Manajemen Strategi 09 Strategi Multi Bisnis

Summary

TLDRThis educational video explores strategic management within multi-business companies. It introduces key concepts such as portfolio analysis, resource allocation, and the BCG matrix, which helps businesses decide where to invest. The video explains how managers use strategies like synergy, building core competencies, and business acquisitions to maintain competitive advantage. It covers the stages of business growth, from stars to dogs, and provides insight into the importance of core competencies for companies like Toyota, Apple, and Walmart. Finally, the video discusses the role of holding companies in managing multiple subsidiaries, with an example of Telkom Indonesia's transformation into a digital telecom company.

Takeaways

- 😀 Multi-business strategies focus on managing business portfolios to allocate resources, make strategic decisions, and achieve efficiency through synergies between units.

- 😀 The BCG Matrix is a strategic tool used to assess business units based on market share and growth rate, categorizing them into Stars, Cash Cows, Dogs, and Question Marks.

- 😀 'Stars' represent businesses with high growth and market share, requiring strategies to maintain their position and support further growth.

- 😀 'Cash Cows' are profitable businesses with low growth; they generate substantial cash flow that can be used to support other business units.

- 😀 'Dogs' are businesses with low market share and growth, and the strategy is usually to divest or eliminate them.

- 😀 'Question Marks' are emerging businesses with high growth potential but low market share, requiring investment to grow and become Stars.

- 😀 Despite its usefulness, the BCG Matrix has limitations, including oversimplification and the inability to account for market complexity and internal synergies.

- 😀 Core competencies are unique capabilities that give a company a competitive advantage and are difficult for competitors to replicate.

- 😀 Examples of core competencies include Toyota’s lean production system, Apple’s innovative technology, and Walmart’s efficient supply chain management.

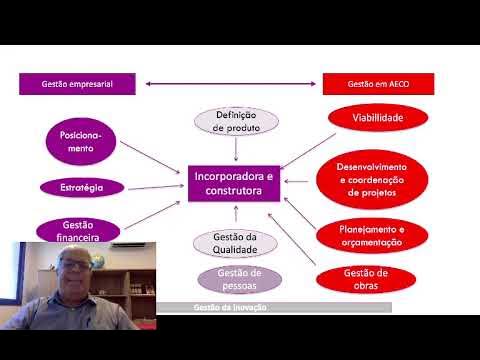

- 😀 A holding company oversees multiple subsidiaries and can either focus on investment or have operational control over the businesses it owns.

- 😀 Telkom Indonesia has been transforming into a digital telecommunications company, enhancing customer experience, efficiency, and agility through its subsidiaries like Telkomsel.

Q & A

What is the primary purpose of the BCG Matrix?

-The BCG Matrix is used to help companies make strategic decisions regarding investments, by analyzing their business units or products based on market growth and relative market share. It categorizes them into four quadrants: Stars, Cash Cows, Dogs, and Question Marks.

What strategies are recommended for businesses in the 'Stars' quadrant of the BCG Matrix?

-For businesses in the 'Stars' quadrant, the recommended strategy is to 'hold' the business in that position by maintaining a strong focus and investing in promotions to sustain growth, as competition in this market is typically fierce.

How does a business in the 'Cash Cow' quadrant differ from those in the 'Stars' quadrant?

-A 'Cash Cow' is a business with a large market share but low market growth, meaning it generates substantial cash flow with minimal investment. In contrast, 'Stars' are in high-growth markets and require substantial investment to maintain their market leadership.

What is the ideal strategy for businesses in the 'Dogs' quadrant?

-For businesses in the 'Dogs' quadrant, the best strategy is typically 'divest,' meaning the company should consider eliminating or selling off the business due to low market interest and low sales.

What does the 'Question Mark' quadrant represent in the BCG Matrix?

-The 'Question Mark' quadrant represents new products or businesses that have high market growth potential but are not yet generating significant sales. The recommended strategy for these businesses is 'build'—continuing to develop and invest in them to increase market share.

What are some limitations of the BCG Matrix when applied in real business environments?

-The BCG Matrix has limitations such as its narrow focus on only two dimensions—market growth and relative market share—and may not account for the complexities of the business environment. It also overlooks internal synergies, core competencies, and external factors affecting the business.

What is meant by 'core competencies' in a business context?

-Core competencies refer to the unique capabilities and resources that allow a company to achieve a competitive advantage. They involve integrating knowledge, skills, and behaviors that are difficult for competitors to replicate.

Why is it important for companies to focus on their core competencies?

-Focusing on core competencies enables companies to maintain a competitive edge, differentiate themselves from competitors, expand their range of innovations, and build a strong identity that is difficult for competitors to copy.

How do holding companies function in a business environment?

-Holding companies are entities that own a controlling interest in one or more subsidiary companies. They manage, coordinate, and oversee the performance of these subsidiaries, either through direct involvement in decision-making or by holding a significant portion of their shares.

What are the two types of holding companies, and how do they differ?

-The two types of holding companies are investment holding companies, which primarily own shares for investment purposes and do not interfere with subsidiary management, and operating holding companies, which are more involved in managing and overseeing the operational decisions of their subsidiaries.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级5.0 / 5 (0 votes)