Debits and Credits

Summary

TLDRThis video script explains the fundamental accounting concepts of debits and credits. It suggests thinking of debits as 'left' and credits as 'right' to understand how they affect the balance sheet equation: assets = liabilities + stockholders' equity. Assets increase with debits, while liabilities and stockholders' equity increase with credits. Revenues, which increase stockholders' equity, are also recorded as credits. Expenses and dividends, which decrease stockholders' equity, are recorded as debits. The script emphasizes applying this logic to understand how transactions are recorded in journal entries.

Takeaways

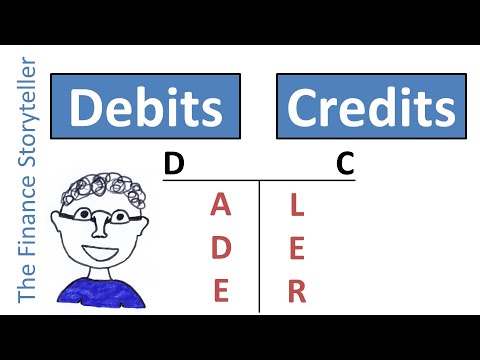

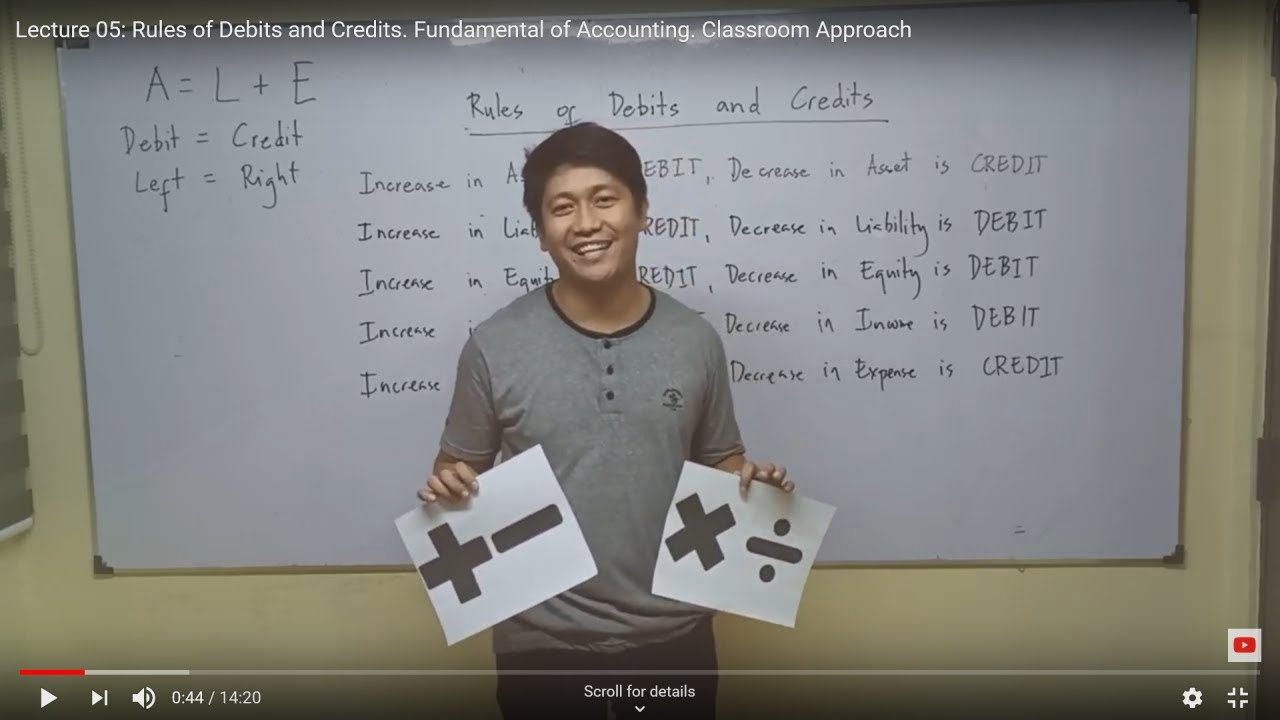

- 📚 Debits and credits are fundamental to accounting and should be thought of as left and right, respectively.

- 🔍 The basic accounting equation is Assets = Liabilities + Stockholders' Equity, and it must always balance.

- 📈 Assets increase with a debit, as they are on the left side of the equation.

- 📉 Liabilities and Stockholders' Equity increase with a credit, as they are on the right side of the equation.

- 💹 Revenues increase Stockholders' Equity, so they are recorded as credits.

- 🛒 Expenses decrease Stockholders' Equity, so they are recorded as debits.

- 💸 Dividends reduce Stockholders' Equity, and thus are also recorded as debits.

- 🔄 The opposite logic applies to decreases in assets, liabilities, and Equity accounts.

- 📝 Debits and credits are recorded in journal entries to track economic transactions.

- 📑 These entries are then posted to a ledger, which helps in maintaining the financial records of a business.

Q & A

What is the fundamental concept discussed in the video?

-The video discusses the fundamental concept of debits and credits in accounting.

How should the terms 'debit' and 'credit' be thought of in the context of the video?

-In the video, 'debit' should be thought of as synonymous with 'left' and 'credit' as 'right'.

What is the basic accounting equation mentioned in the video?

-The basic accounting equation mentioned is Assets = Liabilities + Stockholders' Equity.

How do assets increase according to the video?

-Assets increase with a debit, as they are on the left side of the accounting equation.

What happens to liabilities and stockholders' equity when they increase?

-Liabilities and stockholders' equity increase with a credit, as they are on the right side of the accounting equation.

How does the concept of debit and credit apply to revenue?

-Revenue increases stockholders' equity, which is on the right side, so it increases with a credit.

What is the impact of expenses on stockholders' equity and how are they recorded?

-Expenses decrease stockholders' equity, so they are recorded with a debit, as they do the opposite of increasing equity.

What is the effect of issuing dividends on stockholders' equity and how are they recorded?

-Issuing dividends decreases stockholders' equity, so they are recorded with a debit, reflecting the reduction in equity.

How does the video explain the recording of decreases in asset accounts?

-A decrease in an asset account is recorded with a credit, as it is the opposite of increasing an asset with a debit.

Similarly, how are decreases in liability accounts recorded?

-Decreases in liability accounts are recorded with a debit, as it is the opposite of increasing a liability with a credit.

Where do debits and credits take place as discussed in the video?

-Debits and credits take place in journal entries, which are then posted to a ledger to record economic transactions.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级5.0 / 5 (0 votes)