How Documents Against Payment works in International Trade

Summary

TLDRThis video explains the Documentary Collection method, specifically Documents Against Payment (DP), a payment method used when an exporter and importer don't have an established relationship. The exporter ships the goods, prepares the necessary documents, and sends them to their bank. The bank collects payment from the importer on behalf of the exporter. Once payment is made, the documents are released, allowing the importer to clear the goods from the port. This transaction is governed by the Uniform Rules for Collection (URC 522), ensuring both parties are protected during the process.

Takeaways

- 😀 The Documentary Collection Method is a payment system used when the importer and exporter don't trust each other and require a bank’s assistance.

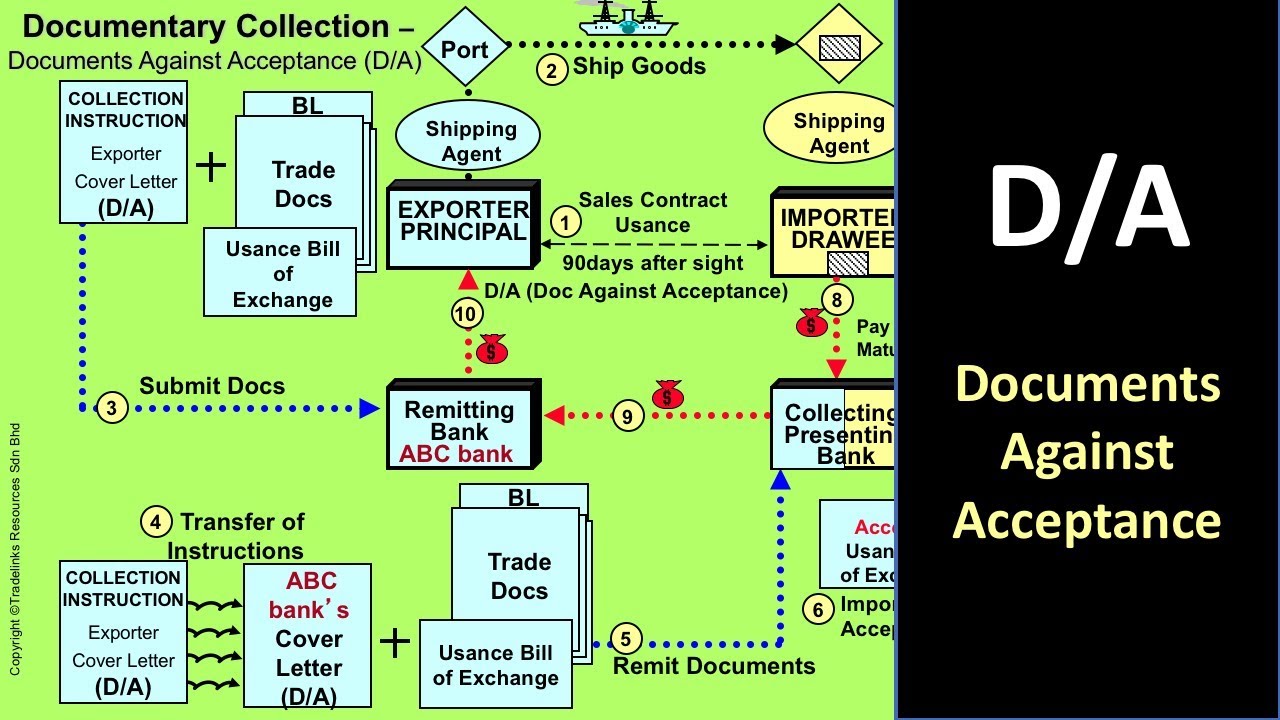

- 😀 This method is divided into two categories: DP (Documents Against Payment) for sight transactions and DA (Documents Against Acceptance) for usance transactions.

- 😀 In the DP method, the exporter ships goods and prepares trade documents, including the bill of lading and sight bill of exchange.

- 😀 The exporter sends the trade documents and collection instructions to their bank (the remitting bank), asking it to collect payment from the importer.

- 😀 The remitting bank forwards the documents to the collecting bank (the importer’s bank), acting as an intermediary between the exporter and importer.

- 😀 The collecting bank informs the importer that payment is required to receive the documents needed to clear the goods from the port.

- 😀 Upon receiving payment from the importer, the collecting bank releases the trade documents to the importer.

- 😀 After the collecting bank receives payment, it remits the funds to the remitting bank, which credits the exporter's account.

- 😀 With the documents in hand, the importer can clear the goods from the port and complete the transaction.

- 😀 The entire transaction is governed by the Uniform Rules for Collections (URC 522), published by the International Chamber of Commerce (ICC).

- 😀 The documentary collection method ensures that the exporter gets paid before the goods are handed over, while the importer only receives goods after payment.

Q & A

What is the documentary collection method (DP)?

-The documentary collection method (DP) is a trade finance process where the exporter ships goods to the importer, but the documents required to claim the goods are only released after the importer makes payment to the collecting bank.

Why is the documentary collection method used in international trade?

-The documentary collection method is used when the exporter and importer don't have a trusting relationship. It provides a secure payment method through banks, reducing the risk for both parties in the transaction.

What are the two types of documentary collection methods?

-The two types of documentary collection methods are Documents Against Payment (DP) and Documents Against Acceptance (DA). DP requires payment upfront, while DA allows the importer to pay at a later date.

What is the role of the exporter in the DP method?

-The exporter, also known as the principal, prepares the trade documents, including the bill of lading and site bill of exchange, and sends them to their bank with collection instructions to facilitate payment collection from the importer.

What is the role of the remitting bank in the DP process?

-The remitting bank is the exporter's bank that receives the trade documents from the exporter, prepares the collection instructions, and forwards the documents to the collecting bank to facilitate the payment collection from the importer.

How does the collecting bank function in the DP method?

-The collecting bank receives the trade documents from the remitting bank and informs the importer of the need to make payment. Once the importer pays, the collecting bank releases the documents to the importer and sends the payment to the remitting bank.

What happens after the collecting bank receives payment from the importer?

-Once the collecting bank receives payment from the importer, it releases the trade documents to the importer and remits the payment to the remitting bank, which then credits the exporter's account.

How does the importer use the trade documents to claim the goods?

-The importer uses the trade documents, which are released upon payment, to clear the goods from the port and complete the transaction.

What is URC 522, and how does it relate to the documentary collection method?

-URC 522 refers to the Uniform Rules for Collections, a set of rules published by the International Chamber of Commerce that govern documentary collection transactions. It ensures the process is standardized and legally recognized across countries.

What is the key difference between Documents Against Payment (DP) and Documents Against Acceptance (DA)?

-The key difference is that DP requires the importer to pay immediately to receive the documents, while DA allows the importer to make payment at a later date, typically after a set period.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

How Documents Against Acceptance works in International Trade

Methods of Payment in International Trade: Documentary Collections

Methods of Payment in International Trade for Export & Import (2020)

5 Payment Methods for International Trade

5 Payment Methods in International Trade Upload

Criterios para elegir un medio de pago

5.0 / 5 (0 votes)