1-Market Mechanics

Summary

TLDRThis script delves into market structure and order flow, emphasizing the role of speculators and their emotional impact on market dynamics. It outlines how technical analysis is used to identify trading opportunities through price movement and volume. The script also discusses various market participants, including commercial companies and financial institutions, and their influence on currency exchange rates. It explains the concepts of supply and demand and how they drive price changes in a free market. Additionally, it touches on the manipulative aspects of financial markets and the importance of recognizing patterns in price action to make informed trading decisions.

Takeaways

- 📈 Market structure is used as a framework to understand the order flow of the market.

- 🌊 The collective behavior of speculators can lead to herd mentality, influencing market movements.

- 📊 Technical analysis is a tool to identify trading opportunities through the study of price movement and volume.

- 🏦 Large commercial companies and financial institutions contribute to market order flow through significant transactions.

- 🔄 Speculators, including retail traders, aim to profit from exchange rate movements, contributing to market dynamics.

- 💵 Market participants are influenced by human emotions, which drive order flow and price action.

- 🔄 Price action on charts reflects the patterns formed by the interaction of buyers and sellers.

- 🌐 Currency exchange rates fluctuate due to supply and demand from various market participants.

- 💹 The meeting point of buyers and sellers is at the price level, where demand and supply interact to set market prices.

- 📉 In a free market, price movements should reflect a balance between supply and demand, but financial markets can be manipulated by large players.

- 📚 Understanding the basics of supply and demand, as well as the mechanics of order flow, is crucial for successful trading.

Q & A

What is the role of market structure in guiding order flow?

-Market structure serves as a mechanical framework that helps understand the order flow of the market by analyzing the interactions between buyers and sellers.

How do speculators contribute to market behavior?

-Speculators, being emotionally charged, often exhibit herd mentality, which influences the order flow and market structure through their collective actions driven by fear, greed, and uncertainty.

What is the significance of technical analysis in trading?

-Technical analysis is a framework used to identify trading opportunities by studying price movement and volume, reflecting the battle between buyers and sellers.

How do commercial companies impact the forex market?

-Commercial companies, such as large corporations needing to exchange currencies for international transactions, influence the forex market by placing significant orders through banks, affecting currency supply and demand.

What are the different types of market participants mentioned in the script?

-The script mentions commercial companies, banks and financial institutions (BFIs), speculators, and retail traders as key market participants.

How do emotions affect the market order flow?

-Emotions such as fear, greed, and uncertainty, when involved with large sums of money, drive the order flow as they influence the behavior of market participants.

What is the relationship between currency exchange rates and market speculators?

-Currency exchange rates fluctuate based on the supply and demand from market speculators, which includes both institutional and private investors.

How does the price of a currency pair reflect the interaction of buyers and sellers?

-The price of a currency pair is determined by the meeting point of buyers and sellers, where they agree on a price, creating demand and supply pressures that influence price movement.

What is the concept of a 'perfect free market' in the context of financial markets?

-In a perfect free market, prices would move smoothly to match demand and supply without manipulation. However, financial markets often experience price manipulation by large players due to the volume they control.

How do aggressive and passive orders contribute to order flow?

-Aggressive orders are executed instantly at the current market price, affecting the market immediately, while passive orders wait for the market price to reach a specified level, contributing to future order flow.

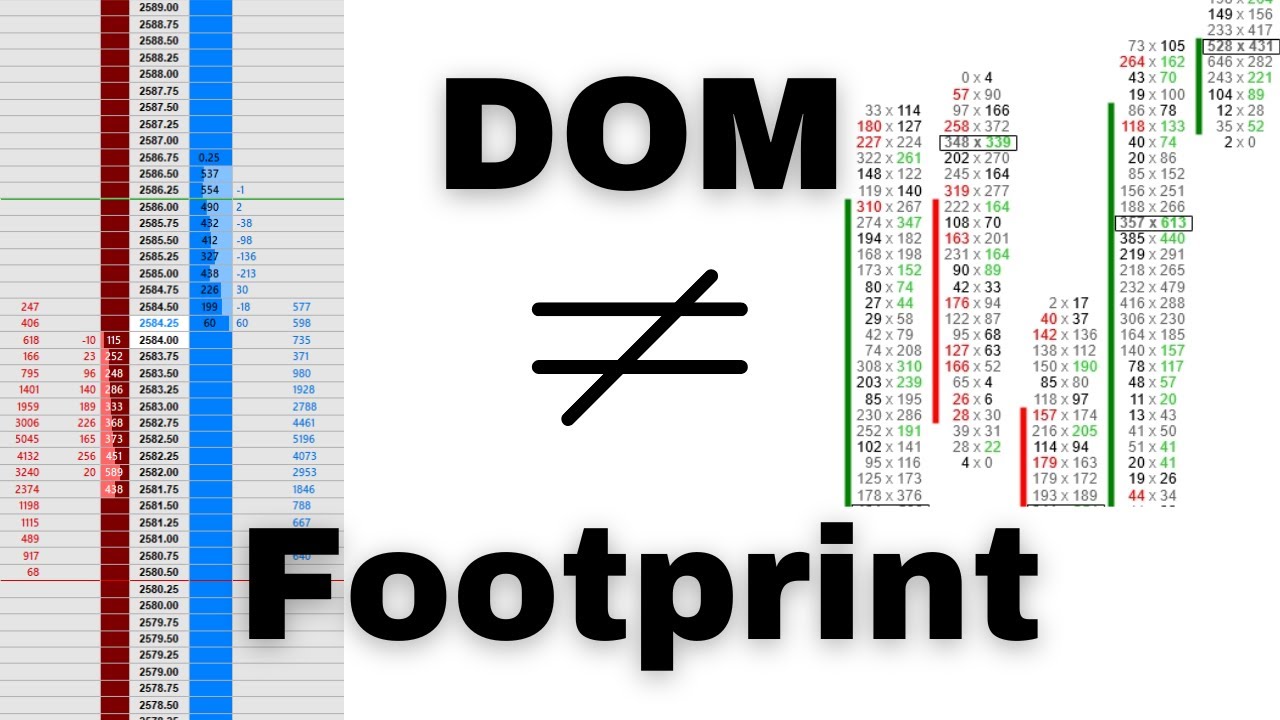

What is the purpose of a price ladder in the context of order flow?

-A price ladder, also known as the depth of market (DOM), visualizes the order book by showing bids and offers at different price levels, indicating the volume of passive orders waiting to be filled.

How does the imbalance between supply and demand manifest on a price chart?

-An imbalance between supply and demand causes rapid price movements to a new equilibrium. On a price chart, this can appear as a breakout from a range or a significant price spike, followed by a return to fill remaining orders.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级5.0 / 5 (0 votes)