||CLASS-42||INVOICE VERIFICATION IN SAP MM || MIRO/MIR4/MRBR T code In SAP||IR BEFORE GR PROCESS||

Summary

TLDRThis detailed script guides users through the process of invoice verification and material management in a logistical context. It covers multiple steps, from entering invoice data, selecting purchase orders, and setting baseline dates, to calculating tax amounts and resolving payment blocks. The script also explains key concepts like the importance of matching reference numbers, delivery status, and understanding different account entries for vendor transactions. With step-by-step instructions, the video offers valuable insights into handling invoice verification processes and effectively managing vendor payment documentation in a professional setting.

Takeaways

- 😀 The process starts with managing logistics and material management, followed by moving to invoice verification and documentation.

- 😀 Invoices are entered with both the 'Invoice Date' (when received from the vendor) and the 'Posting Date' (when it is recorded in the accounting system).

- 😀 Users can select the posting date to match the date when the invoice is recorded, and they have the option to modify the date if needed.

- 😀 Vendors' references like invoice numbers can be entered during the invoice entry process, helping in tracking and verification.

- 😀 The system provides options to categorize the invoice under specific purchase orders or service agreements, such as vendor transport or service center visits.

- 😀 Basic details like quantity and amount must be filled in, and tax calculation is automatically applied based on predefined tax rules.

- 😀 Payment terms (e.g., 15 days or 30 days after receipt) are essential for defining the schedule for vendor payments.

- 😀 After entering the basic details, including quantity and amount, a baseline date is automatically suggested or can be manually set.

- 😀 The invoice's tax and payment status are calculated and displayed, and any imbalance in the amount must be adjusted before posting.

- 😀 Users must ensure that the balance is zero for an invoice to be successfully posted; otherwise, the system will not allow posting.

- 😀 In cases of discrepancies in quantity delivery, users can check for relevant messages and resolve them before completing the invoice entry.

- 😀 Vendors' payment statuses can be blocked or unblocked depending on the invoice verification process, ensuring payment is processed only when conditions are met.

Q & A

What is the first step in the invoice entry process?

-The first step involves entering the invoice details, including the invoice date, posting date, and reference details like the vendor's invoice number.

What is the significance of the 'posting date' in the invoice entry process?

-The 'posting date' refers to the date when the invoice is officially recorded in the accounting system. It helps track the financial transaction in the correct accounting period.

What should be done if the invoice date is different from the posting date?

-If the invoice date is different from the posting date, the invoice date should be recorded as per the actual invoice received, and the posting date can be adjusted based on the system settings.

What is meant by 'baseline date' in the context of payment terms?

-The 'baseline date' is the date from which payment terms, like payment due dates, are calculated. It determines the payment period agreed with the vendor.

How is the 'input tax' calculated in the process?

-The input tax is calculated by applying the relevant tax rate to the invoice amount. The system automatically calculates the tax amount based on the predefined settings.

What role does the purchase order play in the invoice entry process?

-The purchase order (PO) is linked to the invoice to verify that the invoiced items match the purchase order details, such as quantities and amounts, ensuring the accuracy of the transaction.

How does the system handle the verification of the invoice against the purchase order?

-The system checks the quantities and amounts in the invoice against the purchase order details. If any discrepancies are found, a warning message is generated, prompting corrections.

What happens if there is a payment block on the invoice?

-If a payment block is applied to an invoice, the payment cannot be processed until the block is released. This may occur due to discrepancies or incomplete documentation.

What is the purpose of the 'payment block release' process?

-The 'payment block release' process is necessary when any issues with the invoice, such as discrepancies, are resolved. It clears the block, allowing the payment to be processed.

What should be done if the item quantity in the invoice does not match the delivery quantity?

-If the quantity in the invoice does not match the delivered quantity, it is important to update the system with the correct delivery details before posting the invoice.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

Status ERROR/Contact BLO/ERO এর অর্থ কি? Hearing Documents Uploading সমগ্র process কি?

2. Rekam Referensi Nomor Seri Faktur Pajak

MyInvois Portal User Guide - Full Guidance

MyInvois Portal User Guide (Chapter 4) - Submissions Management

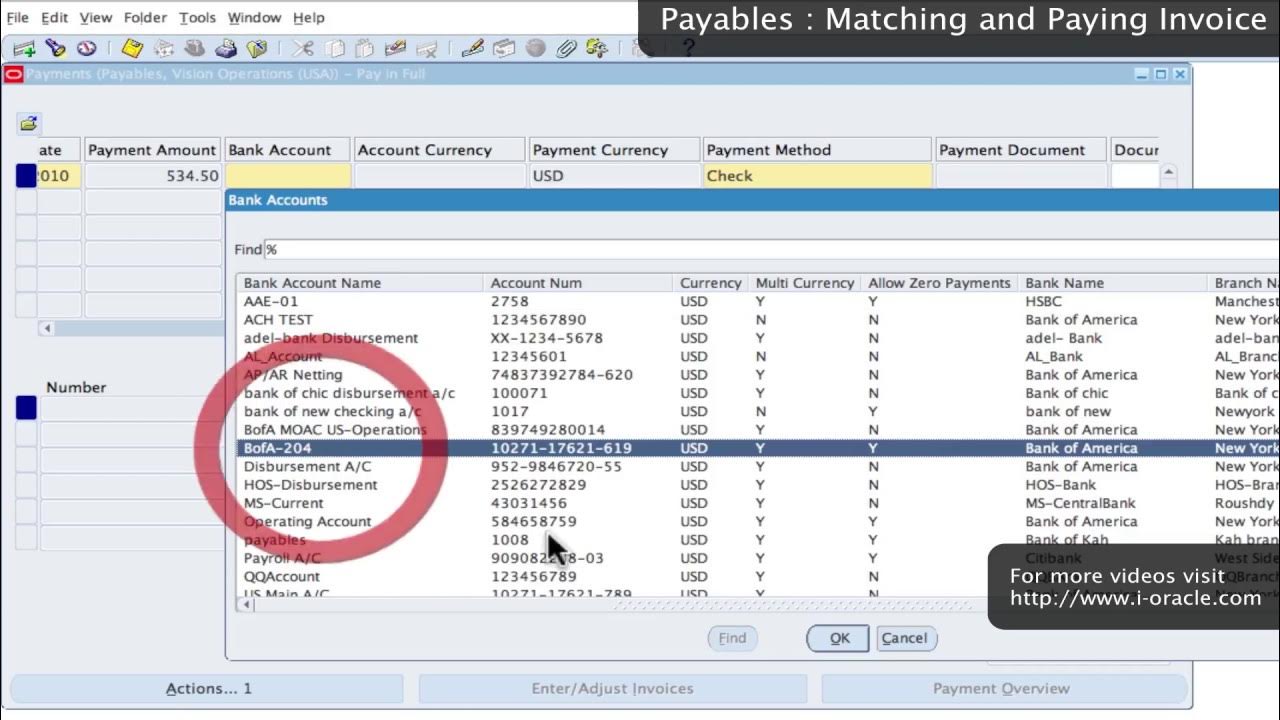

Oracle Training - Accounts Payable in Oracle E-Business Suite R12 (1080p - HD)

2. Coretax Instansi Pemerintah : Login akun instansi, tampilan akun, penunjukan PIC

5.0 / 5 (0 votes)