Predict Price Direction Up To 80% Correctly

Summary

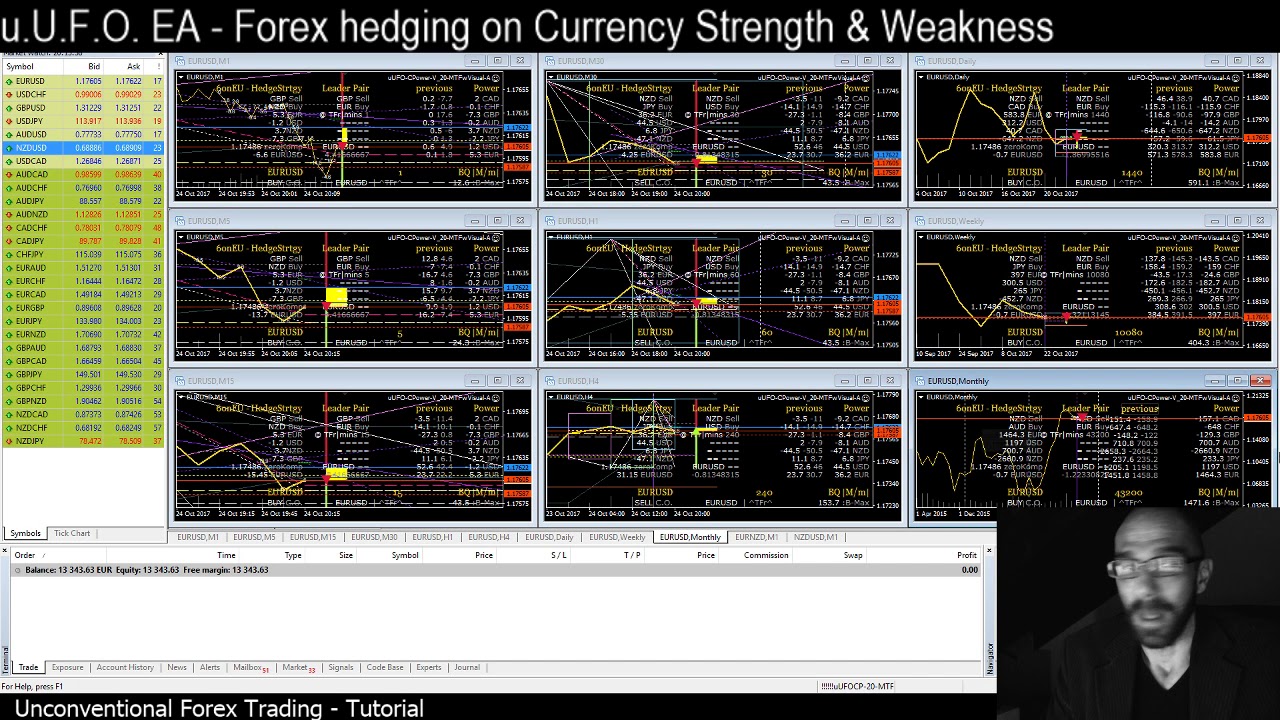

TLDRThe video discusses trading strategies in the forex market, particularly focusing on the EUR/USD currency pair. The speaker emphasizes the significance of interest rate differentials, global risk sentiment, and macroeconomic indicators in influencing currency movements. Despite rising U.S. interest rates, the EUR/USD pair shows a delayed upward trend, highlighting market complexities. The discussion also covers how traders can anticipate interest rate changes through economic data, underscoring the importance of a comprehensive understanding of market behavior. Overall, the video aims to equip traders with insights to enhance their decision-making processes.

Takeaways

- 😀 Understanding time lag is crucial, as market movements may not align immediately with economic changes, such as interest rate increases.

- 📈 Global risk sentiment significantly influences currency pairs, determining whether investors are willing to take risks.

- 💡 Carry trading relies on interest rate differentials, and understanding its weaknesses is essential for making informed decisions.

- 🔍 Multiple factors impact the forex market, and traders must recognize when their strategies might not work effectively.

- 🗓️ Observing economic data releases can provide insights into future interest rate changes, helping traders stay ahead of market movements.

- 📉 Economic indicators like productivity and debt levels are key metrics that central banks monitor when adjusting interest rates.

- 🧠 Forward-looking indicators can signal potential changes in interest rates based on economic health, such as unemployment and retail sales data.

- 🔄 Market reactions can occur before official interest rate changes, highlighting the importance of real-time economic analysis.

- 🌍 Different macroeconomic environments can alter the effectiveness of trading strategies, requiring ongoing assessment by traders.

- 📝 Traders should develop a bias based on historical trends and data, allowing them to make more strategic investment decisions.

Q & A

What is the significance of interest rate differentials in currency trading?

-Interest rate differentials are crucial because they influence currency value; higher rates tend to attract foreign capital, increasing demand for that currency.

How does time lag affect the movement of currency pairs like EUR/USD?

-Time lag refers to the delay between when economic indicators change (like interest rates) and when the market reacts. This can lead to disparities in expected versus actual currency movements.

What role does global risk sentiment play in currency trading?

-Global risk sentiment affects traders' willingness to take risks, which can greatly influence currency performance, especially in carry trading environments.

What is carry trading, and why is it important to understand its weaknesses?

-Carry trading involves profiting from the difference in interest rates between two currencies. Understanding its weaknesses, particularly in changing risk environments, is essential for making informed trading decisions.

How can economic data releases serve as forward-looking indicators for interest rates?

-Economic data, such as unemployment rates and retail sales, can signal changes in productivity and debt levels, which central banks use to decide on interest rate adjustments.

What should traders consider when using interest rates as part of their trading strategy?

-Traders should consider not only current interest rates but also expectations for future changes, the macroeconomic environment, and how these factors interact.

Why might prices move before an official interest rate change is announced?

-Prices may move in anticipation of interest rate changes due to traders reacting to economic indicators and market sentiment, which often signals future trends.

What is the impact of a declining economy on interest rates?

-In a declining economy, central banks may lower interest rates to stimulate growth, which can initially boost the economy but may lead to longer-term issues.

How can traders apply the concepts discussed in the video to their trading systems?

-Traders can use the insights on interest rate differentials, global risk sentiment, and economic indicators to form a bias and guide their trading decisions, enhancing their overall strategy.

What is meant by the term 'macroeconomic environment' in the context of trading?

-The macroeconomic environment encompasses various economic factors, including inflation, employment rates, and overall economic growth, all of which can influence currency movements and trader decisions.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级5.0 / 5 (0 votes)