ALUR PENGELOLAAN KAS KECIL PADA PERUSAHAAN

Summary

TLDRThis video explains the flow of petty cash management at PT Cahaya Agung, a trading company in the electronics sector. It outlines the three key activities: formation of petty cash, petty cash expenditures, and replenishment. Through various roles within the company, such as cash department, accounting, and petty cash holders, the video demonstrates the process of handling small, urgent expenses without going to the bank. It also highlights the importance of collaboration and transparency across departments to ensure efficient and accountable petty cash management.

Takeaways

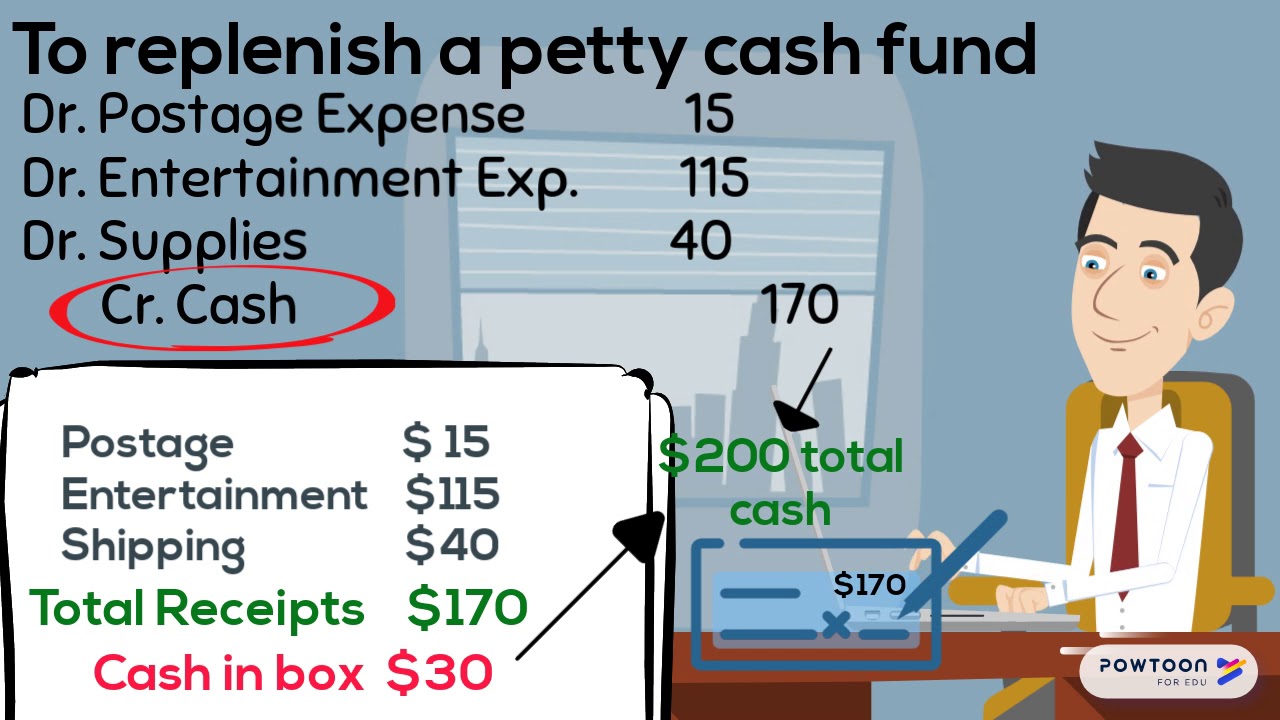

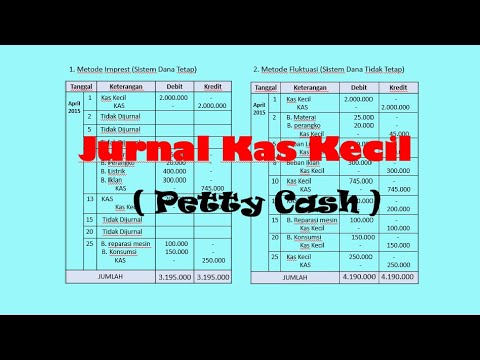

- 😀 The petty cash management process in a company includes three main activities: formation of petty cash, petty cash expenditures, and replenishment of petty cash funds.

- 😀 The formation of petty cash funds is initiated by company leadership to handle small, unexpected expenses without needing to go to the bank or cash checks.

- 😀 The cash department is responsible for issuing a check to establish the petty cash fund, with approval from the company leader and proper documentation from the accounting department.

- 😀 The accounting department records all company transactions, including the formation of petty cash, and generates proof of cash out as internal evidence to support the check issuance.

- 😀 The petty cash fund holder manages and stores petty cash, handling direct disbursements for various departmental needs as they arise.

- 😀 Departments requiring petty cash must submit an expenditure request with detailed information and receive approval before cash is disbursed.

- 😀 When petty cash is running low, the fund holder submits a request to replenish the petty cash, including a record of all previous expenditures.

- 😀 A petty cash expenditure proof is created each time cash is disbursed, accompanied by receipts or notes to ensure accountability.

- 😀 Replenishment of petty cash funds involves submitting a request letter with evidence of prior expenditures, which is then approved by the accounting department.

- 😀 An audit is conducted periodically to ensure transparency and accountability in petty cash management, confirming that the process is efficient and compliant with internal controls.

Q & A

What are the three key activities involved in petty cash management at PT Cahaya Agung?

-The three key activities are: formation of petty cash, petty cash expenditures, and replenishment of petty cash funds.

Why did Mr. Suryo decide to issue a policy for petty cash management?

-Mr. Suryo decided to establish a petty cash fund to handle sudden and relatively small company expenses without the need to go to the bank or cash a company check.

What is the role of the cash department in the petty cash management process?

-The cash department, represented by Mrs. Amel, is responsible for managing and storing company cash, issuing checks for petty cash, and working with the accounting department to ensure all transactions are recorded.

How does the accounting department contribute to petty cash management?

-The accounting department, represented by Mrs. Sandra, records all company transactions, including the petty cash formation transaction, and creates proof of cash out, which serves as internal evidence for the issuance of the check.

What does the petty cash fund holder, Bulusiana, do in the process?

-Bulusiana, the petty cash fund holder, manages the petty cash directly, cashes the checks into cash, distributes petty cash to other departments as needed, and requests replenishment when the balance is running low.

How do departments request petty cash for expenditures?

-Departments must submit a petty cash expenditure request document detailing the needs and amount, which must then be approved by the relevant department head before being given to the petty cash fund holder for cash disbursement.

What steps does a department take after receiving petty cash for an expenditure?

-After receiving petty cash, the department makes the necessary purchase (such as buying stamps), keeps the receipt or note, and creates proof of petty cash expenditure, which must be approved by the department head before being submitted to the petty cash fund holder.

How is petty cash replenished when the balance is low?

-When the petty cash balance runs low, the petty cash fund holder submits a request letter to the accounting department, detailing the expenditures and the amount needed for replenishment. After approval, the cash department issues a check to replenish the fund.

What is the role of the audit department in petty cash management?

-The audit department, represented by Mr. Bag, conducts regular audits to ensure transparency and accountability in the petty cash management process, verifying all expenditures and ensuring proper documentation is maintained.

What is the importance of collaboration between different departments in petty cash management?

-Collaboration between the cash department, accounting department, petty cash fund holder, and other departments is crucial to ensure efficient and accountable management of petty cash, with each part playing a specific role in maintaining proper financial records and approvals.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)