Video 9

Summary

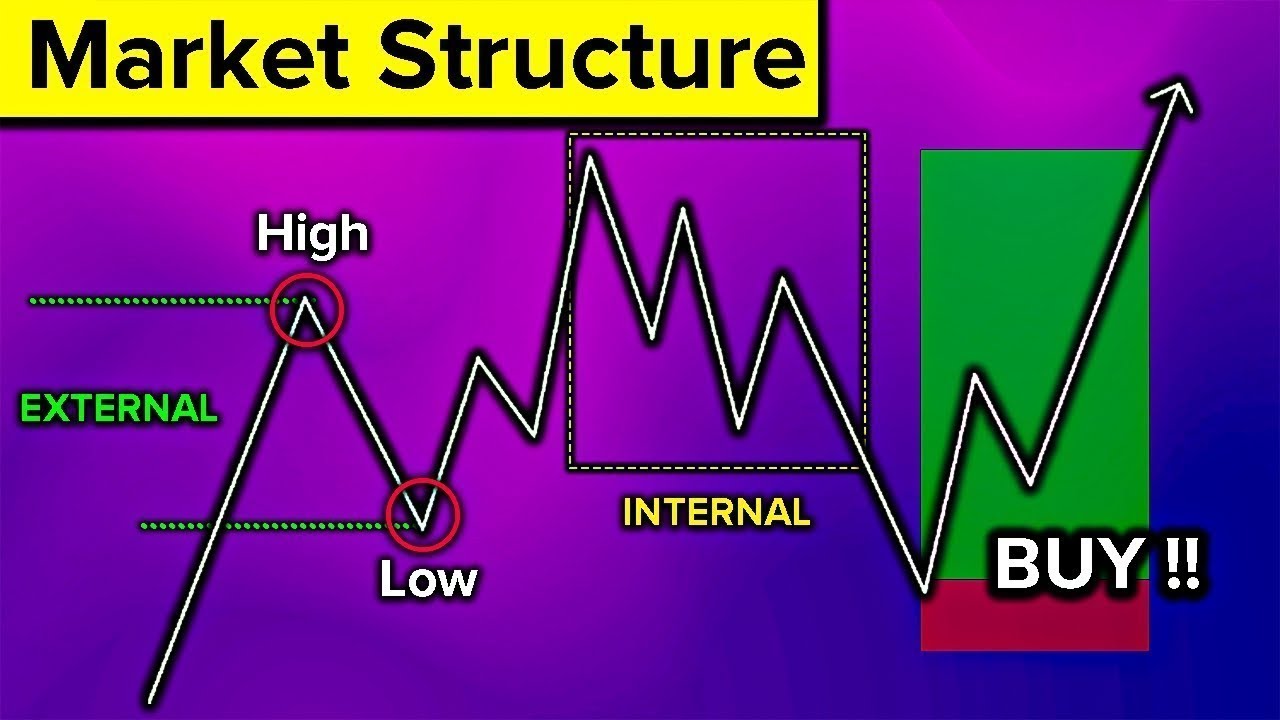

TLDRThe video script delves into the complexities of market analysis, emphasizing the importance of understanding and operating within different time frames and order flows for successful trading. The speaker highlights their commitment to sharing knowledge by posting analysis 24/7, covering markets in Asia, London, and New York. Through detailed explanations of highs, lows, and structural points in market movements, the script explains how to identify and interpret key signals for bullish or bearish flips, and the significance of violating structural lows or highs. The narrative underscores the critical role of higher time frame analysis and not relying on the DXY for trading decisions, offering insights into the dynamics of order flow changes and the importance of adapting to these changes for trading success.

Takeaways

- 📈 The mentor emphasizes the importance of understanding and operating their trading system consistently across different market sessions (Asia, London, New York).

- 📍 Explains the significance of identifying highs and lows in market trends and how a violation of these levels (body close below a low) indicates potential market direction changes.

- 🔧 Introduces the concept of validated highs and lows, stressing that not all highs and lows are equally significant, and that understanding the difference is crucial for market analysis.

- 💬 Discusses the concept of 'order flow' and how it shifts when structural lows are taken out, highlighting the transition from following a minute order flow to a higher time frame analysis.

- 🤖 Mentions the importance of not using the DXY (US Dollar Index) for direct correlation with trading decisions, emphasizing trading based on one's own chart analysis.

- 🖥 Offers insights into how trading strategies should adapt when a daily low is taken out, leading to a change in market behavior and the initiation of a ranging period.

- 🚩 Explains the concept of 'bullish flip' and how failing to put in a new low can quickly lead to a reversal and uptrend, demonstrating the fluidity of market movements.

- 💡 Highlights the importance of experience and knowledge in trading especially volatile or 'ugly' market days, suggesting that not all trading opportunities are suitable for beginners.

- 🏆 Shares his teaching approach on mitigating an area multiple times and how this strategy plays into understanding market structure and making informed trading decisions.

- 📊 Elaborates on the interplay between different time frames (one minute, fifteen minutes, four hours, daily) in trading analysis, emphasizing the need to recognize and adapt to the dominant time frame's influence on market movement.

- 💥 Ends with a discussion on how the violation of key structural points (like higher time frame lows) ushers in a new order flow, stressing the dynamic nature of markets and the importance of staying attuned to these changes.

Q & A

Why does the mentor post about market operations 24/7?

-The mentor posts 24/7 to cover different market operations across various time zones, including Asia, London, and New York, to demonstrate the applicability of their system in real-time market conditions.

What is the significance of identifying highs and lows in market analysis according to the mentor?

-Identifying highs and lows is crucial for understanding market structure and order flow. It helps in predicting future movements by observing how current prices move in relation to these established points.

What does it mean when the mentor mentions 'violating a low'?

-Violating a low refers to when the market price moves below a previously established low point, indicating a potential shift in market direction or momentum.

How does the mentor use the term 'validated high' in their analysis?

-A 'validated high' is a peak that has been confirmed as a significant point of resistance or a turning point in the market. It is used to gauge future bullish movements only when prices move above this level.

Why is the DXY (Dollar Index) not recommended for use in the mentor's analysis?

-The mentor advises against using the DXY because it is a composite index of several currencies and may not accurately reflect the movements of individual currency pairs or the specific market being analyzed.

What does 'failing to put in another low' indicate in the mentor's strategy?

-Failing to put in another low suggests that the market may not have enough bearish momentum to continue downward, potentially indicating a reversal or bullish trend initiation.

How does the mentor describe the process of a 'bullish flip'?

-A 'bullish flip' occurs when the market transitions from a bearish to a bullish trend, often identified by surpassing a significant high after failing to create a new low.

What is the importance of 'order flow' in the mentor's analysis?

-Order flow is crucial for understanding the direction and strength of market movements. It helps in determining the entry and exit points by analyzing the flow of buy and sell orders.

Why does the mentor emphasize trading based on 'higher time frame targets'?

-Higher time frame targets are emphasized because they offer a broader perspective on market trends and potential reversal points, aiding in more strategic and informed trading decisions.

What role does 'mitigating an area multiple times' play in the mentor's trading strategy?

-Mitigating an area multiple times refers to the practice of trading in a zone that has been tested several times for support or resistance. It suggests that these areas are significant for predicting future price movements.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)