Game of Theories: The Monetarists

Summary

TLDRMonetarism, championed by Milton Friedman, emphasizes the role of the money supply in business cycles, arguing that too much or too little inflation can destabilize an economy. While monetarists stress stable money growth and limited central bank discretion, their theory has limitations, especially in explaining business cycles caused by external factors like credit issues or real shocks. Monetarism also struggles with the complexity of different money supply measures and cannot easily adapt to changes in economic velocity. Despite its influence, monetarism remains an incomplete explanation of economic fluctuations.

Takeaways

- 😀 Monetarism emphasizes the importance of the money supply and central bank decisions regarding it.

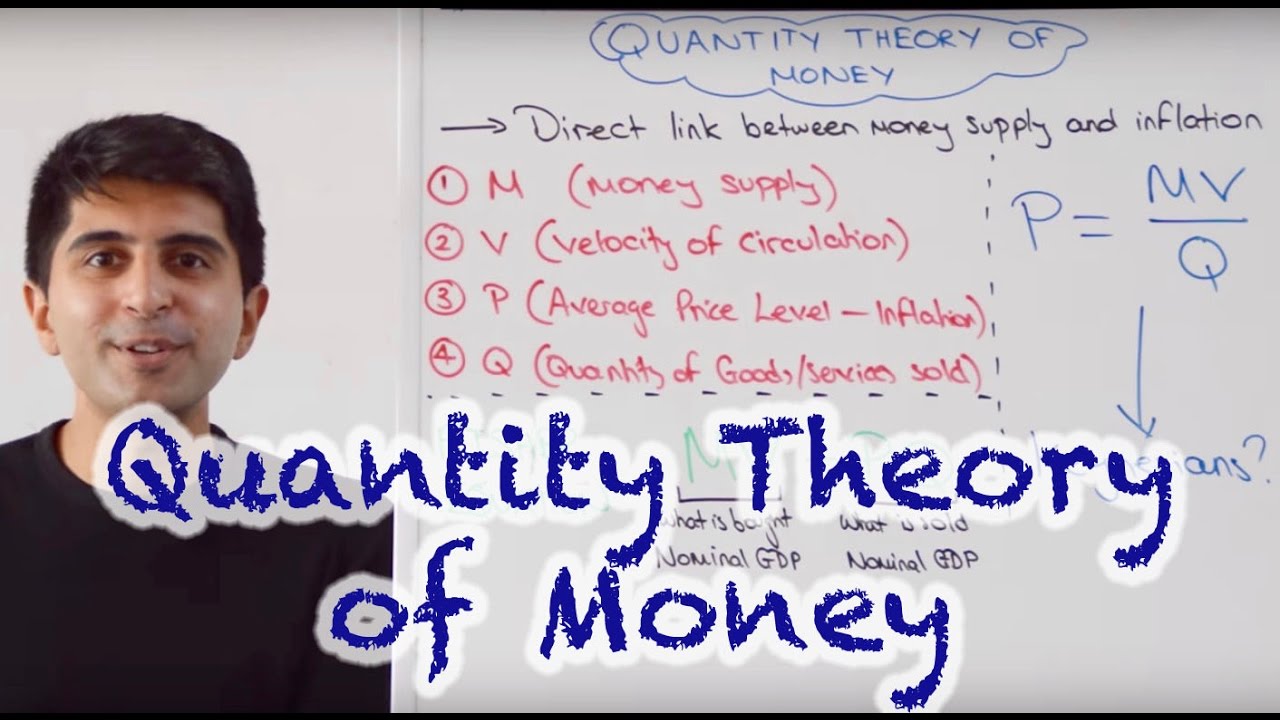

- 😀 The core of monetarism is the Quantity Theory of Money, which suggests that in the long run, the amount of money in an economy doesn't affect real output or employment, but in the short run, inflation can matter.

- 😀 Two potential dangers in monetarism are too much inflation or too little inflation, both of which can negatively impact the economy.

- 😀 In the 1970s, monetarism became popular as it explained high inflation rates in America, attributing it to the Federal Reserve creating too much money.

- 😀 Monetarists argue that inflation distorts economic decisions, making it difficult for individuals to discern price changes caused by inflation versus real value shifts.

- 😀 Monetarism stresses that high inflation may initially boost economic output, but as inflation expectations rise, it becomes ineffective.

- 😀 In contrast, too little inflation or deflation can result in low aggregate demand, leading to economic downturns, and this is similar to Keynesian economics.

- 😀 Monetarists and Keynesians both believe wages are sticky (not easily adjusted), and when money supply decreases, wages don't fall in tandem, leading to layoffs and business cycle downturns.

- 😀 Monetarists advocate for a stable, moderate growth rate of money supply (typically 2-3%) to avoid inflation being too high or too low.

- 😀 Despite its influence, monetarism has limitations: it doesn't fully explain business cycles caused by factors like credit market issues, bubbles, or real shocks.

- 😀 Monetarism assumes a simple concept of 'the money supply,' but in reality, there are various measures of money supply, and they don't always move in sync, complicating stabilization efforts.

- 😀 A rigid approach to controlling the money supply can limit the central bank’s ability to respond to shocks like oil price hikes or interest rate volatility, though newer monetarist offshoots (like market monetarism) allow for some flexibility.

Q & A

What is monetarism and who is its most famous proponent?

-Monetarism is a framework for thinking about business cycles that emphasizes the importance of the money supply and the decisions central banks make regarding it. Its most famous proponent is Nobel laureate Milton Friedman of the University of Chicago.

What does the quantity theory of money suggest?

-The quantity theory of money suggests that in the long run, the absolute amount of money in an economy doesn't affect real output or employment. However, in the short run, changes in inflation rates can have an impact.

What are the two potential dangers highlighted by monetarism?

-The two potential dangers in monetarism are too much inflation, which can distort economic resource allocation, and too little inflation or deflation, which can lead to insufficient aggregate demand and economic downturns.

How did monetarism explain the high inflation rates in America during the 1970s?

-Monetarism explained the high inflation rates in the 1970s by arguing that the Federal Reserve was creating too much new money, which led to rising prices. Monetarists suggested that lowering inflation would lead to more economic stability.

What is the role of sticky wages in the monetarist view of business cycles?

-Monetarists believe that many nominal wages are sticky, meaning they cannot easily be adjusted. When the flow of money through the economy declines, sticky wages prevent easy adjustments, leading employers to lay off workers, which causes a business cycle downturn.

What is the Goldilocks rule in monetarism?

-The Goldilocks rule in monetarism suggests that there should be a constant and moderate rate of money supply growth, typically around 2-3%, to avoid the extremes of too much or too little inflation.

Why do monetarists prefer rules over discretion for central banks?

-Monetarists prefer rules because they believe that central banks should not have too much discretion. They argue that policy lags are long and variable, and that central banks' information is often unreliable, so a stable, rule-based approach is better for economic stability.

What are the main problems with monetarism according to the script?

-Monetarism has several problems: it doesn't fully account for business cycles caused by things like credit market issues or real shocks; it treats the money supply as a single, well-defined concept, even though there are multiple money supply measures; and it can make it harder for the central bank to respond to certain economic shocks.

What is the issue with assuming the money supply is a single, well-defined thing?

-The issue is that there are multiple different measures of the money supply (e.g., narrow measures like currency plus reserves, or broader ones including demand deposits and savings). These measures don't always move together, and focusing on just one may not stabilize the broader economy.

What is market monetarism and how does it differ from traditional monetarism?

-Market monetarism, or nominal GDP targeting, is an offshoot of traditional monetarism. It starts with the monetarist framework but allows for central bank discretion to respond to changes in velocity and other shocks, which traditional monetarism does not accommodate.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级5.0 / 5 (0 votes)