Pengantar Akuntansi - Ayat Jurnal Penutup

Summary

TLDRIn this video, the lecturer explains the process of closing journal entries in accounting, focusing on clearing temporary accounts at the end of the fiscal year. The steps include transferring revenue and expenses to the income summary account, and then moving the net result (profit or loss) to the capital account. The final part discusses adjusting owner’s equity (PR), preparing the accounts for the new period. This process ensures the proper balance sheet and allows the financial records to start fresh for the next accounting cycle.

Takeaways

- 😀 **Understanding Permanent and Temporary Accounts**: Permanent accounts (e.g., cash, accounts receivable, equity) carry over from year to year, while temporary accounts (e.g., revenues, expenses, dividends) reset at the end of each period.

- 😀 **The Importance of Closing Entries**: Closing entries (jurnal penutup) are necessary to transfer the balances of temporary accounts to permanent accounts at the end of an accounting period.

- 😀 **The Role of 'Ikhtisar Laba Rugi'**: The 'Ikhtisar Laba Rugi' (Income Summary) account temporarily holds the balances of revenues and expenses before they are transferred to the owner’s equity account.

- 😀 **Resetting Temporary Account Balances**: To start the new period with zero balances, the income (revenue) and expenses are closed by transferring them into the 'Ikhtisar Laba Rugi' account.

- 😀 **Impact of Net Income on Owner's Equity**: The net income (or loss) calculated through the closing entries is transferred to the owner’s equity (modal) account, increasing it in the case of profit or decreasing it if there is a loss.

- 😀 **Revenue and Expense Balances**: Revenues are credited to 'Ikhtisar Laba Rugi' and expenses are debited in the process of closing accounts. This ensures the balances are reset to zero for the new period.

- 😀 **The Necessity of Periodic Accounting Adjustments**: At the end of each period, it’s essential to clear temporary accounts to reflect only the current year's results in the financial statements.

- 😀 **Impact of Retained Earnings (PR)**: Retained earnings (PR) affect the equity section and must be adjusted annually by closing out the temporary accounts.

- 😀 **Understanding the Role of Closing Process in Financial Reporting**: The closing process, which includes transferring balances to the 'Ikhtisar Laba Rugi' and then to the equity account, ensures accurate reporting and provides a clean slate for the next accounting period.

- 😀 **Final Step - Preparing the Post-Closing Trial Balance**: After closing entries, a post-closing trial balance is prepared to ensure that the accounting records are accurate, with zero balances in all temporary accounts.

Q & A

What is the purpose of closing journal entries in accounting?

-Closing journal entries are made at the end of the accounting period to transfer the balances of temporary accounts (revenues, expenses, and owner's equity) to permanent accounts. This process ensures that the temporary accounts are reset to zero for the new accounting period.

What are permanent accounts in accounting?

-Permanent accounts are accounts that carry their balances over from one period to the next. These include assets, liabilities, and owner's equity accounts. For example, cash, accounts receivable, and capital accounts are permanent accounts.

What are temporary accounts and how are they different from permanent accounts?

-Temporary accounts include revenue, expense, and drawings accounts, which only accumulate balances for the current accounting period. At the end of the period, the balances in these accounts are transferred to permanent accounts, and their balances are reset to zero.

Why is it necessary to transfer balances from temporary accounts to permanent accounts?

-Transferring balances from temporary accounts to permanent accounts ensures that the temporary accounts are reset to zero for the new accounting period. This allows the company to start fresh each period, accurately recording new revenue and expenses.

What is the role of the 'Ikhtisar Laba Rugi' account in the closing process?

-The 'Ikhtisar Laba Rugi' account, also known as the income summary account, is used to collect the balances of revenue and expense accounts during the closing process. After revenues and expenses are transferred to this account, the net income or net loss is then transferred to the capital account.

What happens to the income summary account after the closing process?

-After the closing process, the income summary account should have a zero balance. The balance (representing net income or net loss) is transferred to the capital account, and the income summary account is cleared.

What is the significance of the final transfer from the income summary account to the capital account?

-The final transfer from the income summary account to the capital account reflects the net income or net loss for the period. A net income increases the capital account, while a net loss decreases it, accurately reflecting the financial changes in the owner's equity.

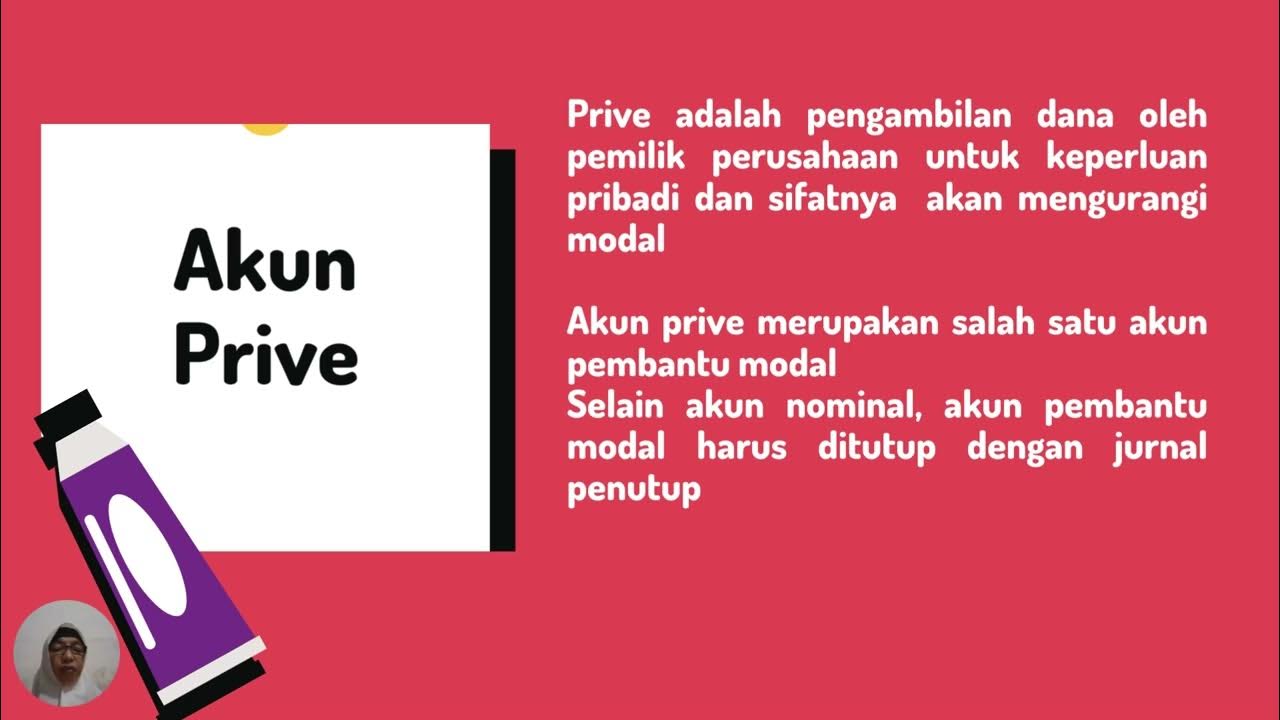

How do you handle withdrawals (PR) in the closing process?

-Withdrawals (PR) are treated as a decrease in the capital account. At the end of the period, the PR account is cleared by transferring its balance to the capital account. This reduces the owner’s equity as withdrawals represent money taken out of the business.

Can temporary accounts carry their balances into the next period?

-No, temporary accounts cannot carry their balances into the next period. They must be closed at the end of the period, with their balances transferred to permanent accounts so that they start the new period with a zero balance.

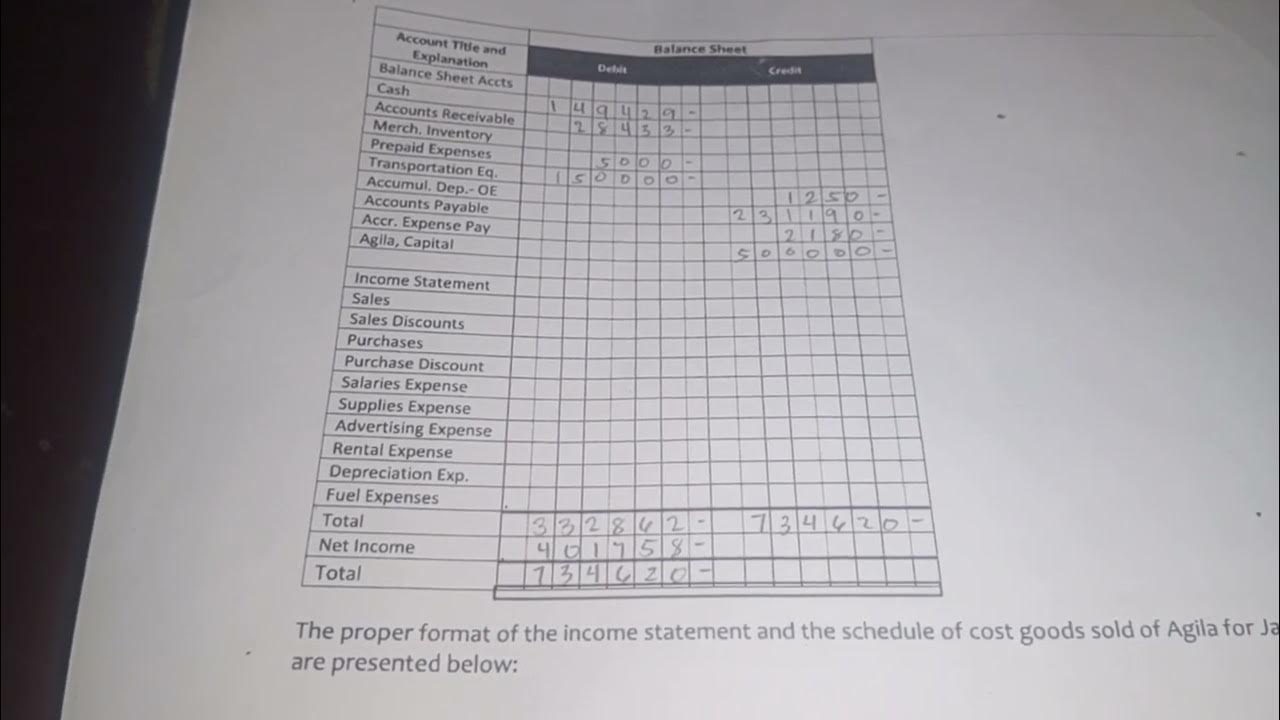

What is a post-closing trial balance and why is it important?

-A post-closing trial balance is prepared after the closing journal entries have been made. It ensures that all temporary accounts are properly closed and that the permanent accounts have the correct balances, which are used to start the new accounting period.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

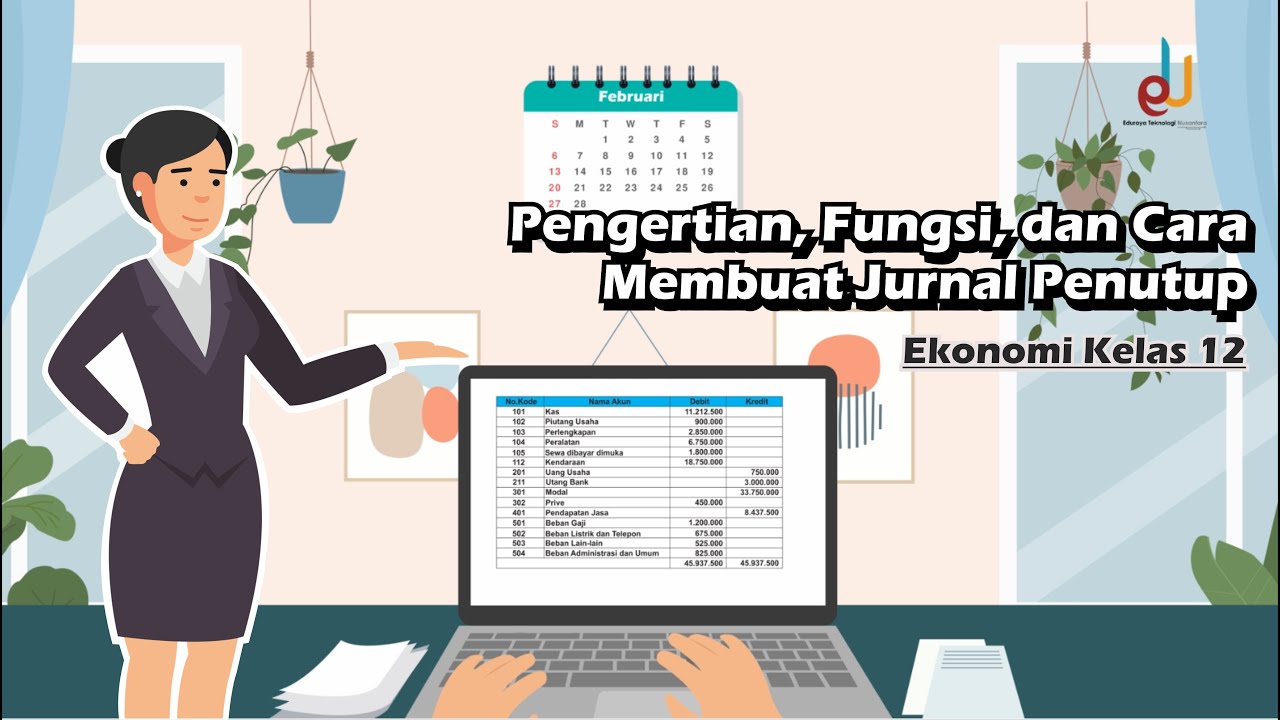

Pengertian, Fungsi, dan Cara Membuat Jurnal Penutup | Ekonomi Kelas 12 - EDURAYA MENGAJAR

Basic Accounting | Accounting Cycle Step 8. Closing Entries are Journalized and Posted (Part 1)

Jurnal Penutup & Jurnal Pembalik | Pengantar Akuntansi

Neng Ida Soniawati–Ekonomi XII-SMAN 1 Babakan Madang-Jurnal Penutup & Pembalik – Nov2022#pgtkjabar

CLOSING ENTRIES: Everything You Need To Know

November 15, 2024

5.0 / 5 (0 votes)