5-S&D Structure Zones Theory Pt1

Summary

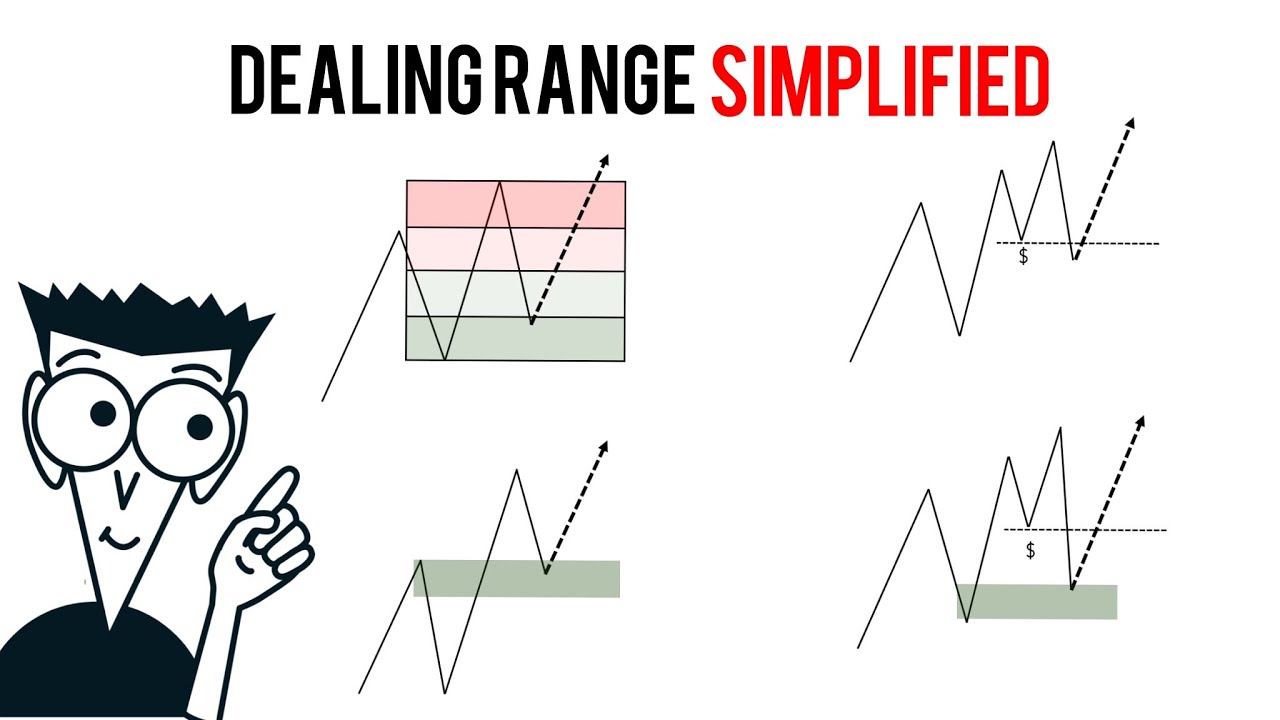

TLDRThe script focuses on the importance of understanding market structure zones in trading. It emphasizes that merely identifying zones and entry models isn't sufficient; traders must grasp the overall narrative of price action. The instructor discusses how to overlay supply and demand onto market structure diagrams to enhance trading decisions. Examples are provided to illustrate the concept of anticipating price movements based on demand zones leading to structure breaks and anticipating pullbacks using significant supply zones.

Takeaways

- 📈 **Importance of Market Structure**: Understanding market structure is crucial as it forms the foundation for analyzing price action.

- 🔍 **Live Market Challenges**: Despite theoretical knowledge, traders often struggle with live markets due to lack of practical application and understanding of price narratives.

- 📊 **Overlaying Supply and Demand**: Supply and demand concepts are layered onto market structure to enhance the framework for better decision-making.

- 📉 **Bullish Market Structure**: In a bullish market, demand controls the price, and weak highs are expected to fail, providing entry points for long positions.

- 📈 **Demand Zones Identification**: Identifying demand zones that led to a structural break is key for potential long entry points when prices return to these areas.

- 📉 **Bearish Market Structure**: Conversely, in a bearish market, supply dominates, and weak lows are anticipated to fail, signaling potential short opportunities.

- 🔄 **Dynamic Market Interpretation**: The same zones that signal continuation trades in a trend can act as catalysts for pullbacks when the trend reverses.

- 🔍 **Mitigation of Zones**: As prices interact with zones, they get mitigated, reducing their effectiveness for future trades, which influences how traders should view these areas.

- 🎯 **Anticipating Pullbacks**: Traders can anticipate potential pullbacks by looking at significant supply or demand zones that might act as catalysts for trend reversals.

- 📌 **Focus on Unmitigated Zones**: For counter-trend trades, it's more effective to focus on unmitigated zones that haven't been tested recently, as they are more likely to cause significant price reactions.

Q & A

What is the main issue traders face when applying market structure in live markets?

-The main issue traders face is not having a solid grasp of the overall narrative of price action. They might understand the entry model and see the price come into the zone, but they struggle with why they're taking lots of losses and getting thrown around in the market.

Why is it important to understand market structure?

-Market structure is the base case, framework, and building block for trading. It forms the foundation of understanding price action, which is crucial for anticipating market movements and making informed trading decisions.

What is meant by 'overall narrative of price action'?

-The 'overall narrative of price action' refers to the comprehensive understanding of how price moves in the market, including trends, patterns, and the interplay between supply and demand.

What is the significance of a demand zone that led to a break of structure?

-A demand zone that led to a break of structure is significant because it indicates a point where buyers were strong enough to push the price higher. When the price comes back into this zone, it presents a potential buying opportunity as it is expected to find support and continue the upward movement.

How do you identify a valid institutional demand zone?

-A valid institutional demand zone is identified by its role in causing a break of structure. It is a zone where significant buying pressure was evident, leading to a price breakout.

What is the expectation when price falls back to demand in a bullish market?

-In a bullish market, when price falls back to demand, the expectation is that any supply in the way will fail, and the weak highs will be broken as the price continues its upward trend.

What is meant by 'mitigations' in the context of supply and demand zones?

-Mitigations refer to the process where a previously significant supply or demand zone has been partially or fully filled with orders, causing the price to move in the direction of the prevailing trend. As orders are filled, the zone's potential impact on future price movements diminishes.

Why is it important to not overcomplicate the analysis with multiple timeframes or structures?

-Overcomplicating the analysis with multiple timeframes or structures can lead to confusion and incorrect trading decisions. Focusing on one type of structure and one timeframe helps in maintaining clarity and making more precise trading decisions.

What is the role of a supply zone in a bearish market?

-In a bearish market, a supply zone acts as a resistance level where sellers are expected to dominate. When price pulls back up to a supply zone, it is anticipated to respect this level, leading to further price decline.

How can supply and demand zones help anticipate a pullback after a break of structure?

-Supply and demand zones can help anticipate a pullback by identifying significant zones on the chart. After a break of structure, traders can look for the nearest significant supply zone to anticipate where the pullback might start.

What is the difference between a supply zone in a bearish trend versus a new bullish trend?

-In a bearish trend, a supply zone is seen as a continuation area where price is expected to continue falling. In a new bullish trend, the same supply zone is viewed as a potential starting point for a pullback, not as a continuation area.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级5.0 / 5 (0 votes)