Petty Cash

Summary

TLDRThis video explains the management of petty cash in companies, detailing its purpose for small purchases like office supplies and snacks. It outlines the establishment of a petty cash fund through a journal entry, the custodian's role in dispensing cash and tracking receipts, and the monthly reconciliation process. If discrepancies arise, such as a cash shortage or overage, adjustments are made to the cash over and short account. The summary also emphasizes that cash, not petty cash, is credited when replenishing the fund, maintaining a cycle of fund management.

Takeaways

- 😀 Petty cash is a fund used by companies for small cash purchases, such as office supplies and meeting refreshments.

- 💰 A petty cash fund eliminates the need for multiple journal entries for small transactions, simplifying financial management.

- 📊 Companies can decide the amount for their petty cash fund, typically ranging from $50 to $1,000.

- 📝 Establishing a petty cash fund requires a journal entry that debits petty cash and credits cash.

- 🏦 The petty cash custodian is responsible for managing the fund and tracking expenses through receipts.

- 🔄 At the end of each month, the custodian reconciles the petty cash fund by comparing remaining cash with receipts.

- 💵 The replenishment journal entry includes debiting each expense and crediting cash to restore the fund to its original amount.

- ⚖️ If there is a shortage in the cash fund during reconciliation, a debit is recorded to 'Cash Over and Short.'

- ✔️ Any overage is recorded as a credit to 'Cash Over and Short' to balance discrepancies.

- 🔁 The petty cash management process is cyclical, repeating each month as employees utilize the fund.

Q & A

What is the purpose of a petty cash fund in a company?

-A petty cash fund is used for small dollar item purchases that need to be paid in cash, such as refreshments, postage, office supplies, and other miscellaneous expenses.

Why do companies prefer to have a petty cash fund?

-Companies prefer petty cash funds to eliminate multiple journal entries for small dollar amounts, simplifying accounting processes.

How does a company establish a petty cash fund?

-To establish a petty cash fund, a company makes a journal entry that debits petty cash and credits cash, effectively writing a check for the desired fund amount.

What is the role of the petty cash custodian?

-The petty cash custodian is responsible for managing the fund, tracking the money used, and collecting receipts for all expenses made from the petty cash.

How does the reconciliation process for petty cash work?

-At the end of the month, the custodian reconciles the petty cash by counting the remaining cash and reviewing the receipts. The total of the receipts and cash should match the original fund amount.

What happens if there is a cash shortage during reconciliation?

-If there is a cash shortage, the accountant must add a debit to a 'cash over and short' account to account for the discrepancy.

What is included in the journal entry for replenishing petty cash?

-The journal entry for replenishing petty cash includes debits for each expense incurred and a credit to cash, as the fund is replenished back to its original amount.

How does a company handle cash overages in petty cash?

-If there is a cash overage, it is credited to the 'cash over and short' account during the replenishment process.

What is the typical range for establishing a petty cash fund?

-Petty cash funds can range from fifty to a thousand dollars or any amount the company decides.

How often does the petty cash replenishment process occur?

-The petty cash replenishment process occurs monthly, allowing employees to continue using the fund for small purchases.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

Akuntansi Keuangan - Dana Kas Kecil Definisi, fungsi dan tujuan

ALUR PENGELOLAAN KAS KECIL PADA PERUSAHAAN

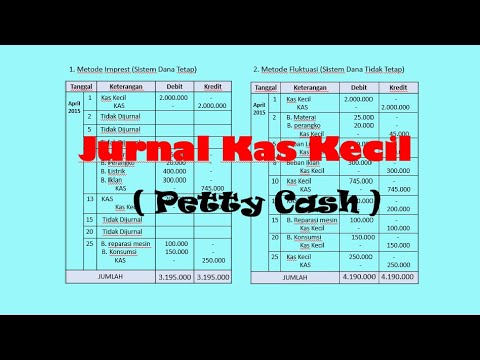

KAS KECIL METODE IMPREST DAN FLUKTUASI || Kas Kecil Sistem Dana Tetap dan Sistem Dana Tidak Tetap

PROFIL MANAJEMEN PERKANTORAN & LAYANAN BISNIS SMK AL AMANAH KAB. BANDUNG

Petty Cash 101: Penjelasan Lengkap Tentang Kas Kecil

Kas kecil Metode Imprest dan Fluktuasi

5.0 / 5 (0 votes)