2022 ICT Mentorship Episode 40

Summary

TLDRThis video focuses on effective Forex trading strategies, with an emphasis on using the economic calendar to select the right currency pairs. The educator discusses how to manage trades based on high-impact news events, like USD/CAD volatility, and how to compare pairs for correlation and SMT divergences. Key insights include focusing on one market based on economic drivers, understanding correlations between pairs like EUR/USD and GBP/USD, and using market reviews to refine decision-making. The video concludes the 2022 mentorship while offering continuous market reviews to further the learning experience.

Takeaways

- 😀 **Economic Calendar**: Use the economic calendar to focus on high-impact news events that drive volatility and influence trade decisions.

- 😀 **Risk Management**: Avoid overtrading; focus on high-probability setups rather than trying to trade every day for consistent success.

- 😀 **Focus on Liquidity Areas**: Identify key liquidity zones like old highs, old lows, and imbalances to understand price movement direction.

- 😀 **Volume Analysis**: In Forex, 'volume' refers to market activity or energy rather than actual trade volume, helping identify the market's direction.

- 😀 **Fair Value Gaps**: Look for fair value gaps in price action, which indicate imbalances and opportunities for trades.

- 😀 **Intermarket Relationships**: Understanding correlations between markets (e.g., EUR/USD vs GBP/USD) can provide insights into where to focus your trades.

- 😀 **Smart Money Technique (SMT) Divergence**: Use SMT divergences between correlated pairs to determine which market to trade based on relative strength.

- 😀 **Avoid Predicting Exact Prices**: Don’t aim to predict exact closing prices, instead focus on understanding the market's general direction from higher time frames.

- 😀 **Patience and Discipline**: Wait for the right setups and avoid impulsive trades to build a disciplined trading strategy that’s aligned with market conditions.

- 😀 **Market Symmetry**: When trading based on news events, look for correlated pairs moving in the same direction, and use divergence to determine where the best opportunity lies.

- 😀 **Quality Over Quantity**: Focus on a few high-probability setups, such as one currency pair based on the economic calendar, rather than trying to trade multiple markets.

- 😀 **Long-Term Learning**: The speaker highlights that continuous learning and market review, such as Monday-to-Friday reviews, can lead to consistent improvements in trading skills.

Q & A

What is the purpose of analyzing weekly charts in Forex trading?

-The purpose of analyzing weekly charts is to understand the long-term market direction and identify key liquidity zones. This helps traders set a broader market bias, determining whether to expect the market to move higher or lower.

How does the concept of 'liquidity' apply to Forex trading?

-In Forex trading, liquidity refers to the areas of the market where price has the potential to move towards. This is typically seen as the market targeting old highs or lows, which are considered key liquidity zones where orders may be resting.

Why is the economic calendar important for Forex traders?

-The economic calendar is important because it helps traders identify when significant news events are scheduled to release. These events can cause increased volatility in the market, and knowing when they are happening allows traders to position themselves accordingly.

What is a fair value gap in trading, and how does it impact trading decisions?

-A fair value gap refers to an imbalance in the market, where price moves too quickly in one direction and leaves behind a gap. Traders look for these gaps as they indicate areas where price may return to balance itself out. This can present potential trading opportunities.

What is the role of market structure in trading, especially on lower time frames?

-Market structure refers to the way the price moves in waves, showing patterns such as higher highs or lower lows. On lower time frames, traders use market structure to spot shifts that indicate potential reversal points or continuation patterns, helping them time their entries.

How does the concept of 'Risk-On' and 'Risk-Off' relate to currency trading?

-'Risk-On' refers to a market sentiment where investors are more willing to take risks, typically leading to a weakening of the US dollar and a rise in foreign currencies and stocks. Conversely, 'Risk-Off' indicates a more cautious market sentiment where the dollar strengthens, and risk assets like stocks and foreign currencies decline.

What are SMT (Smart Money Technique) divergences and how do they influence trading decisions?

-SMT divergences occur when two correlated pairs, like Euro Dollar and Pound Dollar, show differing price movements before a major news event. Traders use these divergences to identify which currency pair might offer a better trade opportunity, as the pairs often move in sympathy with each other.

How can economic news events influence the decision to trade a particular currency pair?

-Economic news events can have a significant impact on currency pairs by driving volatility. For instance, if the economic calendar shows high-impact news for the Euro, traders may focus on pairs like Euro Dollar or Pound Dollar, assessing them for potential trading setups based on the news.

What is the importance of not over-trading, especially for beginners in Forex?

-Over-trading can lead to unnecessary losses, especially for beginners who may not yet have a clear understanding of market conditions. It's important to wait for the right setups and avoid trading every day, focusing on high-probability trades that align with market conditions.

Why should a trader focus on a specific currency pair when there's a high-impact news event?

-Focusing on a specific currency pair during a high-impact news event allows traders to concentrate their efforts on the market with the highest expected volatility. This increases the chances of capturing significant price moves, as the news event is likely to influence that pair the most.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

How To Interprete/Trade Forex Economic Calender

How to Start Forex Trading as a BEGINNER in 2025 (Full Guide)

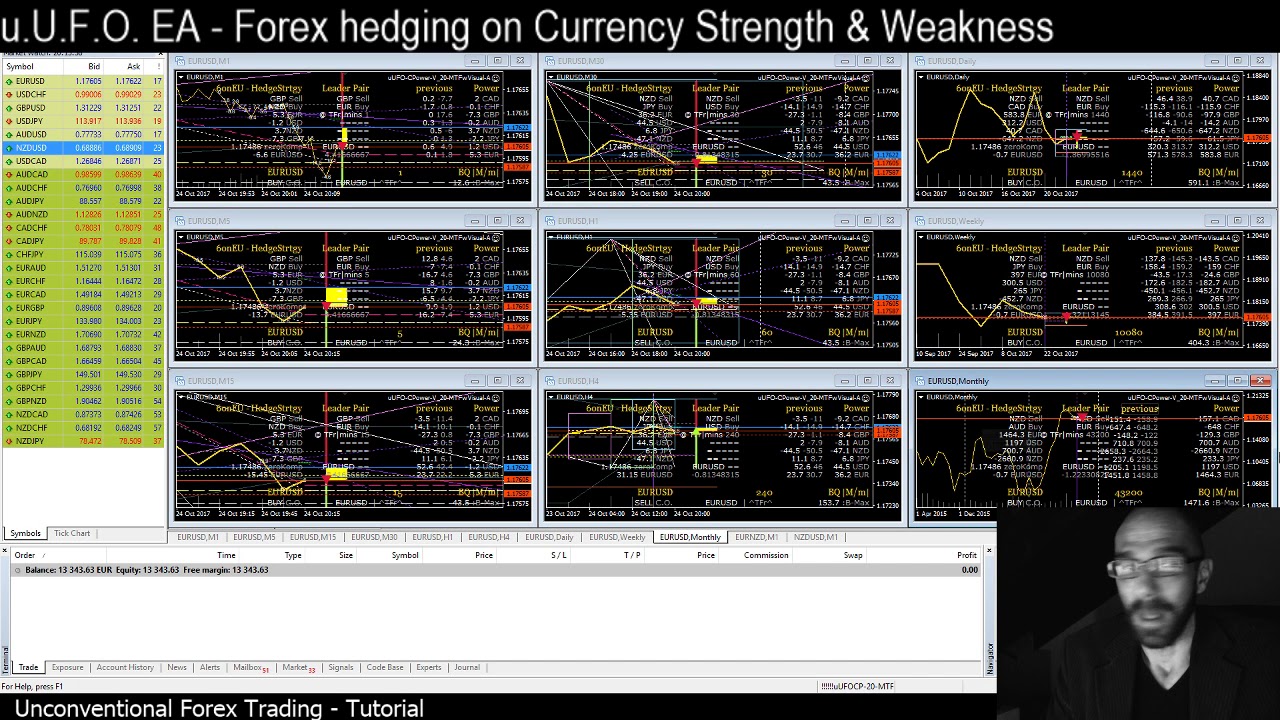

Forex math based formula application - MT4 - uUFO-EA: foreign currency hedging strategy explained.

Forex Trading for Beginners in India | What is Forex Trading | Best Forex Trading Strategy in India

How to Calculate Pips in Forex

Jam terbaik untuk trading: Trading tidak perlu 23.4 jam

5.0 / 5 (0 votes)