Basic Accounting | Accounting Cycle Step 8. Closing Entries are Journalized and Posted (Part 1)

Summary

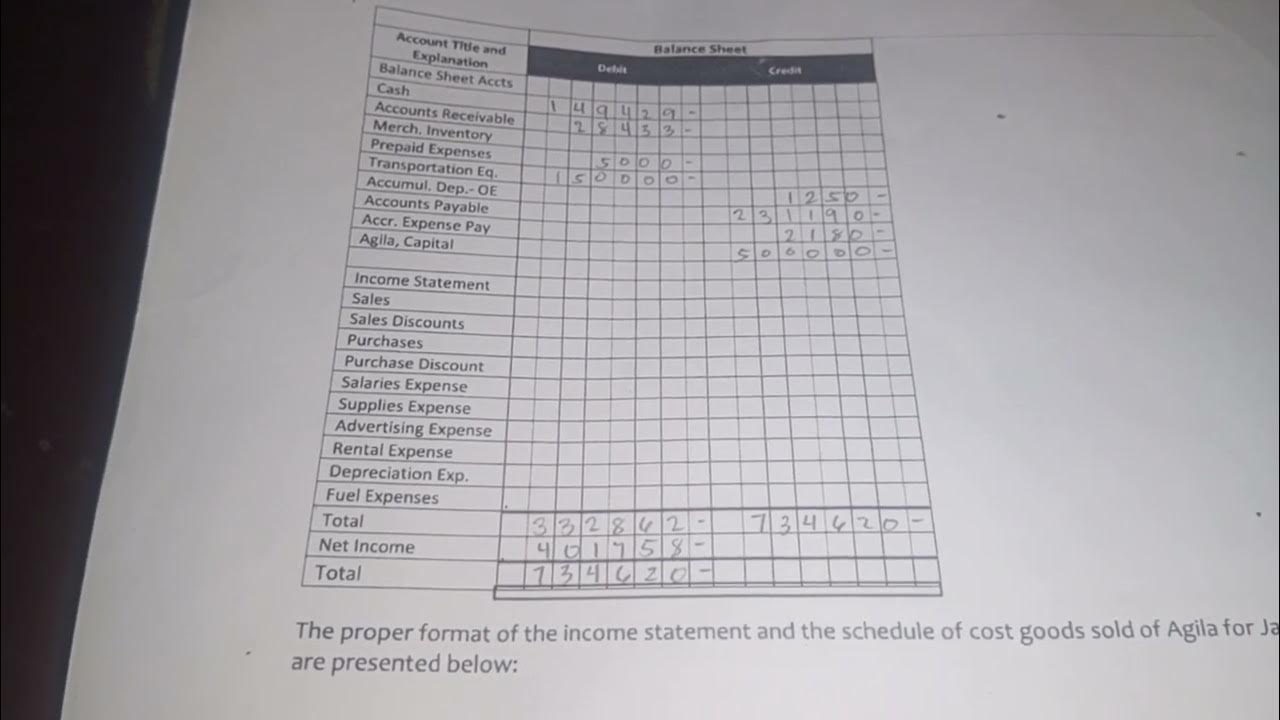

TLDRThis video explains the process of closing journal entries in the accounting cycle. It covers how temporary accounts—such as revenue, expense, and withdrawal accounts—are closed at the end of an accounting period. These balances are transferred to permanent accounts like the capital account. Key steps include closing revenue accounts to the income summary, transferring the income summary to the capital account, and closing withdrawal accounts. The video emphasizes the importance of ensuring accurate financial records and explains how the closing process prepares the business for the new period.

Takeaways

- 😀 Temporary accounts, including income, expense, and withdrawal accounts, are closed at the end of the accounting period to transfer their balances to the capital account.

- 😀 Closing journal entries ensure that the balances of temporary accounts are reset to zero at the end of the period.

- 😀 The process of closing involves transferring balances from income and expense accounts to the Income Summary account.

- 😀 The Income Summary account serves as an intermediary to transfer net income or loss to the capital account.

- 😀 To close income accounts, a journal entry debits each income account and credits the Income Summary account.

- 😀 Expense accounts are closed by debiting the Income Summary account and crediting each expense account.

- 😀 The net balance in the Income Summary account (representing net income or loss) is transferred to the capital account.

- 😀 Withdrawal accounts are also closed by debiting the capital account and crediting the withdrawal account.

- 😀 Compound journal entries can be used to close multiple income or expense accounts in a single entry, making the process more efficient.

- 😀 At the end of the closing process, all temporary accounts will have a zero balance, and the updated capital account will reflect net income or losses and withdrawals.

- 😀 The closing process is crucial for preparing accurate financial statements, such as the income statement, for the next accounting period.

Q & A

What is the purpose of closing journal entries in the accounting cycle?

-The purpose of closing journal entries is to reset the balances of temporary accounts, such as income, expense, and withdrawal accounts, to zero. These balances are transferred to the capital account at the end of the accounting period.

What are temporary accounts in accounting?

-Temporary accounts are those that accumulate balances over a single accounting period, including income accounts, expense accounts, and withdrawal accounts. They are closed at the end of the period to prepare for the next one.

Which accounts are involved in the closing process?

-The accounts involved in the closing process are income accounts, expense accounts, and withdrawal accounts. These are transferred to the capital account through closing journal entries.

What happens to income accounts at the end of the accounting period?

-At the end of the accounting period, income accounts are closed by transferring their balances to the income summary account. This helps reset their balances to zero for the next period.

How is the closing entry for an income account recorded?

-The closing entry for an income account is recorded by debiting the income account and crediting the income summary account. For example, a revenue balance of 67,700 pesos would result in a debit to the income account and a credit to the income summary.

What is the role of the income summary account in the closing process?

-The income summary account acts as a temporary account used to accumulate the net income or loss for the period. After closing income and expense accounts into the income summary, its balance is transferred to the capital account.

How are expense accounts closed during the closing process?

-Expense accounts are closed by debiting the income summary account and crediting the respective expense accounts. For example, a salaries expense of 15,600 pesos would involve a debit to income summary and a credit to the salaries expense account.

What is the final step in the closing process?

-The final step in the closing process is transferring the balance in the income summary account to the capital account. This step reflects the net income or loss for the period in the capital account.

What are compound entries in the context of closing journal entries?

-Compound entries are journal entries that involve multiple debits or credits in a single entry. In the context of closing, compound entries may be used to close all income or expense accounts at once.

What is the difference between temporary and permanent accounts?

-Temporary accounts, such as income, expense, and withdrawal accounts, are closed at the end of the period, while permanent accounts, like the capital account, carry their balances forward into the next period and are not closed.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

Pengertian, Fungsi, dan Cara Membuat Jurnal Penutup | Ekonomi Kelas 12 - EDURAYA MENGAJAR

Neng Ida Soniawati–Ekonomi XII-SMAN 1 Babakan Madang-Jurnal Penutup & Pembalik – Nov2022#pgtkjabar

Pengantar Akuntansi - Ayat Jurnal Penutup

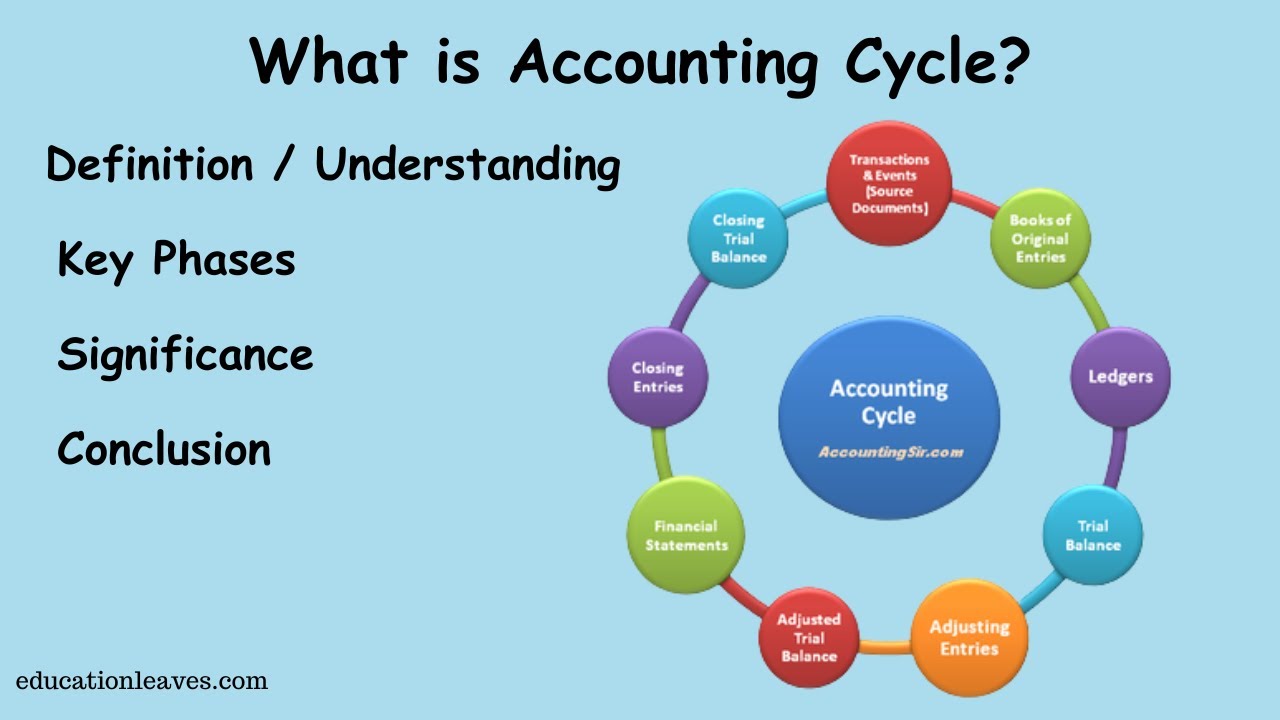

What is Accounting cycle? | Key phase, Significance of Accounting cycle

November 15, 2024

GENERAL LEDGER: Visual Guide to Posting Journals

5.0 / 5 (0 votes)