Sesuai PMK 168/2023 Berlaku Januari - Cara Hitung PPH 21 Bukan Pegawai

Summary

TLDRThis video explains the updated method for calculating PPh 21 (income tax) for non-employees in Indonesia, effective from January 2024. The changes simplify the process by focusing solely on the gross income, which is multiplied by 50% to determine the taxable amount (DPP). The script highlights that factors like NPWP and continuity of work are no longer considered. It provides clear examples and explains the responsibilities of both employers and non-employees in terms of tax deductions and reporting. This new system aims to streamline tax calculations and minimize errors.

Takeaways

- 😀 The calculation of PPh 21 for non-employees has changed starting January 2024, as per PP No. 58 of 2023 and PMK No. 168 of 2023.

- 😀 For non-employees, the main factor in the new calculation is the gross income, which is multiplied by 50% to determine the taxable income (DPP).

- 😀 Unlike previous methods, there is no need to check if the non-employee has an NPWP (Taxpayer Identification Number) or if the employment is continuous or not.

- 😀 The new method simplifies the process, eliminating complex checks for NPWP and work continuity.

- 😀 The PPh 21 tax rates remain the same as before, ranging from 5% for income up to Rp 50 million.

- 😀 Non-employees can include individuals providing services like technicians, freelancers, or other independent workers without fixed contracts.

- 😀 The DPP is calculated by multiplying the gross income by 50%, which is a significant change from previous practices that involved multiple calculations.

- 😀 A practical example shows how a service worker earning Rp 7 million in November 2024 would have their DPP calculated as Rp 3.5 million, with a tax due of Rp 175,000 at a 5% rate.

- 😀 The payer (employer or company) is responsible for withholding the PPh 21 from the non-employee's payment and providing a withholding certificate.

- 😀 The non-employee must report the income and the tax withheld in their annual tax return (SPT) for the relevant year, claiming the withholding as a tax credit.

Q & A

What is the main topic discussed in the video?

-The main topic of the video is the calculation of PPh 21 (Income Tax Article 21) for non-employees in Indonesia, particularly in light of recent changes starting January 2024.

What significant change occurred in the calculation of PPh 21 starting January 2024?

-Starting January 2024, the calculation for PPh 21 for non-employees was simplified. Now, the only factor considered is the gross income, which is multiplied by 50% to determine the taxable income (DPP), regardless of whether the person has a tax ID (NPWP) or whether the work is continuous.

How is the taxable income (DPP) calculated for non-employees under the new rules?

-The taxable income (DPP) is calculated by multiplying the gross income by 50%. For example, if a non-employee receives a gross income of 10 million IDR, the DPP would be 5 million IDR (50% of 10 million).

What are the applicable tax rates for PPh 21 under the new regulations?

-The tax rates for PPh 21 remain the same as previous years. For example, the rate could start at 5% for taxable income up to a certain threshold, as outlined in Article 17 of the relevant tax laws.

Do the new rules require employers to check if a non-employee has an NPWP?

-No, under the new rules, employers no longer need to check if a non-employee has an NPWP. The calculation only focuses on the gross income and applies the 50% reduction directly.

What is the significance of PP No. 58 of 2023 and PMK No. 168 of 2023 in the calculation of PPh 21?

-PP No. 58 of 2023 and PMK No. 168 of 2023 provide the legal basis for the updated method of calculating PPh 21 for non-employees, establishing the new guidelines and procedures for tax calculation and withholding.

What happens if a non-employee performs work for only one month?

-If a non-employee performs work for only one month, the same rule applies: their gross income is multiplied by 50%, and the tax is calculated based on the resulting DPP using the applicable tax rates.

What is meant by 'non-employee' in the context of PPh 21?

-A non-employee refers to an individual who is not a permanent or temporary employee, such as freelancers or independent contractors, who perform services based on agreements without a formal employment contract.

What should an employer do after withholding PPh 21 from a non-employee?

-After withholding PPh 21, the employer must issue a tax withholding certificate (bukti potong) to the non-employee. This certificate is used for the non-employee to report their income in their annual tax return (SPT).

How does the PPh 21 withholding impact the non-employee's annual tax return?

-The PPh 21 withheld by the employer serves as a tax credit in the non-employee's annual tax return. The non-employee can offset the withheld tax from their total annual tax liability when filing their SPT.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Menghitung Pajak Penghasilan PPh 21 terbaru tahun 2023 #pph21 #pajakpenghasilan #pajak

Tutorial Pengisian e-SPT PPh Pasal 21/26

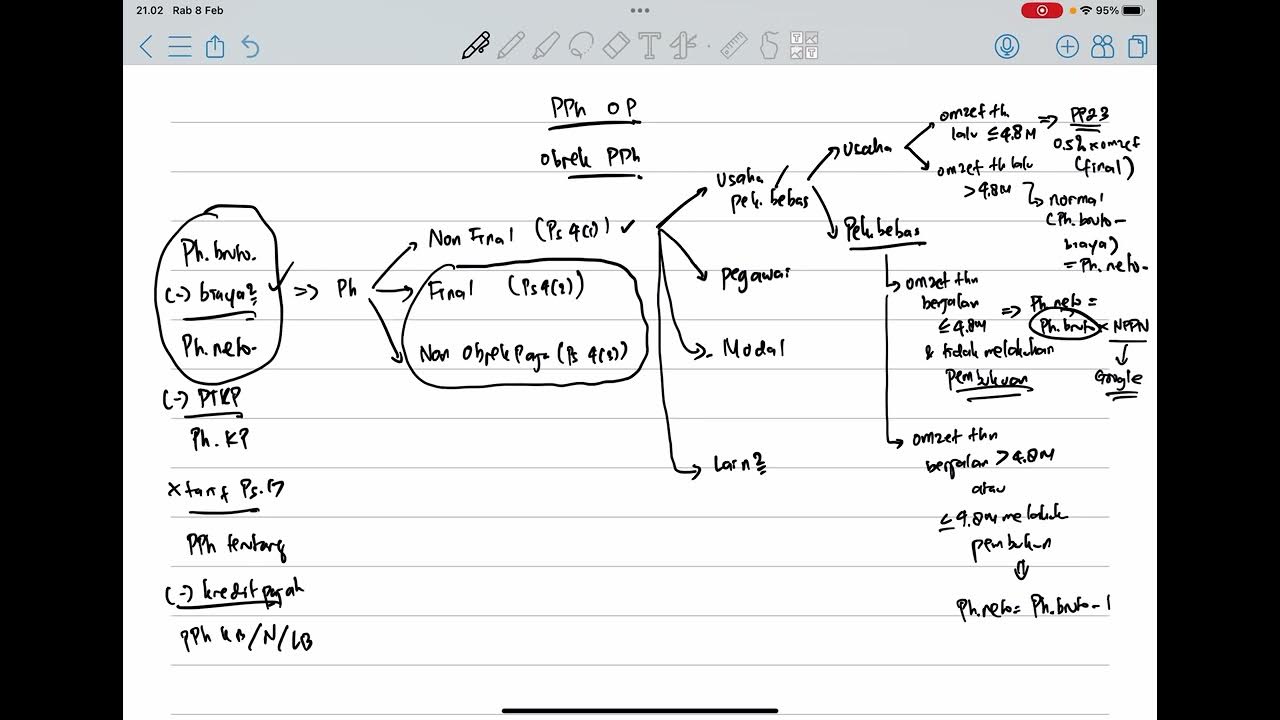

PPh Orang Pribadi (Update 2023) - 5. Kredit Pajak

PART 10 | TUTORIAL E-BUPOT 21/26 | Perbedaan Perhitungan PPh Pasal 21 Nett, Gross, dan Gross Up

PPH Orang Pribadi (Update 2023) - 2. Objek Pajak

Menghitung Pajak Penghasilan Pasal 21 || Materi Ekonomi Kelas XI

5.0 / 5 (0 votes)