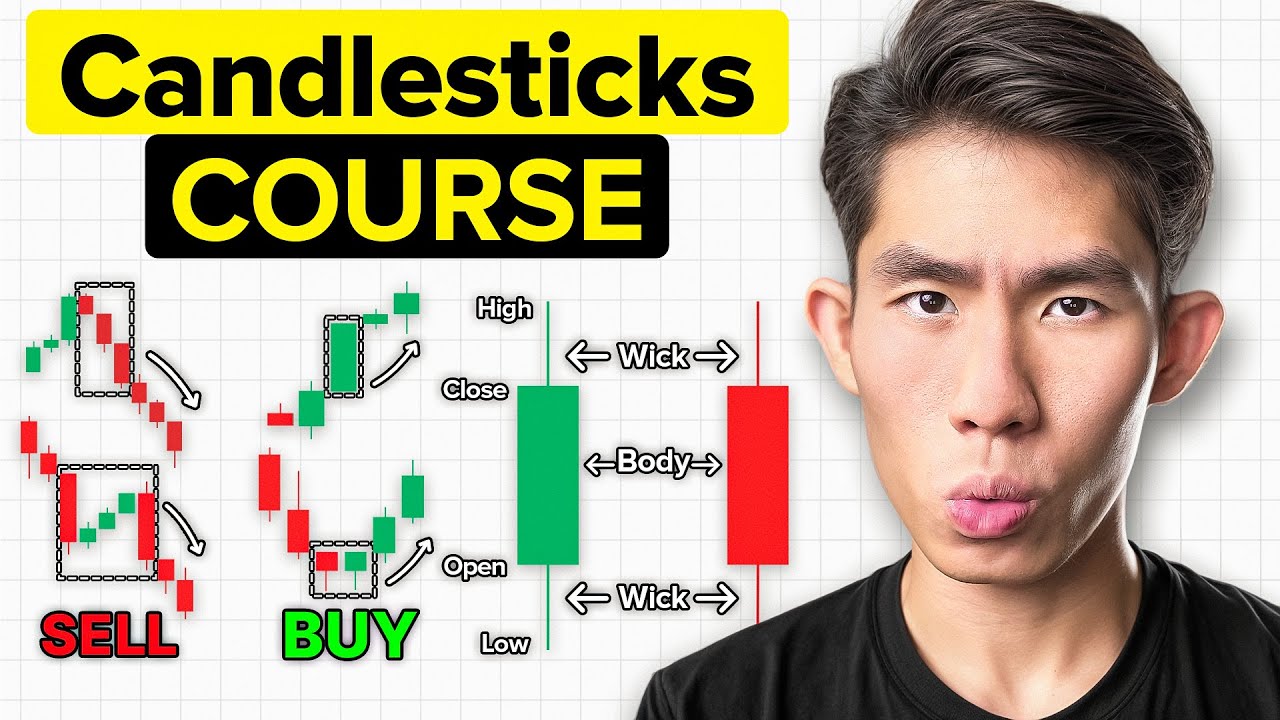

TLDRThis video script delves into the art of candlestick pattern analysis for successful trading. It highlights the importance of identifying patterns like the engulfing candle, momentum candle, and multiple candlestick patterns to predict market direction. The script also touches on the significance of doji, hammer, shooting star, tweezer, and marubozu patterns, offering insights into market reversals and trends. A bonus tip introduces using TradingView indicators to spot these patterns effortlessly, aiming to enhance viewers' trading strategies and avoid false breakouts.

Takeaways

- 📈 The video discusses a recent successful trade that resulted in a 10% gain, highlighting the importance of candlestick patterns in predicting market movements.

- 🕯️ The 'Engulfing Candle' is a strong reversal pattern where a candle of the opposite color completely engulfs the previous candle, signaling a potential trend reversal.

- 📊 The 'Momentum Candle' is a large candle, two to three times bigger than the previous ones, indicating a strong directional move that is likely to continue.

- 🔄 The 'Multiple Candlestick Pattern' involves three or more candles with wicks going in the same direction, suggesting a higher probability of the price respecting the pattern and moving accordingly.

- 🍬 The 'Doji Candle' represents market indecision and is often followed by a reversal, especially when confirmed by additional candles of the same color.

- ⛏ The 'Hammer' is a bullish pattern with a small body and a long lower wick, indicating that buyers have absorbed selling pressure and may drive the price up.

- 🌠 The 'Shooting Star' is similar to the hammer but with a small body and a long upper wick, suggesting a potential bearish reversal.

- 🪢 The 'Tweezer' pattern consists of a red and a green candlestick with similar lower wicks, indicating potential upward momentum, with the bearish version having upper wicks.

- 🟢 The 'Bullish Marubozu' is a green candlestick without wicks, signaling strong buying pressure and a likely continuation of the upward trend.

- 🔴 The 'Bearish Marubozu' is a red candlestick without wicks, indicating strong selling pressure and a probable continuation of the downward trend.

- 🛠️ TradingView can be used to add candlestick pattern indicators, which automatically highlight when specific patterns occur, aiding in pattern recognition without memorization.

Q & A

What is the main topic of the video?

-The main topic of the video is candlestick patterns and how they can be used to predict market direction and improve trading strategies.

What is an 'engulfing candlestick' and how does it indicate a potential market reversal?

-An 'engulfing candlestick' is a candle that is in the opposite color of the previous one and completely covers it, indicating a potential market reversal at the point where it appears.

Why is it important to combine candlestick patterns with other trading tools and strategies?

-Combining candlestick patterns with other trading tools and strategies helps to avoid relying solely on patterns, which can sometimes be misleading, and provides a more comprehensive approach to trading.

What is a 'momentum candle' and how can it be used in trading?

-A 'momentum candle' is a large candle that is two to three times bigger than the previous candles. It can be used in trading as an indicator that the price is likely to continue in the direction of the candle, especially in choppy markets.

How can the 'multiple candlestick pattern' be used to identify key support or resistance levels?

-The 'multiple candlestick pattern', which consists of three or more candles with wicks going in one direction, can be used to identify key support or resistance levels when these candles appear exactly at these levels, indicating a higher probability of price reversal.

What does a 'doji candle' represent and how can it be used as a trading signal?

-A 'doji candle' represents market indecision and can be used as a trading signal for a potential price reversal, especially when it appears after a strong trend and is followed by additional confirming candles of the opposite color.

What is the significance of a 'hammer candle' in predicting market direction?

-A 'hammer candle', characterized by a small body and a long lower wick, signifies that buyers have absorbed the selling pressure and pushed the price back up, indicating a bullish signal and potential continuation of the upward trend.

How does a 'shooting star candle' differ from a 'hammer candle' and what does it indicate?

-A 'shooting star candle' is similar to a 'hammer candle' but has a small body and a long upper wick. It indicates a bearish signal, suggesting that the price may reverse and start moving downwards after a strong upward trend.

What is the 'tweezer pattern' and how can it signal a potential market move?

-The 'tweezer pattern' consists of a red candlestick followed by a green one, both with similar wicks on the bottom, signaling a potential upward move. Conversely, a green followed by a red with similar wicks on the top signals a potential downward move.

What is a 'marubozu candle' and how can it confirm the continuation of a trend?

-A 'marubozu candle' is a large candle without any wicks, indicating that the opening and closing prices were the same for the bullish version and that the trend is likely to continue in the upward direction. The bearish version indicates a downward trend continuation.

How can trading platforms like TradingView assist in identifying candlestick patterns?

-Trading platforms like TradingView can assist by providing indicators that notify traders when specific candlestick patterns occur, making it easier to spot these patterns without having to memorize and manually identify them.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Panduan Candlestick untuk pemula lengkap dan simple

The ONLY Candlestick Patterns You Need To Know

MAKE $100 PER DAY ON BYBIT !!! (secret method)

Intip 4 Rahasia Trading Price Action ini! Dijamin Trading Tambah PeDe

ULTIMATE Candlestick Patterns Trading Guide *EXPERT INSTANTLY*

Perfecting LTF Orderblock Entries With CRT - Candle Range Theory - ICT Concepts

5.0 / 5 (0 votes)