Apa itu Pajak Final? Apa bedanya PPh Final dan PPh Non-Final? | #Paham Pajak

Summary

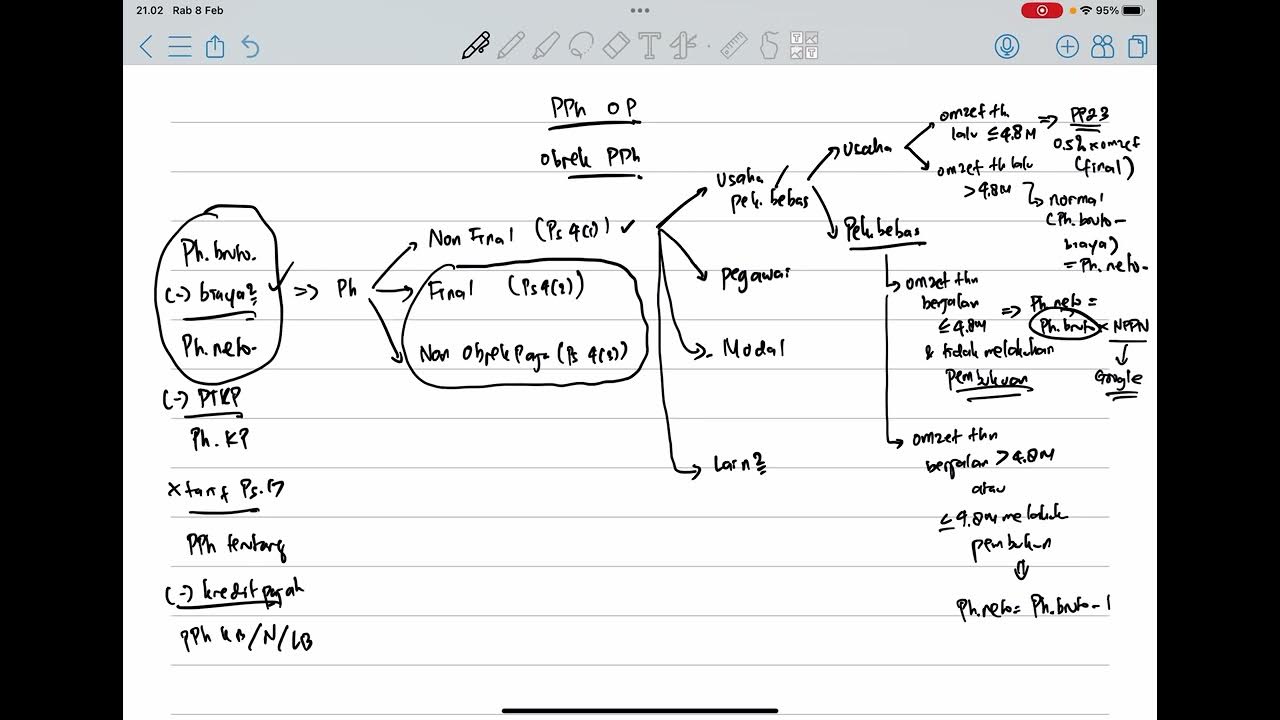

TLDRThis video explains the difference between final and non-final income tax (PPH) in Indonesia. It highlights that final taxes are settled at the moment of receiving income and are not included in the annual tax return, while non-final taxes require reporting and calculation at the end of the year. The video provides practical examples to illustrate these concepts, such as rental income being subject to PPH final and a tour guide's salary falling under PPH non-final. The video aims to clarify the tax system and encourage viewers to engage through comments and visits to the website.

Takeaways

- 😀 PPH (Income Tax) Final and Non-Final are two types of income tax in Indonesia, often discussed in terms of income tax (PPH).

- 😀 PPH Final is a tax that is immediately settled upon receiving income, and no further tax is due for that specific income at the end of the year.

- 😀 PPH Non-Final, on the other hand, requires the income to be calculated and reported on the annual tax report (SPT), and it is not fully settled until the report is filed.

- 😀 For PPH Final, the income is not included with other earnings on the annual tax report, while for PPH Non-Final, it is included in the calculation with other income.

- 😀 PPH Final is considered fully paid, so it cannot be used as a tax credit in the annual report. In contrast, PPH Non-Final can be counted as a credit during the tax filing process.

- 😀 Examples of PPH Final include income from savings, bonds, lottery prizes, certain business sales, and rental income.

- 😀 A practical example of PPH Final: A person renting out a house deducts a 0.5% tax from the rental income as it is received, and does not need to report this income again on the annual SPT.

- 😀 A practical example of PPH Non-Final: A tour guide’s salary is subject to non-final tax, which must be reported in the annual tax filing for calculation and payment of the tax.

- 😀 PPH Final cannot be reduced by expenses related to generating or maintaining income, whereas for PPH Non-Final, such expenses are deductible.

- 😀 The video is aimed at explaining these two tax types in simple terms for people unfamiliar with tax concepts, using everyday examples like renting and working as a tour guide.

Q & A

What is the main topic of the video?

-The video explains the difference between final tax (pajak final) and non-final tax (pajak non-final) in Indonesia's tax system.

What is 'Pajak Final' (Final Tax)?

-'Pajak Final' is a type of tax that is deducted and paid immediately at the time of receiving income. Once paid, the tax obligation is considered fully settled, and there is no further requirement to report it in the annual tax return.

Can you give an example of income that is subject to final tax?

-Examples of income subject to final tax include interest from deposits, income from the sale of stocks, rental income, and income from certain services like construction or shipping businesses.

What is the difference between final and non-final tax regarding reporting in the annual tax return?

-For final tax, the income is not reported again in the annual tax return, as the tax has already been settled. In contrast, non-final tax income must be included in the annual tax return for further tax calculation.

What happens when a taxpayer receives income subject to 'Pajak Non-Final' (Non-Final Tax)?

-When a taxpayer receives non-final tax income, they need to include it in their annual tax return and calculate the total tax due for the year. The tax is not immediately deducted, and it is settled at the end of the tax year.

How does 'Pajak Non-Final' affect the calculation of taxes?

-Pajak non-final requires taxpayers to report the income and calculate the tax due at the end of the year. This involves combining the non-final income with other taxable income for the year.

What is the role of 'bukti potong' in 'Pajak Final'?

-In the case of Pajak Final, the 'bukti potong' (tax slip) cannot be used as a tax credit in the annual tax return. The tax is fully settled at the time the income is received.

Can 'bukti potong' from 'Pajak Non-Final' be used in the annual tax return?

-Yes, the 'bukti potong' from Pajak Non-Final can be used as a tax credit in the taxpayer's annual tax return, reducing the total amount of tax payable.

How are expenses related to generating income treated differently between 'Pajak Final' and 'Pajak Non-Final'?

-For Pajak Final, expenses related to earning and maintaining the income cannot be deducted from the taxable income. However, for Pajak Non-Final, these expenses can be deducted when calculating the total taxable income.

Can you explain the example involving Mr. Ahmad's rental income and tour guide job?

-Mr. Ahmad earns rental income, which is subject to Pajak Final, meaning the tax is deducted and paid immediately. He does not need to report this income again in his annual tax return. However, his salary as a tour guide is subject to Pajak Non-Final, meaning it must be reported and included in the annual tax return for further tax calculations.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

PPH Orang Pribadi (Update 2023) - 2. Objek Pajak

PPh Orang Pribadi (Update 2023) - 5. Kredit Pajak

Cara Menghitung Pajak Penghasilan (PPh) Badan Perusahaan Tahun Pajak 2023

[PART 1- Watax] Pajak Penghasilan (PPh) Pasal 4 Ayat 2| Tax Center UIN Jakarta

Sesuai PMK 168/2023 Berlaku Januari - Cara Hitung PPH 21 Bukan Pegawai

Belajar Pajak untuk UMKM (PPh Final/PP23 2018)

5.0 / 5 (0 votes)