This FVG Tells You EXACTLY When Price Will Reverse

Summary

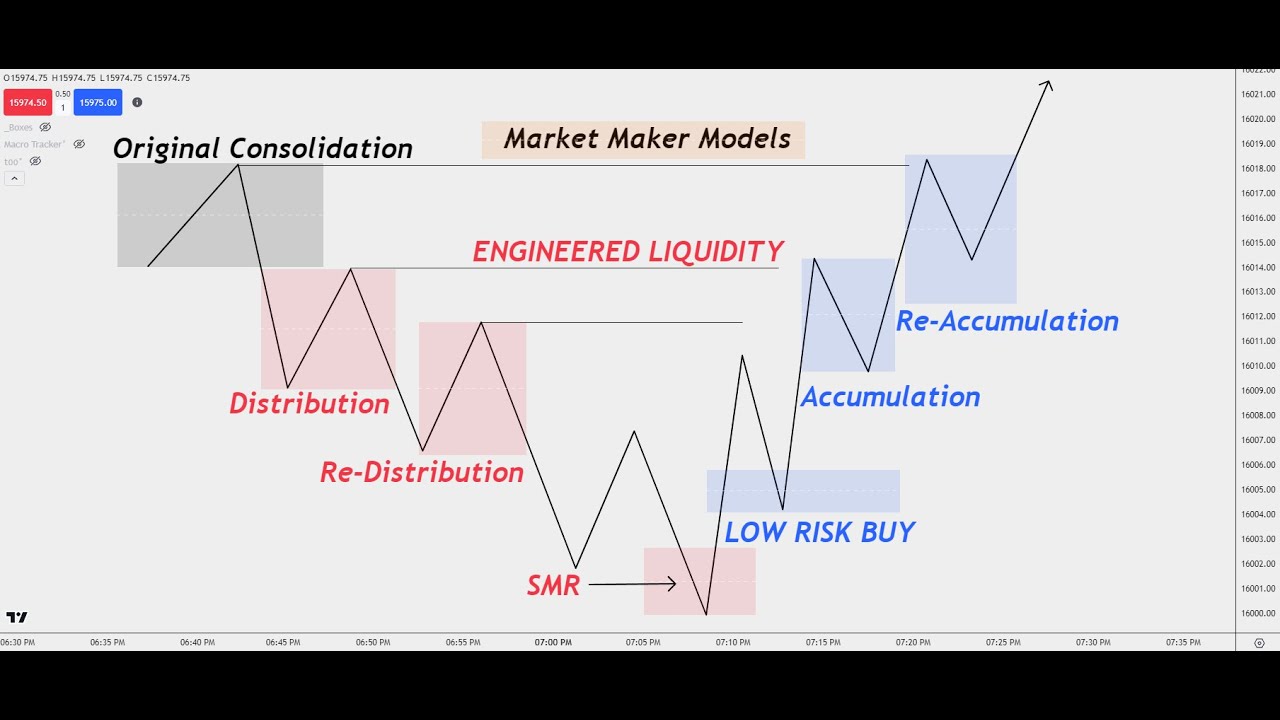

TLDRThis video explains a method for accurately identifying market reversals using fair value gaps and impulse shifts, aligned with smart money concepts. The strategy focuses on identifying key market points of interest across various time frames, from monthly down to 1-minute charts, to align trades with institutional market moves. By recognizing v-shaped reversals and understanding how large financial institutions move the market, traders can spot high-probability setups. The video includes multiple examples, detailing step-by-step how to enter trades using this approach, making it a comprehensive guide for traders looking to align with smart money and enhance their trading strategies.

Takeaways

- 😀 Impulse shifts are key to identifying reversals in the market, using fair value gaps as indicators of price displacements.

- 😀 The method focuses on trading smart money by identifying price movements caused by large institutional orders.

- 😀 Fair value gaps are created when price rapidly displaces away from a point of interest, showing institutional participation.

- 😀 V-shaped reversals with a fair value gap are high probability indicators of impulse shifts, but they are not always necessary for validation.

- 😀 Proper time frame alignment is critical: higher time frames (monthly, weekly) dictate the context for entry on lower time frames (daily, hourly, etc.).

- 😀 Impulse shifts are validated by checking for the disrespected fair value gaps on higher time frames to avoid trapped order flow.

- 😀 Traders should avoid trading fair value gaps that are within trapped order flow zones, where price is stuck between competing higher time frames.

- 😀 Once higher time frames align, traders can focus on lower time frame fair value gaps to enter positions in line with the overall trend.

- 😀 An impulse shift can be traded by entering at the high or low of the fair value gap and setting a stop loss at the swing point that created the shift.

- 😀 Market analysis should include checking correlated assets (like gold and silver) to spot divergences (SMT) that increase the probability of impulse shifts.

- 😀 The strategy works not only on traditional markets but also on meme coins, where similar market behavior is observed with fair value gaps and impulsive moves.

Q & A

What is an Impulse Shift in trading, and why is it important?

-An Impulse Shift is a price movement that impulsively displaces from a higher time frame point of interest, often seen in V-shaped reversals. It’s important because it helps identify when large institutional players, or smart money, are entering the market, which gives traders high-probability opportunities to align with those moves.

Why is it crucial to align time frames when identifying an Impulse Shift?

-Aligning time frames ensures you are confirming your analysis with a structure that works within the market’s larger context. For example, a higher time frame gap may indicate a higher probability of success on lower time frames, as it shows market intentions at a macro level, making the trades more reliable.

What is the significance of Fair Value Gaps in the context of Impulse Shifts?

-Fair Value Gaps occur when price moves impulsively and leaves a gap in its wake. These gaps serve as footprints of smart money and can act as confirmation for potential price reversals or continuations. They are essential for identifying entry points during an Impulse Shift.

How does the concept of ‘Push Context’ relate to Impulse Shifts?

-Push Context refers to the internal to external liquidity range on a higher time frame. It indicates a phase where price is moving within a defined range, and an Impulse Shift out of this context can signal a high-probability trade, as the market often reacts strongly once it exits this range.

What is the importance of checking higher time frames like the Weekly or Monthly when trading on lower time frames?

-Checking higher time frames is essential because they provide a broader context of the market's direction. Ignoring higher time frame gaps or support/resistance areas can lead to trapped order flow, where price may reverse unexpectedly. Higher time frames offer the strength of market sentiment, which can overpower lower time frame moves.

What does it mean when price is in ‘Trapped Order Flow’, and how should traders handle it?

-Trapped Order Flow occurs when price is stuck between two significant higher time frame levels, like a Weekly and Monthly Fair Value Gap. In this scenario, price can go in either direction, resulting in 50/50 odds. Traders should avoid entering positions in such conditions and wait for clear signals of price breaking one of those levels.

Can an Impulse Shift happen without a Fair Value Gap, and is it still valid?

-Yes, an Impulse Shift can occur without a Fair Value Gap. While a gap typically confirms the move, the absence of a gap does not invalidate the shift itself. Traders may still rely on the V-shaped reversal to confirm the market’s direction, but the probability of success may be lower without the gap.

What is the role of closely correlated assets like Silver when analyzing a trade setup in Gold?

-Closely correlated assets like Silver can serve as a secondary confirmation for a potential trade in Gold. Divergences between these assets, such as a swing low in Silver that is not mirrored in Gold, can provide additional confidence that the market may be shifting direction, enhancing the validity of the Impulse Shift.

Why is the concept of a ‘Breakaway Gap’ important when trading with higher time frame context?

-A Breakaway Gap signals that price is unlikely to retrace into the gap and instead may continue moving in the direction of the break. This type of gap is crucial because it shows strong momentum and confirms that the market has decisively shifted from one program (buy or sell) to another, increasing the likelihood of trend continuation.

How can traders use the 15-minute and 1-minute time frames for fine-tuning entries during an Impulse Shift?

-Traders can use the 15-minute and 1-minute time frames to refine their entries by waiting for a Fair Value Gap to appear on the smaller time frames after confirming the larger time frame setup. The 1-minute chart, for example, can give very precise entry points for high-probability trades, allowing traders to target small, highly-defined movements.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

ICT Market Maker Model - Live Trade Explanation

ICT Concepts: Understanding How To Trade ICT Market Maker Models!

How To Spot the Bottom of ICT's Market Maker Model

ICT Market Maker Model - Explained In-depth!

ICT Strategy That Works Every Time! Standard Deviation Trading

ICT SMT Divergence - Everything to Know About (Secrets)

5.0 / 5 (0 votes)