C 1 BOND YTM & YTC

Summary

TLDRThis video tutorial explains how to calculate bond yields, including yield to maturity (YTM) and yield to call (YTC), using both TI Business Analysts 2 (TIBA2) and Excel. The script covers bond valuation for different bond types, including callable, non-callable, annual, and semi-annual payers. It explains how to adjust bond functions for various scenarios, such as solving for YTM and YTC, and highlights the necessary changes for semi-annual and callable bonds. The tutorial also provides step-by-step examples and a bond matrix to reinforce the concepts.

Takeaways

- 😀 Bond value is calculated by summing the present value of coupon payments and the face value paid at maturity.

- 😀 In bond calculations, 'N' represents the number of periods, 'I/Y' is the yield to maturity (YTM), 'PV' is the current bond price (negative value), and 'Payment' is the periodic coupon payment (positive value).

- 😀 TIBA2 and Excel both have dedicated bond functions, including the bond worksheet in TIBA2 and the RATE and PV functions in Excel.

- 😀 Solving for YTM requires entering known values like N, coupon payment, and face value in both TIBA2 and Excel, and then solving for I/Y or using the RATE function.

- 😀 Yield to maturity (YTM) is calculated when solving for the bond price, which is an observable value in the market.

- 😀 Callable bonds involve adjusting the formula for yield to maturity (YTM) to reflect the first call date and call price, including any call premium.

- 😀 Semi-annual bonds require adjustments: N is multiplied by 2 (number of periods), the coupon payment is halved, and the yield to maturity (YTM) result must be doubled.

- 😀 To solve for yield to call (YTC), the same approach as YTM is used but with N reflecting the number of periods to the first call date and FV as the call price.

- 😀 The 'academic method' simplifies bond calculations by using period counts rather than actual dates for settlement and redemption.

- 😀 When calculating for semi-annual callable bonds, adjustments include doubling the number of periods (N), halving the coupon payment, and using the call price for FV.

- 😀 A bond matrix helps recap the necessary adjustments for different bond types (annual, semi-annual, callable, non-callable) to aid in understanding when and how to apply each formula.

Q & A

What is the basic bond valuation formula for a non-callable annual payer bond?

-The basic bond valuation formula for a non-callable annual payer bond is the sum of the present value of the coupon payments (annuity) and the present value of the face value to be paid at maturity. The formula includes N (number of periods to maturity), I/Y (yield to maturity or current market rate), PV (current price of the bond), Payment (periodic coupon payment), and Face Value (the face value of the bond to be paid at maturity).

How can the price of a bond be determined using a TI Business Analysts 2 (TIBA2) calculator or Excel?

-In the TI Business Analysts 2 (TIBA2) calculator, the price of a bond can be calculated by entering values for N (number of periods), I/Y (yield to maturity), the coupon payment, and the face value, then solving for PV. In Excel, the PV function can be used with the same values, remembering that I/Y must be entered as a decimal.

Why are bond prices typically quoted, and how does this relate to solving for the yield to maturity?

-Bond prices are typically quoted because the market often requires an understanding of the yield to maturity (YTM), which is not directly observable. To solve for YTM, the same basic method used for determining bond price is applied, but instead of solving for PV, the yield is calculated by solving for I/Y using the TI calculator or the RATE function in Excel.

What adjustments are necessary when solving for yield to call for a callable bond?

-When solving for yield to call for a callable bond, two key adjustments are made. First, N is the number of periods to the first call date. Second, the future value (FV) is set to the call price, which includes the face value plus any call premium.

How does the semi-annual bond payment structure differ from annual payments in terms of calculations?

-In a semi-annual bond payment structure, N (the number of periods) is calculated as the number of years to maturity multiplied by 2, as there are two periods per year. The payment is divided by 2, and the yield to maturity (YTM) is divided by 2 when solving for the bond price. When solving for the yield, the result needs to be multiplied by 2.

What are the changes needed to adjust the calculation for a callable semi-annual bond?

-To adjust for a callable semi-annual bond, the number of periods (N) is calculated by multiplying the years to the first call by 2. The payment is divided by 2, and the call price (FV) includes the call premium. The final yield result is obtained by doubling the semi-annual yield to get the annual yield.

What is the yield to maturity for a non-callable bond with a 6% coupon, a $950 price, and a 20-year maturity?

-For a non-callable bond with a 6% coupon, a price of $950, and a 20-year maturity, the yield to maturity (YTM) calculated using the TI calculator or Excel is 6.45%.

What are the necessary adjustments to calculate the yield to maturity for a semi-annual bond with the same details as the annual bond example?

-For a semi-annual bond with the same 6% coupon, $950 price, and 20-year maturity, the adjustments include changing N to 40 (20 years * 2), setting the payment to $30 (6% of $1,000 divided by 2), and dividing the yield to maturity by 2. The final result for YTM is doubled to get the annualized yield.

How would the calculation differ if the bond is callable at $1,030 in 5 years?

-If the bond is callable in 5 years at $1,030, for the annual payer bond, the number of periods (N) is set to 5, and the future value (FV) is the call price of $1,030. For a semi-annual bond, N is adjusted to 10 (5 years * 2), the payment remains $30, and the call price is $1,030. The final yield to call is calculated by doubling the semi-annual yield.

What is the bond matrix, and how does it help with bond valuation calculations?

-The bond matrix is a summary that recaps the bond valuation concepts and adjustments for semi-annual and callable bonds. It helps clarify when and how to make adjustments for bond calculations, such as changing the number of periods, adjusting for call dates, and modifying the coupon payments for semi-annual bonds.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

Yield to Maturity & Yield to Call - VALUASI OBLIGASI Part 2

Video (12) OBLIGASI Oleh: Nataria dan Angga Naga Sastra

9.3 Limiting Reactants and Percentage Yield

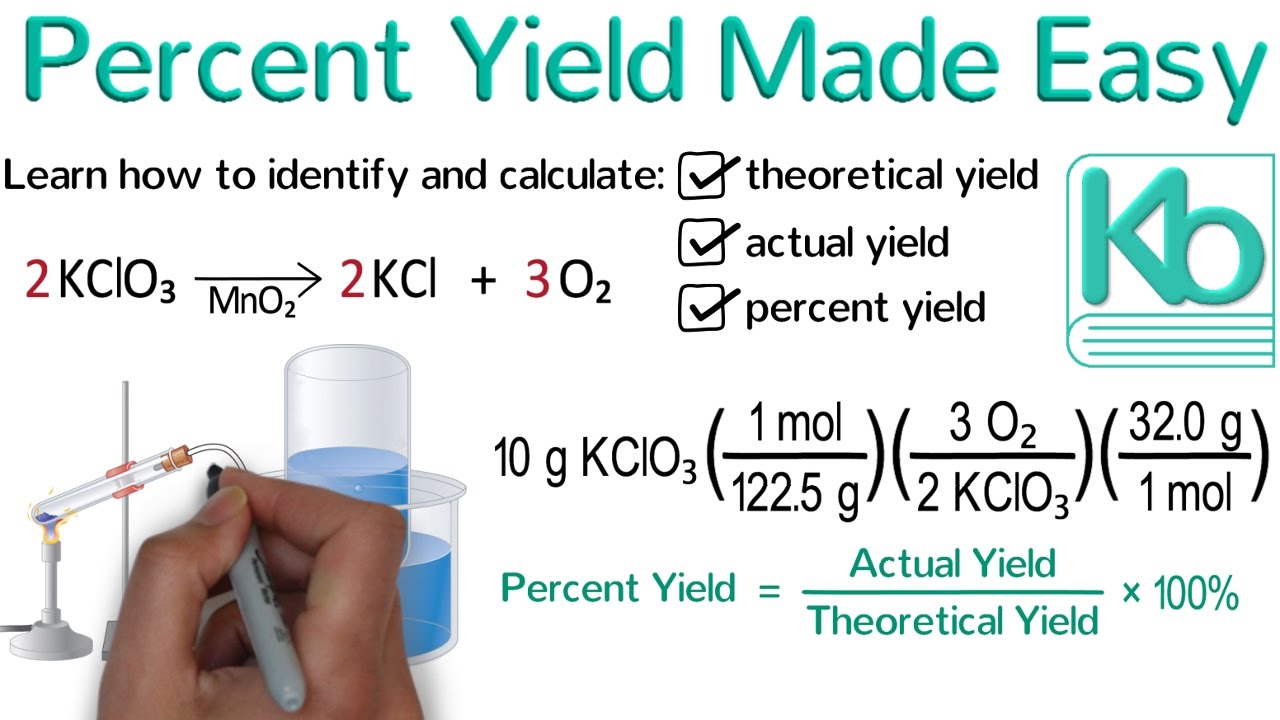

Percent Yield Made Easy: Stoichiometry Tutorial Part 4

How to Calculate Percent Yield

Bond Prices And How They Are Related To Yield to Maturity (YTM)

5.0 / 5 (0 votes)